US Median Rents Slide For Eighth Month On Surge In New Apartment Supply

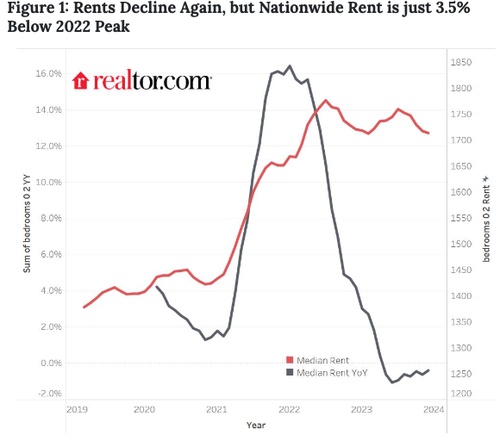

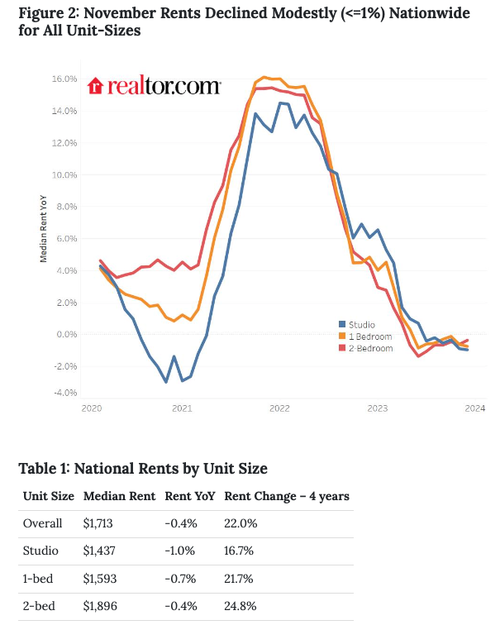

High-frequency data from Realtor.com shows US median rents slid in December on a year-over-year basis for the eighth consecutive month, down -.4% for 0-2 bedrooms across the 50 top metro areas. The median asking rent was $1,713, down by $4 from last month and $63 (-3.5%) off the July 2022 peak. However, rents are still $309 (22.0%) higher than the same time in 2019.

“In 2023, the rental market experienced a significant shift in momentum,” Realtor said, explaining that the “influx of record-high new multi-family homes exerted downward price pressure on median asking rents” and added this trend will continue producing “weakness in the rental market for 2024, as the completion of much-needed supply is expected to further impact the dynamics.”

The report pointed out that metro areas across the West, such as San Francisco and Los Angeles, saw continued declines in rent prices on a year-on-year basis. However, some of the most significant declines were in the southern tier of the US, as multi-family completion rates soared 32% from January to October.

Specifically, the top 3 metros experiencing the most significant year-over-year rent declines are Orlando, FL (-6.2%), Austin, TX (-5.4%) and Dallas, TX (-4.7%). -Realtor

In a separate report, rental property software provider RealPage said US apartment supply topped a 36-year last year with 440,000 apartment units completed – and that figure could be even higher this year.

Rent costs are sliding, and since shelter constitutes a third of the Consumer Price Index (CPI) basket, the rising supply of apartments will likely reduce rent costs further – this is good news for the Fed’s war on inflation.

Tyler Durden

Sat, 01/27/2024 – 09:55

via ZeroHedge News https://ift.tt/pLHBqhg Tyler Durden