Auto Insurance Rates Soar At Fastest Pace Since 1970s Inflation Spike

Have you noticed a surge in your auto insurance premiums in the past few years?

Well, this could be why:

- Rivian Owner Shocked By $41,000 Repair Bill For Minor Damage

- “Shocking Number”: Rivian Owner Sees $42,000 Repair Bill For Minor Accident

Bloomberg penned a note Thursday reminding everyone who legally drives with insurance why rates are skyrocketing. The main reason is the complexity of new vehicles.

“It’s the complexity of vehicles these days. Repairing a base model Kia is nothing like it was just a few years ago. It might have ten different computers and all kinds of sensors,” said Ben Clymer, who co-owns a chain of body shops in Southern California.

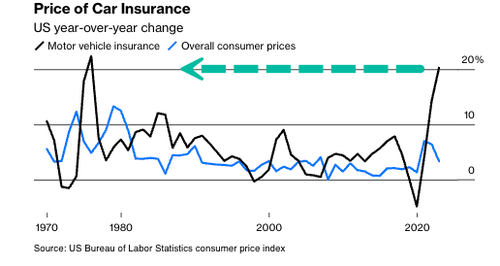

Clymer noted part prices are soaring and warned this “really creates the perfect storm for higher repair costs.” This has contributed to auto insurance rates rising the fastest since the inflation spike in the mid-1970s.

Soaring premiums are pressuring working poor households battered with elevated inflation, drained personal savings, and rising credit card debt to survive an era of failed ‘Bidenomics.’

Bloomberg pointed out: “But some drivers have been cutting costs by reducing their coverage and increasing the deductible they have to pay out of pocket for a repair. Rising rates are even pushing some people to choose older cars, which are less expensive to insure.”

“For the majority of people, auto insurance is definitely an afterthought,” said Jessica Caldwell, executive director of insights at auto researcher Edmunds.com.

Caldwell continued: “But [for] anyone evaluating the total cost of ownership before purchasing, it may very well affect what they ultimately can buy and may even exclude them from the new car market.”

Tyler Durden

Fri, 01/26/2024 – 05:45

via ZeroHedge News https://ift.tt/N5QOt0l Tyler Durden