Big-Tech & Bitcoin Bounce, Regionals Red As Flotilla Of FedSpeak Hints ‘Higher For Longer’

The buyers are back in banks and big-tech today despite an avalanche of hawkish talk from Fed speakers. An ugly consumer credit print at the end of the day offset the fact that the US trade deficit narrowed last year by the most since 2009 as the value of imported goods declined and the services surplus increased.

The algos only had one think in mind – S&P 500 hitting 5,000… and they managed to get to 4999.89 before the front-running failed.

Nomura’s Charlie McEllifgott noted that “large investors including real money, continue to indicate they are being forced to ‘grab into’ beta through futures and/or index options upside.”

But, the narrative is clearly being shifted back to ‘higher for longer’.

Six Fed speakers today – all saying the same thing – don’t expect cuts any time soon…

-

KUGLER: MAY BE APPROPRIATE TO HOLD TARGET RANGE STEADY AT CURRENT LEVEL FOR LONGER

-

KASHKARI: WE CAN TAKE TIME TO ASSESS DATA BEFORE CUTTING; SEE 2-3 CUTS THIS YEAR AS APPROPRIATE RIGHT NOW

-

BARKIN: “IN THE WORLD OF ELEVATED UNCERTAINTY,… IT’S A REASONABLE IDEA TO BE PATIENT”; LOW RESPONSE RATES, REVISIONS MAKE YOU WARY OF DATA

-

COLLINS: THERE IS A RISK THAT INFLATION PROGRESS STALLS, REASONABLE CHANCE RATES SETTLE HIGHER VS PRE-PANDEMIC

Yesterday we had:

-

KASHKARI: “WE’RE NOT ALL THE WAY THERE YET” ON INFLATION

-

MESTER: EXPECT FED TO GAIN CONFIDENCE TO CUT “LATER THIS YEAR”; POLICY IS IN A GOOD PLACE, MISTAKE TO CUT RATE TOO SOON

And that followed Powell on Sunday who very clearly confirmed that ‘higher for longer’ view (no matter what 60 Minutes editing/voice-over said).

As Goldman Sachs’ Nelson Armbrust noted:

“The economy is stronger than expected, consumption is solid and jobs are very strong.

Personally, I have a hard time going along with the narrative of multiple cuts this year with the data at hand. Rates normalization just for the sake of it doesn’t seem enough for me.

If the economy can sustain higher rates, it might be positive to have more room to cut in the future in case the economy needs a boost.”

Of course, all that hawkishness hits the fan if a bank or two collapses…

-

COLLINS: OVERALL, I SEE BANKS AS WELL-CAPITALIZED

-

KASHKARI: WE’RE WATCHING CRE VERY CAREFULLY, CRE ISSUES APPEAR LIMITED TO INDIVIDUAL BANKS

-

REMACHE: FED TO WATCH MONEY MARKET CONDITIONS AS RRP USE FALLS

And today was all about NYCB (which is/was the 35th largest bank in the US) as it oscillated from total failure to heroic resurrection…

But some context might help…

Source: Bloomberg

The overall Regional Bank index rebounded solidly (but we note that we have seen this kind of rebound three times now in the last week and we’re still a lot lower)… but ended the day lower…

Source: Bloomberg

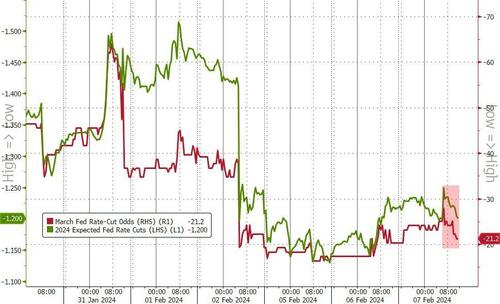

But the regional bank rebound, and FedSpeak, sent rate-cut expectations (hawkishly) lower…

Source: Bloomberg

Nasdaq outperformed on the day, followed closely by the S&P 500. The Dow managed solid gains but Small Caps battled ‘unch’ in the last hour (and lost)…

The Mag7 soared to new highs today, up 13.5% from January ‘s lows…

Source: Bloomberg

…as the NVDA soared back above $700 again (up $50BN today)…

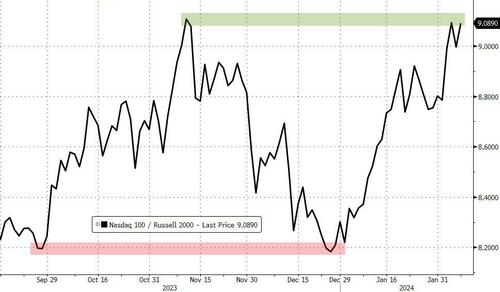

Nasdaq’s gains relative to Small Caps have pushed it back up to a notable level…

Source: Bloomberg

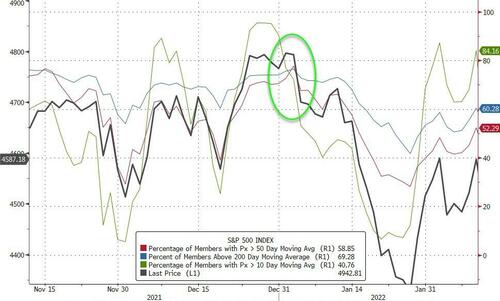

Before we leave equity-land, with the S&P within an inch of 5,000 and record-er highs, the last time the S&P 500 was at this record high, in Jan 2022, 77% of names were above their 10DMA, 73% above the 50DMA, and 76% above their 200DMA…

Source: Bloomberg

This time, only around 40% of names are above their 10DMA, less than 60% above their 50DMA and less than 70% above their 200DMA…

Source: Bloomberg

As @JasonGoepfert noted on X, “Since 1928, that’s only happened once before: August 8, 1929.”

Stocks rallied even with yields being higher today – despite a strong (record size) 10Y auction. The roller-coaster day left yield sup only around 2bps on the day across the curve but 30Y is lagging on the week…

Source: Bloomberg

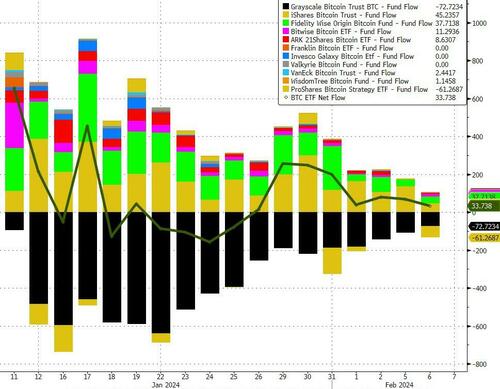

Bitcoin rallied today, back above $44,000 at one-month highs…

Source: Bloomberg

…after the 8th straight day of net inflows into bitcoin ETFs…

Source: Bloomberg

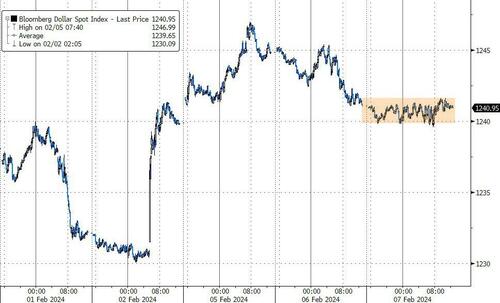

Amid all the moves in other assets today, the dollar went absolutely nowhere…

Source: Bloomberg

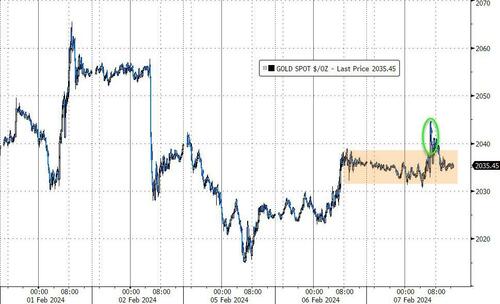

Gold spiked amid bank chaos early on (above $2040) but ended unch…

Source: Bloomberg

Oil prices drifted gently higher today after big product draws

Source: Bloomberg

US NatGas prices dropped below $2 for the first time since Sept 2020…

Source: Bloomberg

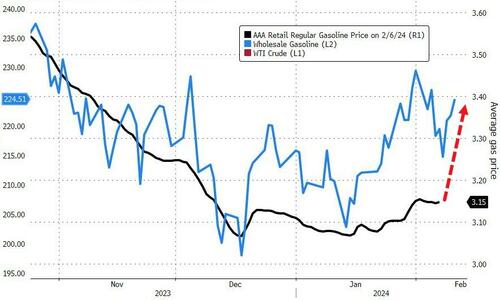

Finally, Powell and Biden may have a problem soon as wholesale gasoline prices are ‘high’, suggesting pump prices are going to be heading up soon…

Source: Bloomberg

…must be those greedy ‘Big Oil’ execs again!!

Oh, and while you’re celebrating, this analog just keeps chugging along…

Source: Bloomberg

But hey, the nice people on CNBC said ‘buy stocks, this ain’t anything like 1990!’.

Tyler Durden

Wed, 02/07/2024 – 16:00

via ZeroHedge News https://ift.tt/FqGIb1j Tyler Durden