Bond Yields, Bitcoin, & Black Gold Bounce As Economic ‘Animal Spirits’ Wreck Rate-Cut Hype

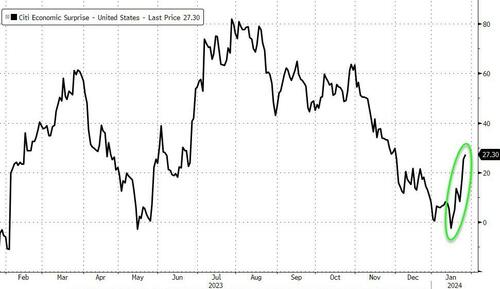

While the micro (earnings) has been more mixed (NFLX/IBM good, INTC/TSLA bad), the macro has been a one-way street of ‘no-landing-narrative’ awesomeness this week…

Source: Bloomberg

But that shouldn’t be a surprise since we warned that the lagged impact of the massive loosening of financial conditions was set to ignite ‘animal spirits’ – and with it, the end of any “soft”-landing narrative with the potential for re-acceleration of inflation…

Source: Bloomberg

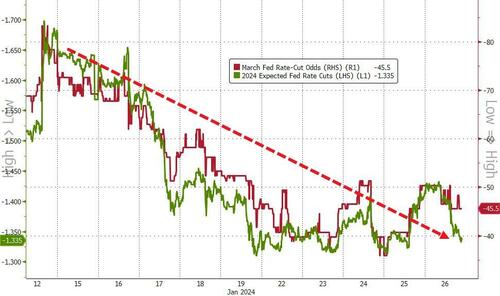

…and that has pushed rate-cut expectations lower (hawkishly), with a 45% chance of a cut in March and 133bps of cuts in 2024 (down from 85% and 165bps just over a week ago)…

Source: Bloomberg

Do investors really expect The Fed to cut with GDP (and PCE) expectations surging once again?

Source: Bloomberg

Today’s oil trading was extremely technical as a first surge perfectly tagged the 200DMA, prompted a run-stop sell-down, then a rebound back off $75 sent WTI back to the highs…

The growthiness and ongoing shitshow in the Middle East pushed WTI to its best week since September, with its highest weekly close since the first week of November.

Source: Bloomberg

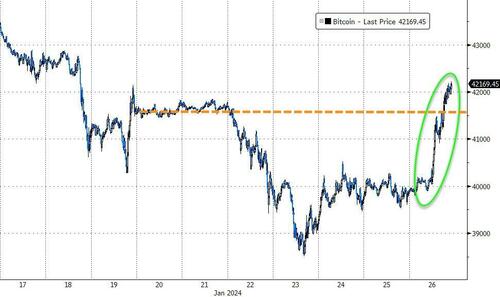

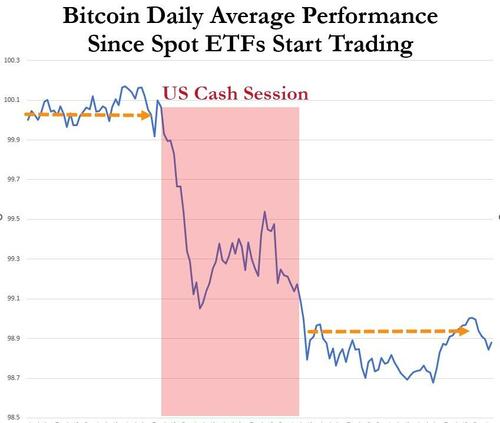

Bitcoin ended the week higher too, surging back above $42,000 today after an almost endless stream of selling since the spot ETFs were unleashed…

Source: Bloomberg

We note two things in crypto-land:

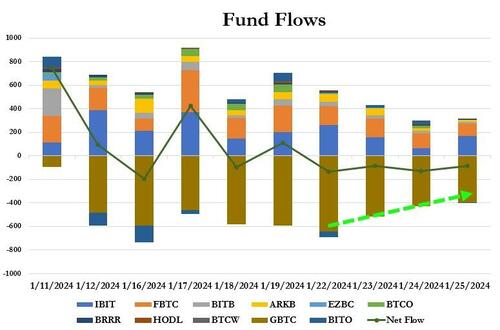

1) GBTC outflows are slowing…

and 2) all the selling in the underlying bitcoin has been focused (since the ETFs began trading) during the US equity trading session… Is that constant pressure about to abate?

US equity markets rallied on the week once more – ignoring higher yields, lower rate-cut expectations – as Small Caps outperformed (following a very similar pattern every day) while The Dow and Nasdaq lagged (though still closed green on the week)…

The S&P 500 (cash) tried and failed 3 times this week to close above 4900 as heavy gamma turned it back each time…

Energy stocks soared almost 5% on the week while Consumer Discretionary was the biggest loser…

Source: Bloomberg

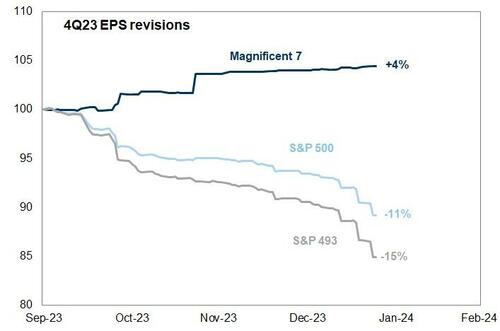

Don’t forget – the mega-cap tech names report in the next week…

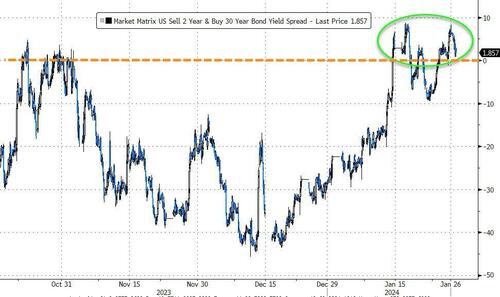

Treasury yields were all up today but mixed on the week with the long-end underperforming…

Source: Bloomberg

Which meant the yield curve (2s30s) steepened on the week (4th weekly steepening on the last 5), closing back above zero once again…

Source: Bloomberg

Gold (spot) went nowhere on the week, hovering around $2020…

Source: Bloomberg

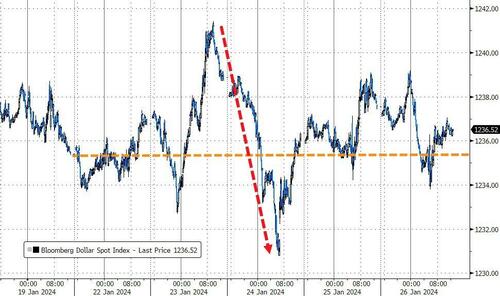

And the dollar also ended very modestly higher on the week with some good chop midweek around The ECB…

Source: Bloomberg

Finally, “you are here” in the dotcom meltup analog…

Source: Bloomberg

With The Fed confirming the end of its BTFP facility (and RRP withdrawals accelerating), March is lining up for something big (especially if The Fed doesn’t cut as so many hope).

Tyler Durden

Fri, 01/26/2024 – 16:00

via ZeroHedge News https://ift.tt/ODyl01J Tyler Durden