Stocks, Bonds, Bullion, & Bitcoin All Rip As Catalyst-Heavy Week Begins

Quiet macro day today a collapse in Texas Manufacturing the only significant domestic data (but Treasury’s QRA, part 1 the most noteworthy ahead of tomorrow’s actual announcement), and that was evident in rate-cut expectations being hugely unchanged…

Source: Bloomberg

And the lack of news was enough to allow a ‘buy all the things’ narrative to continue with Treasury’s QRA suggested lower supply expectations.

Bonds were bid across the curve with the belly outperforming (short-end least bought)…

Source: Bloomberg

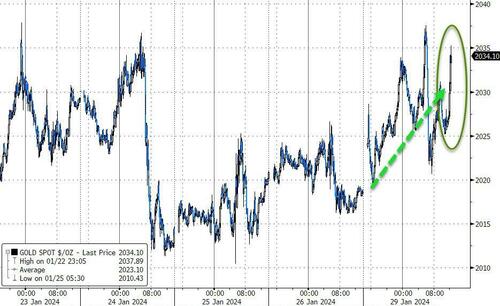

Gold rallied back to the highs after the QRA…

Source: Bloomberg

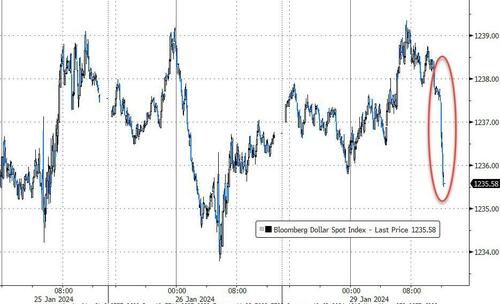

…as the dollar declined…

Source: Bloomberg

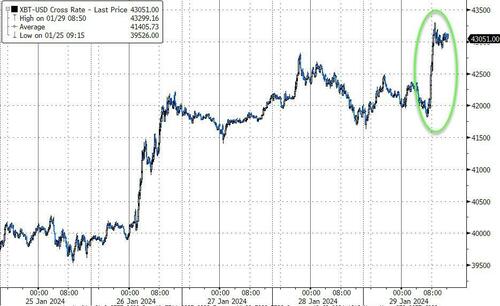

Bitcoin ripped higher, topping $43,000 back at two-week highs…

Source: Bloomberg

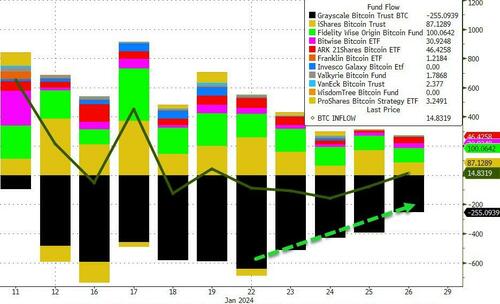

As GBTC outflows are trending lower and Friday saw net inflows…

Source: Bloomberg

And of course, stocks drifted higher all day – as they do – but then jumped notably higher on the AQR supply report…

Source: Bloomberg

With MAG7 stocks accelerating after the AQR up to new record highs…

Source: Bloomberg

And ‘most shorted’ stocks were squeezed hard (up to last week’s highs)…

Source: Bloomberg

Of course, with everything else rallying, there had to be something to sell… and it was crude oil (because, yeah, the middle-east is much calmer today)…

Source: Bloomberg

And finally, Nasdaq melted up even more today, but the rest of the week has plenty of hurdles…

Source: Bloomberg

Will the Dotcom bubble analog hold for a dip to be bought?

Tyler Durden

Mon, 01/29/2024 – 16:00

via ZeroHedge News https://ift.tt/IVrlpPu Tyler Durden