Recession Still Not A Shoo-In As Leading Data Behaves Unusually

Authored by Simon White, Bloomberg macro strategist,

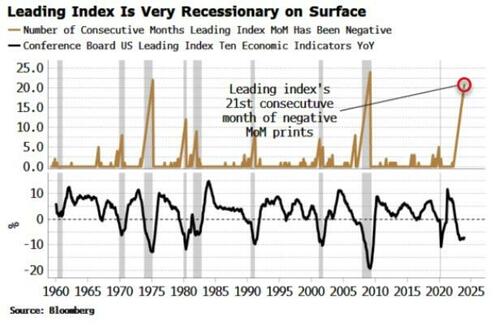

The Conference Board’s Leading Index continues to look recessionary, but under the surface the picture is mixed.

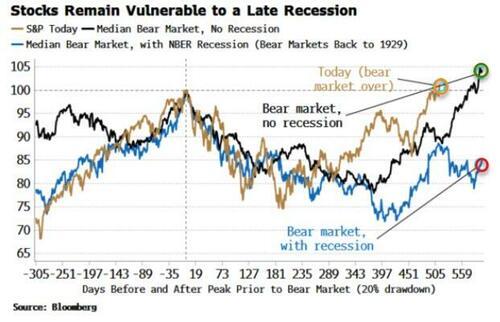

A recession is more likely than not later this year, but it’s far from a sure thing. Go-go stocks are too optimistic, however, leaving them very exposed if there is a downturn.

The legacy of the pandemic has not yet left us. It’s still wreaking havoc with hitherto reliable data series that would normally be consistent with a recession that was already underway.

The Conference Board’s Leading Index is made up of ten leading indicators, such as capital goods orders, weekly hours worked, the yield curve and stock prices. December’s update was released on Monday and marked the 21st consecutive monthly decline in the index.

That’s about as high as it gets, only the 1974 and 2008 saw it (marginally) higher. Historically speaking that’s unequivocally in recession territory.

Yet we are not in an NBER recession (subject to huge negative revisions, which is not a base case at the moment) and one does not look imminent.

A look under the hood of the Leading Index throws some light on what is going on.

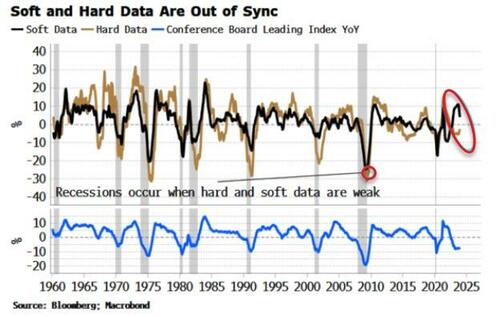

Splitting up the index’s inputs into soft (market and survey) data and hard (real economic) data shows that prior recessions not only had the headline index contracting on an annual basis, but both the soft and hard inputs were contracting at the same time.

This time, in the initial phase of the pandemic, soft data weakened (the market fell, sentiment was terrible) but hard data weakened only much more slowly. By the time hard data was contracting, the soft data had recovered (due to QE, etc).

Now soft data is beginning to weaken (but is still positive). If it continues to do so while the hard data remains weak, then a recession is more likely than not.

But, as the chart shows, hard data is slowly recovering. If it manages to do so while the soft data does not significantly weaken more, then it’s possible a recession is skirted.

This is emblematic of how the goods and services economy have been out of sync since the pandemic.

The fact they have not been contracting simultaneously is thus far what has kept a full-blown recession at bay.

Stocks are certainly banking on this outcome. But that means a slump would leave the market with a lot of clear air below.

Tyler Durden

Tue, 01/23/2024 – 11:45

via ZeroHedge News https://ift.tt/fnA9eEY Tyler Durden