Dollar Longs Are Steadily Throwing The Towel In

Authored by Simon White, Bloomberg macro strategist,

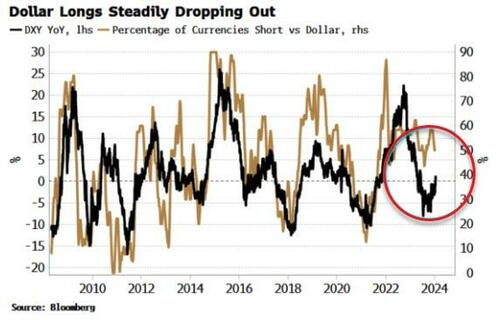

Speculators are reducing the number of currencies they are short versus the dollar, as well as increasing the size of their bets against it. The real yield curve shows that the dollar should trend lower over the coming months.

The dollar may have had a good start to the year, with the DXY up almost 2%, but speculators appear to have little faith this strength will continue.

Based on positioning data in the Commitments of Traders report, speculators’ net short positioning in CHF, JPY, CAD and NZD has almost halved (as a percentage of open interest) over the last month.

Moreover, carry is looking increasingly attractive in EM currencies.

Net positioning in the BRL and the MXN has remained historically quite elevated, while positioning in the ZAR has shot to close to a five-year high in recent weeks.

The percentage of currencies (of the eleven covered in the COT report) net short versus the dollar is steadily declining. This tends to be a reasonably good indicator of the dollar’s trend.

Overall, speculators are much net shorter the dollar versus EM compared to DM currencies (again, in open-interest terms).

But as mentioned above, they are also progressively reducing their shorts in currencies such as the Swiss franc and the Canadian dollar, while maintaining net longs in the euro and sterling.

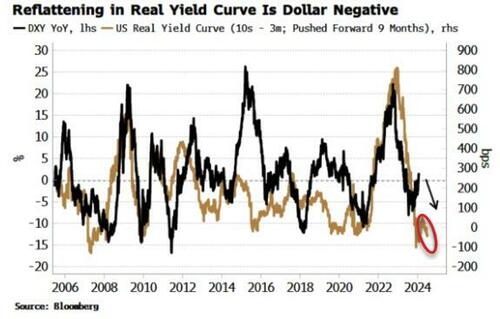

The Fed’s pivot has given store to the notion that there may be better carry options in currencies outside of the US. This is corroborated by the real yield curve, which leads the growth in the dollar by about six-to-nine months.

The dollar is driven at the margin by the foreign buyer of US assets.

The re-flattening in the real yield curve after the Fed’s pivot means the real return from longer-term US debt is falling again relative to the real cost of borrowing dollars, which should reduce demand for them.

Speculators hope so anyway.

Tyler Durden

Mon, 01/22/2024 – 09:20

via ZeroHedge News https://ift.tt/CorDwHl Tyler Durden