Shenanigans Begin Again: Fed ‘Magic’ Turns $2.5BN Deposit Outflow Into $42BN Inflow

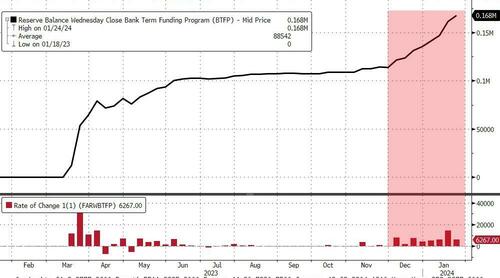

Banks usage of the Fed bailout fund as a free-money arb play ended this week with the BTFP facility ballooning to $168BN ($54BN of which could be in the ‘arb’)…

Source: Bloomberg

At the same time liquidity is being pulled from The Fed RRP facility (down $54BN this week), on target for the end of March as ‘Zero-liquidity’-day…

Source: Bloomberg

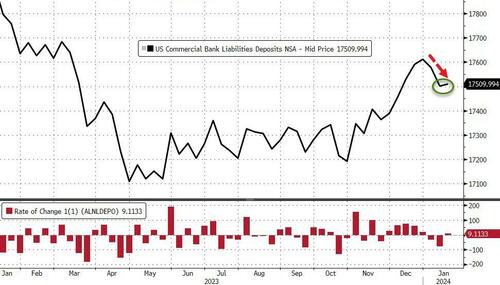

And after last week’s huge domestic bank deposit outflow (NSA), all eyes are on tonight’s Fed data for signals of stress.

Total bank deposits rose $51bn (on seasonally-adjusted basis) last week, pushing them to their highest since the SVB crisis…

Source: Bloomberg

On a non-seasonally-adjusted basis, total bank deposits also rose, but by just $9BN, leaving them still lower year-to-date…

Source: Bloomberg

But, and it’s a big BUT…

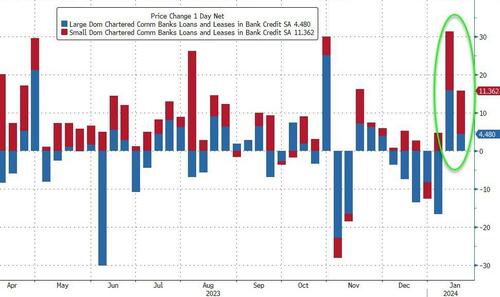

Excluding foreign banks, Domestic banks saw a $2.4BN (NSA) deposit OUTFLOW (Large banks +$5BN NSA, Small Banks -$7.4BN NSA) – the 3rd weekly NSA outflow in a row. and here’s the but – Domestic banks saw a $42BN (SA) INFLOW (Large banks +$33BN SA, Small Banks +$8.5BN SA)…

Source: Bloomberg

On the other side of the ledger, bank loan volumes increased for the second week in a row (Large banks +$4.5BN, Small banks +11.4BN)…

Source: Bloomberg

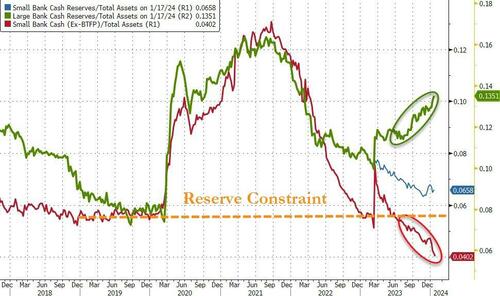

Finally, we note that without the help of The Fed’s BTFP, the regional banking crisis is back bigly (red line), and large bank cash needs a home – green line – like picking up a small bank from the FDIC…

Source: Bloomberg

And now you know why The Fed will cut rates in March – no matter what jobs or inflation is doing.

As we warned yesterday, watch the SOFR-O/N RRP Spread for signs of stress…

Key things to keep an eye on are re-increases in the RRP, indicating extra reserves are being taken back out of the system, or a rising take-up in the Fed’s standing repo facility, which would point to potential funding problems. All said and done, don’t put your spanner away yet, knowing how to plumb remains an essential skill.

Tyler Durden

Fri, 01/26/2024 – 16:40

via ZeroHedge News https://ift.tt/wbB8dza Tyler Durden