The Best And Worst Performing Assets Of January 2024

Despite the S&P hitting multiple all-time highs toward the end of the month, January was a mixed month as far as markets were concerned, because as DB’s Henry Allen writes, financial assets saw a fairly divergent performance. On the one hand, economic data kept surprising on the upside for the most part, which meant equities continued their gains from late 2023, and the S&P 500 reached a new all-time high. However, geopolitical concerns have persisted, particularly given attacks from the Houthi rebels on commercial shipping in the Red Sea. And sovereign bonds also lost ground as investors dialled back the prospect of rate cuts in Q1, with Fed Chair Powell suggesting that a cut by March was unlikely.

Month in Review – The high-level macro overview

January saw several developments for markets, but an important one was that hopes for a soft landing continued, which meant risk assets kept up their momentum from November and December. For instance, US data surprised on the upside once again, with Q4 growth at annualised rate of +3.3%, whilst the unemployment rate remained at 3.7% in December. That was echoed in various surveys as well, with the University of Michigan’s consumer sentiment index rising to a two-and-a-half year high in January. Likewise in the Euro Area, although growth has been weaker, the single currency area unexpectedly avoided a technical recession in Q4, as GDP was unchanged, rather than contracting by -0.1% as the consensus expected.

That positive momentum helped global equities to advance for the most part, with both the S&P 500 (+1.7%) and Europe’s STOXX 600 (+1.5%) posting a third consecutive monthly gain. However, another continued theme from 2023 was how narrow the equity rally was, since the equal-weighted S&P 500 was actually down -0.8% over the month, continuing to lag the overall index. Moreover, regional bank stocks lost ground after NY Community Bancorp reported a loss on January 31 after raising their expected loan losses on commercial real estate. That meant the KBW Regional Bank Index was down -6.8%, mainly thanks to a -6.0% loss on the final day of the month. In addition, Chinese equities didn’t share in the broader gains amidst concerns about the economic outlook there, with the CSI 300 (-6.3%) losing ground for a 6th consecutive month and closing at a 5-year low.

Another important story was geopolitics, as the strikes from the Houthi rebels on commercial shipping in the Red Sea led to significant supply-chain disruption. And in turn, the US and the UK responded with air strikes against the Houthi rebels. Against that backdrop, oil prices rose again in January after three monthly declines, with Brent Crude up +6.1% to $81.71/bbl. Most notably, freight costs have soared, with Drewry’s World Container Index up to $3,964 per 40ft container as of 25 January. That’s almost triple its levels from late-October, when costs were at a post-pandemic low. Towards the end of the month, a drone attack also killed three US troops in Jordan, which has continued to raise fears about a wider escalation in the region.

In the meantime, sovereign bonds also struggled as central bank officials pushed back on the prospect of Q1 rate cuts. For instance, a rate cut from the Fed by March was fully priced in at the end of 2023, but was down to a 35% likelihood by the end of the month. In part, that followed Fed Chair Powell’s remarks after the January meeting, where he suggested a March cut was unlikely. Likewise at the ECB, the likelihood of a cut by March fell from 65% to 23% over the course of January. So investors are still expecting rate cuts to happen fairly soon, but the confidence about cuts as soon as Q1 has been dialled back. In turn, US Treasuries were down -0.2% by the end of the month, and Euro sovereign bonds were down -0.6%.

January’s Biggest Winners

- DM Equities : Over January as a whole, the S&P 500 (+1.7%) and the STOXX 600 (+1.1%) both advanced in total return terms. However, the advance continued to be a narrow one, with the equal-weighted S&P 500 down -0.8%.

- Oil : The geopolitical backdrop meant that oil prices rose after three consecutive monthly declines, with Brent Crude (+6.1%) and WTI (+5.9%) both posting gains.

- US Dollar : After losing ground in November and December, the Dollar Index strengthened by +1.9% in January, and the US Dollar strengthened against every other G10 currency.

January’s Biggest Losers

- Sovereign Bonds : As investors grew less confident that central banks would cut rates in Q1, sovereign bonds lost ground. US Treasuries ended the month -0.2% lower, and Euro sovereign bonds were down -0.6%.

- EM Assets : It was a difficult month for EM assets, with the MSCI EM index down -4.6%, whilst EM bonds were down -1.2%.

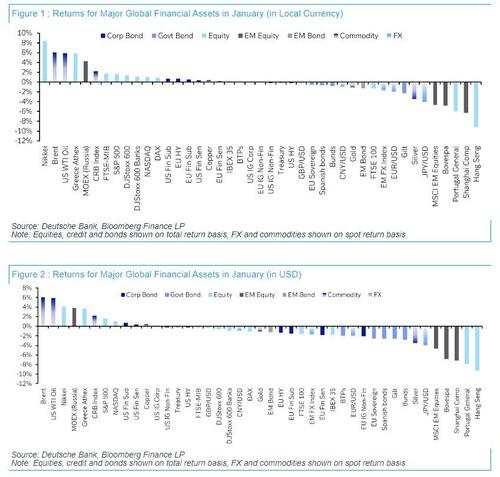

Finally, as DB’s Jim Reid recaps, across the board there were more losers than gainers in January in USD terms, with Brent crude oil (+6.1%) topping the list and the Hang Seng (-9.2% in USD terms) the largest decliner. The S&P 500 (+1.7%) and Nasdaq (+1.0%) eked out gains but the Russell 2000 (-3.9%) was lower. Indeed, most global equity and bond markets were slightly lower in USD terms on the month due to a stronger dollar. Returns in many European markets were slightly positive in local currency terms.

On the last day of the month yesterday, we saw a notable risk-off tone. That was because of a slightly hawkish FOMC versus market expectations (see our econ recap here), as well as the news that New York Community Bancorp (-37.67%) had reported a loss as they raised their expected loan losses on commercial real estate. That meant the KBW Regional Banking Index (-6.00%) saw its largest decline since the regional banking turmoil last March. In addition, Aozora Bank (-21.49%) in Japan reported losses overnight that were also because of US commercial property.

Tyler Durden

Thu, 02/01/2024 – 14:24

via ZeroHedge News https://ift.tt/SpOjec8 Tyler Durden