DoubleLine’s Gundlach Doubles Down On Recession As The Other “Big Short” Is Now “Blissfully Long”

Despite Powell’s pushback on expectations for a March rate cut, signaling that the US economy is hotter than the market – which until recently was pricing in 6 cuts for 2024 – expects, today DoubleLine’s Jeff Gundlach doubled down on his bearish outlook and told CNBC that a recession is still likely to occur in 2024 along with a higher unemployment rate.

“We know that inflation was going to come down,” Gundlach said. “For now, we think there will be a stall in the inflation rate coming down. This means the market is not going to get the Goldilocks picture that it was euphoric about a couple of weeks ago.”

Gundlach also criticized the Fed’s ‘higher-for-longer’ strategy, saying it posed a negative risk to future growth.

“The longer the Fed stays at what is going to be about a 200 or 300 basis points real interest rate on Fed funds, there is risk to economic growth as we move into this year,” he told CNBC.

Gundlach said higher rates continue to pose a major threat to the banking system but saw Wednesday jitters over New York Community Bancorp, as an isolated case. Nonetheless, there is still plenty of anecdotal evidence to give credence to the belief the urban and commercial real estate market is in a “debacle,” he added.

And while the bond king was sweating the coming shakeout (and ostensibly buying bonds which tends to surge during recessions), one former uber bear was “blissfully” complacent about the coming meltdown.

Steve Eisman, best known for being the other “Big Short”, for his highly profitable bet against subprime mortgages, said he’s now “more long-oriented” on the US market despite others’ deep concerns about ballooning federal deficits and crowding in stocks.

According to Bloomberg, the Neuberger Berman Group portfolio manager said there’s no real sign that the soaring US debt poses a problem for markets or the US government. He’s equally sanguine on equities, despite the parallels that some perceive between today’s market and the dot-com bubble era.

“I’m very blissful,” Eisman said Tuesday at the iConnections Global Alts conference in Miami Beach, referring to his broad market outlook. “I’m a happy-go-lucky kind of guy. It’s unbelievable.”

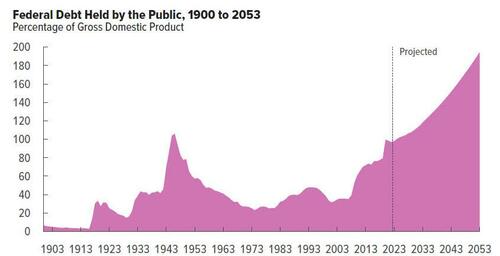

“This argument about the deficit has been going on for forty years,” Eisman said, adding there are few reasons to worry “until I see real signs there’s a problem.” It wasn’t clear what signs he is referring to, but one can be absolutely certain they will appear… whatever they are because the trajectory from here on out is clear.

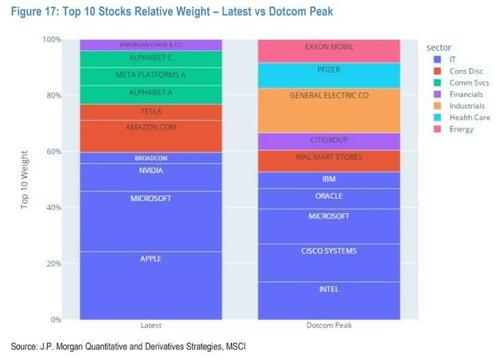

The topic of crowding also came up: earlier this week we noted that according to JPMorgan, today’s Market Is “Far More Similar Than One May Think” To The Dotcom Bubble Peak.” That’s because the share of the top 10 stocks in the MSCI USA Index, including the Magnificent Seven, has climbed to 29.3% as of the end of December, just shy of the 33.2% peak seen in June 2000, sparking comparisons to the last days of the tech bubble.

And while many have (repeatedly) warned there won’t be a happy ending, Eisman expressed no concerns when asked about crowding issues. As for his view on the broader market, he said “it’s a lot more relaxing being more long-oriented,” Eisman said. “The futures are up. A feeling of bliss.”

While Eisman’s complacency is rather understandable – after all he has made his money and is now much more interested in a perpetuation of the status quo instead of profiting from its overhaul – his comments came after Black Swan author Nassim Nicholas Taleb warned earlier in Miami that the world’s biggest economy faces a “death spiral” of swelling debt, adding to recent alarms sounded by former US Treasury Secretary Robert Rubin earlier this month.

Tyler Durden

Wed, 01/31/2024 – 22:20

via ZeroHedge News https://ift.tt/2z8ZeHw Tyler Durden