Disney Shares Soar Despite Top-Line & Subscriber Growth Disappointment

Disney disappointed top-line with $23.5 billion in revenue for the December quarter, flat from the year-ago quarter but below the $23.8 billion consensus.

-

*DISNEY 1Q SPORTS REV. $4.84B, EST. $4.62B

-

*DISNEY 1Q ENTERTAINMENT REV. $9.98B, EST. $10.52B

-

*DISNEY 1Q EXPERIENCES REV. $9.13B, EST. $9.04B

Subscribers also disappointed.

The number of domestic Disney+ subscribers fell to 46.1 million, likely the result of price increases, but the service lost fewer subscribers than Wall Street analysts had predicted. However, global subscribers to Disney+ (including its Hotstar service in India) also dropped to 149.6 million, from 150.2 million a year earlier (well below the 151.2 million expected).

“We continue to expect to reach profitability at our combined streaming businesses in the fourth quarter of fiscal 2024, and are making tremendous progress in this area”

Does the trend in these charts look like they’re about to hockey-stick? Disney sees 5.5-6 million additional subs in Q2.

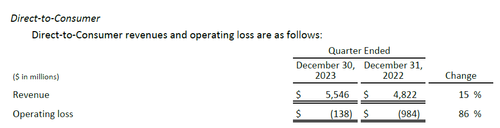

But we note Disney+ revenue rose 15% but it’s still losing money…

Lots of cost-cutting saved EPS (which beat at $1.22 vs 99c exp) :

“Our strong performance this past quarter demonstrates we have turned the corner and entered a new era for our Company, focused on fortifying ESPN for the future, building streaming into a profitable growth business, reinvigorating our film studios, and turbocharging growth in our parks and experiences,” CEO Robert Iger said.

But, what is driving shares higher is its forecast for FY adjusted EPS of $4.60 (well above the $4.27 consensus), and news of buybacks and a dividend boost…

In February 2024, the Board of Directors approved a new share repurchase program effective February 7, 2024; we plan to target $3 billion in repurchases in fiscal 2024.

The Board also declared on February 7, 2024 a cash dividend of $0.45 per share – an increase of 50% versus the last dividend paid in January – payable July 25, 2024 to shareholders of record at the close of business on July 8, 2024.

…and massive layoffs

“We are achieving significant cost reductions across our businesses, as evidenced by the realization of over $500 million in SG&A and other operating expense savings”

Which has sent the stock soaring after hours, up to one-year highs…

Which appears based heavily on cost-cutting (Disney may top $7.5 billion in costs cuts), and on the news that Disney announced late Tuesday of its ESPN network striking a deal with rivals Fox Corp and Warner Bros. Discovery to launch a sports-focused streaming service later this year.

Additionally, investors seem excited by news that Disney will invest $1.5 billion in Fortnite maker Epic Games.

“The Walt Disney Company and Epic Games will collaborate on an all-new games and entertainment universe that will further expand the reach of beloved Disney stories and experiences,” a Disney representative wrote in a news release. “Disney will also invest $1.5 billion to acquire an equity stake in Epic Games alongside the multiyear project. The transaction is subject to customary closing conditions, including regulatory approvals.”

So, to clarify – the streaming business is still losing money (even as revenues rise) and is now actually losing subscribers (and traffic is down in Disney World). But thanks to massive layoffs and a buyback and divi boost – and hopes and dreams of a deal on sports and gaming, everything is awesome for Iger in the mouse house.

Tyler Durden

Wed, 02/07/2024 – 16:22

via ZeroHedge News https://ift.tt/mfDk2WK Tyler Durden