WTI Extends Gains After Surprisingly Large Product Draws

Oil prices extended yesterday’s gains (helped by EIA’s short-term outlook) after a mixed bag from API with a much smaller than expected crude build.

API

-

Crude +674k (+1.3mm exp)

-

Cushing +492k

-

Gasoline +3.65mm (+300k exp)

-

Distillates -3.7mm (-2.0mm exp)

DOE

-

Crude +5.52mm (+1.3mm exp)

-

Cushing -33k

-

Gasoline -3.15mm (+300k exp)

-

Distillates -3.22mm (-2.0mm exp)

A much bigger than expected build in crude inventories shocked the market but Cushing saw stocks decline for the 5th week in a row (though barely) while both Gasoline and Distillates saw big draws…

Source: Bloomberg

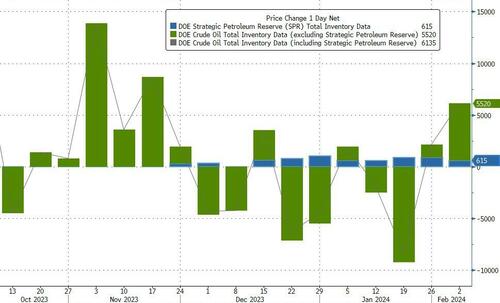

The Biden administration added 615k barrels to the SPR – its 8th weekly rise in a row…

Source: Bloomberg

Cushing stocks are at their lowest since November – and lowest in over a decade for February…

Source: Bloomberg

US Crude production rebounded fully from the storm shut-ins, back to record highs…

Source: Bloomberg

WTI Crude extended the day’s gains on the product draws, back above $74…

Still, upside price gains may be “capped down the road due to rapidly falling expectations around aggressive Fed [interest] rate cuts and growing concerns over China’s economy,” Lukman Otunuga, manager, market analysis at FXTM told MarketWatch.

Tyler Durden

Wed, 02/07/2024 – 10:40

via ZeroHedge News https://ift.tt/M6AI3q2 Tyler Durden