Europe’s Own Tech Stars Are Leading Index To Record

By Michael Msika, Bloomberg Markets Live reporter and strategist

The Euro Stoxx 50 Index’s multi-year transformation, led by the emergence of tech champions, may finally set the region’s benchmark on course toward a new high.

Europe may lack a “Magnificent Seven” tech cohort of its own, but a pared-down version of that phenomenon has emerged. The Euro Stoxx 50 has just hit its highest since 2001, with the latest leg of the surge powered by blowout earnings from the region’s two biggest tech stocks, ASML and SAP. And that hasn’t even made the benchmark expensive.

With its forward price-to-earnings ratio just below 13 times, the Euro Stoxx 50 is still relatively cheap, trading at 35% discount to the S&P 500 Index. What’s more, the latest phase of the rally has done little to increase valuations, suggesting that the gains have been driven by stronger earnings. Easing price pressures and looming interest-rate cuts should help too.

“The valuation of European equities remains very attractive,” said Indosuez Wealth Management portfolio manager Laura Corrieras. “While the level of unemployment has remained stable, disinflation continues at a faster-than-anticipated pace and more and more investors now expect the European Central Bank to reduce its rates in 2024.”

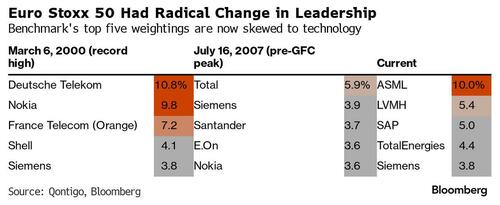

There is still a way to go before making new records: the Euro Stoxx 50 remains about 15% short of its peak. But ASML and SAP now account for almost 15% of the benchmark, the latest sign of how the index, once dominated by oil majors and banks, has radically changed.

The nadir for the index came in March 2009. Since then, more than 50% of its ascent can be attributed to just five names: ASML, LVMH, SAP, Siemens and TotalEnergies. Just ASML and LVMH alone have generated nearly 27% of the benchmark’s return, with ASML joining the index only in 2012. The chip equipment company’s market value soared to nearly €320 billion ($347 billion) from around €6 billion in 2009, while that of LVMH’s increased by 20-fold during the same period.

A glance back to March 2000 shows that telecom stocks, along with Nokia, were the investor favorites then, accounting for about 28% of the index. When the internet bubble burst and flushed out those names, oil and banking stocks stepped up to carry the baton of market dominance. By July 2007, the index was highly diversified, with no stock exceeding 6% in weighting.

The global financial crisis spurred progressive change in the blue-chip benchmark, but financials have largely survived to be the biggest industry group, at nearly 20% today. They are now challenged by consumer discretionary, industrial and tech stocks, each at about 17%.

Still, there may be bumps along the road to a record. For one thing, Europe’s heavy reliance on China links its fortunes to those of the world’s No. 2 economy.

“We think Europe is a top pick to play the China story in the developed market space, providing a wide range of cyclical exposure,” Citigroup strategists led by Beata Manthey wrote in a note last week. Investors may prefer to use European stocks as a proxy for China, rather than taking direct exposure, even as government measures to boost the economy improve sentiment.

The euro-area benchmark remains highly international, with less than a third of its members’ revenue generated within the euro area. It’s 37% exposed to broader Europe, 22% to North America, 25% to Asia and 16% to emerging markets, according to Goldman Sachs strategists.

“Europe remains a good source of diversification from the concentrated valuation risk in US equities which, even excluding the Mag 7, do not reflect the higher-for-longer environment,” said Bernstein strategists Sarah McCarthy and Mark Diver.

Tyler Durden

Tue, 01/30/2024 – 02:45

via ZeroHedge News https://ift.tt/gsC7TiZ Tyler Durden