Catastrophic 5Y Auction Tails Most Since Sept 2022, Sends Yields Surging

After yesterday’s solid 2Y auction, many were confident (certainly Bloomberg’s Market Live commentators who are the kiss of death for auctions) that today’s sale of 5Y paper would be smooth sailing. They were once again dead wrong, because the just concluded sale of $61 billion in 5Y paper, the highest amount for sale in this maturity since 2021 and matching the record high…

… was just shy of a disaster.

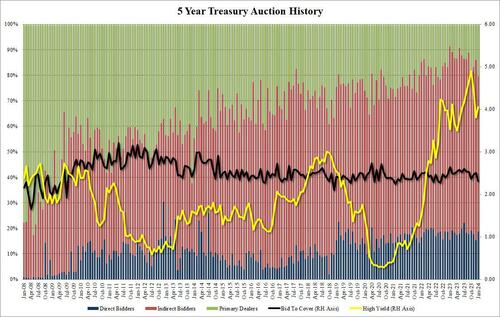

Stopping at a high yield of 4.055%, the yield was above last month’s 3.801% but more importatly tailed the When Issued 4.035% by 2 basis points, the biggest tail since September 2022.

The bid to cover was very ugly, sliding from 2.50 in Dec to just 2.31, the lowest since September 2022 and obviously far below the six-auction average of 2.45.

The internals were even worse, with Indirects tumbling to 60.9% from 70.6%, the lowest since – you guessed it – Sept 2022. And with Directs awarded 18.7%, meant that Dealers were left holding 20.4%, the most since, drumroll, the catastrophic Sept 2022 auction.

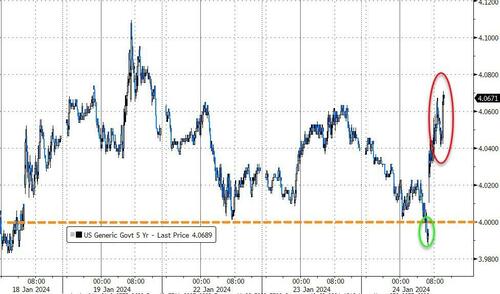

The auction was so ugly, it promptly repriced the curve send yields higher by 3bps, or more, with the 10Y rising as high as 4.17% after the news of the catastrophic auction hit, and up almost 10bps from the session lows earlier today.

Tyler Durden

Wed, 01/24/2024 – 13:27

via ZeroHedge News https://ift.tt/6mzor8d Tyler Durden