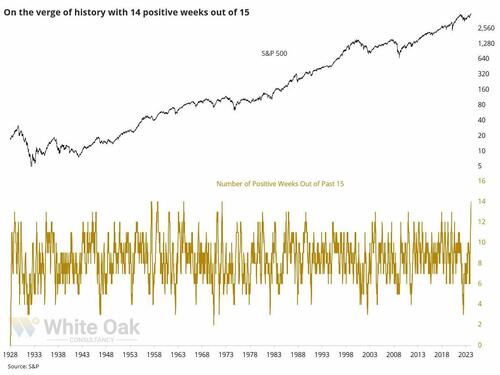

S&P To Open Above 5000, Set To Make It 14 Weeks Higher Out Of 15, Matching Best Stretch On Record

US futures ticked higher again on Friday morning ahead of the release of CPI revision data (previewed here), assuring that the S&P 500 cash index will rise above the historic 5,000 level when it breaks for trading. S&P 500 futures traded 0.2% higher as 7:50am in New York, while contracts for the Nasdaq 100 Index gained 0.3% as Big Tech stocks made more advances in premarket trading. While Asian stocks fell, weighed by Hong Kong, as China was closed for holidays, European stocks gained paced by the Estoxx 50, where energy sector leads as WTI crude oil futures hold most of Thursday’s 3.2% advance. Meanwhile 10Y interest rates rose again, hitting 4.18%, leaving their yield up about 17 basis points in the past five days, as the US dollar and oil traded flat. Today, we get receive CPI revisions (updated seasonal factors and weights) where few expect any major changes but according to JPM, expect “headline inflation rates for recent months to be lowered somewhat on net.” The next key data point will be the regular US inflation print due Tuesday.

With the S&P set to close well above 4958, it will make it 14 up weeks out of the past 15…

… and it will match the best 15-week stretches in history according to Sentiment Trader.

In premarket trading, Expedia Group shares fell after the online travel agency reported fourth-quarter gross bookings that slightly missed estimates, and named Ariane Gorin chief executive officer of the online travel company, while Pinterest made steep losses after the social-media company’s revenue fell short of estimates.

- Affirm Holdings (AFRM US) sank 10% after the buy-now, pay-later firm’s 2024 forecast for annual transaction volume came in below expectations. Analysts noted that the guidance appeared conservative as they do not see a slowdown in volumes in the second-half of the year.

- Cryptocurrency-linked stocks rallied as Bitcoin rises past the $46,000 mark. Stocks gaining include: Marathon Digital (MARA) +11%, Riot Platforms +9%

- Cloudflare (NET) soars 27% after reporting revenue that beat expectations, with analysts noting that sales were boosted by large new deals and renewals.

- Masonite International (DOOR) soars 35% after agreeing to be bought by Owens Corning (OC).

- PepsiCo (PEP) slips nearly 1% after providing a full-year sales forecast light of analysts’ estimates.

- Take-Two Interactive (TTWO US) fell 8.9% after the video-game company slashed its full-year net bookings forecast below consensus estimates. Analysts flagged softness in NBA 2K24 sales and the pushback of a planned release to next year, though were still confident in GTA VI releasing in FY25.

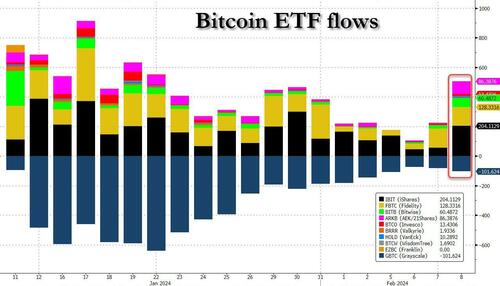

Cryptocurrency-linked companies rallied on Friday as Bitcoin surged past the $47,000 mark after the latest flow data revealed the 2nd biggest net inflow on record into bitcoin ETFs as GBTC outflows trickle to a halt.

The BLS will release its annual revisions to its consumer price index at 8:30 a.m. New York time. Last year, the update was significant enough to cast doubt on overall inflation progress and traders were speculating again that the recalculations might sway views over when the Federal Reserve will cut interest rates (full review here). “This could have important implications for the Fed,” wrote analysts at Rabobank in a research note. “It could increase or decrease the confidence that the FOMC has in a sustainable return to 2% inflation.”

Back to markets, on Thursday the S&P 500 briefly hit 5,000 for the first time after a massive buy program lifted the market as if just for that one reason, before closing little changed. US equities have posted only one weekly drop since late October and the gauge has more than doubled from its March 2020 pandemic-low — driven by expectations for a soft economic landing and optimism about the impact of artificial-intelligence.

“The equity market is responding to the positive data story and quite incredibly continues to march on,” said Charles Diebel, at Mediolanum International. “If growth holds up and there is a soft or no landing, that’s good for equities. And if something bad happens, the Fed will cut rates.”

Despite some soft earnings this season, US stocks have been buoyed by the technology sector and strong economic data, which has kept the benchmark rallying this year. The fun may be ending however: according to Bank of America’s Michael Hartnett, the rally is getting close to triggering sell signals. The bank’s custom bull-and-bear indicator is nearing a reading that could be interpreted as a contrarian signal to sell, he said.

Europe’s Stoxx 600 was little changed after contrasting updates from heavyweights Hermes and L’Oreal. L’Oreal shares tumbled 7% as Chinese shoppers reined in travel spending, while Tesco advanced after Barclays said it will acquire much of the supermarket chain’s banking business. Hermes rallied after reporting surging sales at the end of last year. Here are some of the biggest European movers on Friday:

- Hermes shares gain as much as 6.1% to hit a fresh all-time high after the maker of Birkin handbags posted sales figures which exceeded expectations for the fourth quarter, raising hopes of further growth due to its exposure to ultra-rich clients.

- Tesco shares rise as much as 2.4% after Barclays said it will acquire the grocer’s retail banking unit, which includes credit cards, unsecured personal loans, deposits and the operating infrastructure. Barclays shares fall 1.4%

- Ubisoft shares soar as much as 17% after the French video-game company said its bookings in the current quarter will be “sharply up,” boosted by a slew of launches such as Skull & Bones and Prince of Persia: The Lost Crown.

- Yara shares jump as much as 7.9% after the Norway-based fertilizer maker beat fourth-quarter adjusted Ebitda estimates. Sector peers OCI and K+S also gain.

- Carl Zeiss Meditec shares surge as much as 13% after the German medical optics company reported Ebit for the first quarter that beat the average analyst estimate. The results were “decent,” given the low expectations, Bernstein analysts said.

- Hexatronic shares jump as much as 36% after the Swedish fiber-optics firm reported its latest earnings described by Redeye as much better than feared, with cash flow particularly strong.

- AMS-Osram shares gain as much as 19%. The company reported a good profitability outlook despite soft demand, which should be week received, according to Vontobel.

- Coloplast shares jump as much as 11% after the Danish ostomy and continence care company reported stronger-than-expected margin in the first quarter. The Ebit margin is “solidly in the middle of the full-year guidance range,” according to Bernstein analysts.

- L’Oreal shares slide as much as 7.7% after the beauty company’s like-for-like sales miss stoked concerns over a slowdown in its luxury and Asian businesses.

- Deutsche PBB shares drop as much as 3.9%, hitting another all-time low amid concerns about exposure to commercial real estate, which have also hit its European peers this week.

- Delivery Hero shares fall as much as 6.5% after Bloomberg reported that its major rivals in Southeast Asia, Grab and GoTo, have restarted talks for a merger.

- EMS-Chemie shares fall as much as 5.4%, the most since April, after the Swiss chemical firm’s outlook disappointed, with analysts pointing to a tough operating backdrop.

- Verbund shares decline as much as 9.5% to hit its lowest level since April 2021, after the power producer warned that earnings in FY24 will be significantly below market expectations because of the rapid drop in wholesale electricity prices and emission allowances, as well as a smaller contribution from its Grid segment.

- Legal & General shares dip as much as 3.7% after Citi analyst Andrew Baker opens a 30-day downside catalyst watch.

Earlier in the session, Asian stocks fell weighed by Hong Kong, while many markets including China, Taiwan, South Korea, Indonesia, the Philippines and Vietnam were shut for public holidays. The MSCI Asia Pacific Index slipped as much as 0.4%, dropping for a second day, as investors turned cautious about Chinese markets ahead of the multi-day Lunar New Year holiday. Alibaba and Toyota were among the biggest drags. The Hang Seng dropped 0.8% and Hang Seng China Enterprises Index slid 1.1%, both falling a third straight day. Mainland markets were already shut for the holiday, which meant an absence of southbound flows as a potential support. Meanwhile, Japan’s Nikkei 225 breached 37,000 for the first time since February 1990 amid a weaker currency and earnings updates. In Australia, the ASX 200 was rangebound amid light catalysts, while RBA Governor Bullock reiterated a focus on bringing inflation down but noted that the Board hasn’t ruled in or out a further rate hike and even touched upon cuts.

Stocks dropped in Hong Kong as there is “no further positive policy from the mainland, and no stock connect inflows,” said Steven Leung, executive director at UOB Kay Hian Hong Kong. There seemed to be limited buying interest in Hong Kong “other than that from the southbound stock connect recently.”

In rates, treasuries were steady, with US 10-year yields rising 1bps to 4.17%. Bunds and gilts have pared most of an earlier fall. The Bloomberg Dollar Spot Index is flat. The kiwi tops the G-10 FX pile, rising 0.7% versus the greenback after economists at ANZ said the RBNZ will resume hiking interest rates later this month.

In rates, treasuries were marginally cheaper on the day, still inside weekly ranges, with yields higher by 1bp-2bp across the curve. US 10-year around 4.17% is ~1bp wider vs bunds and gilts in the sector; US 5s30s is little changed with corresponding German and UK curves flatter by ~3bp on the day. By contrast, core European rates see curve-flattening as German and UK long end outperform.

In commodities, oil prices edge up, with WTI rising 0.2% to trade near $76.30. Spot gold falls 0.1%. Bitcoin jumps 2.9%.

Market Snapshot

- S&P 500 futures little changed at 5,019.50

- STOXX Europe 600 little changed at 485.36

- MXAP down 0.1% to 167.34

- MXAPJ down 0.2% to 511.59

- Nikkei little changed at 36,897.42

- Topix down 0.2% to 2,557.88

- Hang Seng Index down 0.8% to 15,746.58

- Shanghai Composite up 1.3% to 2,865.90

- Sensex up 0.3% to 71,615.71

- Australia S&P/ASX 200 little changed at 7,644.84

- Kospi up 0.4% to 2,620.32

- German 10Y yield little changed at 2.36%

- Euro little changed at $1.0775

- Brent Futures little changed at $81.66/bbl

- Gold spot down 0.1% to $2,032.52

- U.S. Dollar Index little changed at 104.15

Top Overnight News

- The Biden administration is considering restrictions on imports of Chinese “smart cars” and related components that would go beyond tariffs to address growing US concerns about data security, according to people familiar with the matter. BBG

- China’s property crisis is starting to ripple across the world. “For Sale” signs on buildings from Mayfair to Toronto are popping up as hard-pressed Chinese investors and creditors try to raise cash. Sales prices will help put hard numbers on just how much trouble the wider industry is in. BBG

- China’s new yuan loans for Jan were ahead of plan at CNY4.92B (vs. the Street CNY4.5B and up from CNY1.1T in Dec) while aggregate financing spiked to CNY6.5T (nearly CNY1T above plan). SCMP

- Financial conditions in Japan will remain easy for the time being even after the Bank of Japan puts an end to the world’s last negative rate regime, Governor Kazuo Ueda said. BBG

- Barclays has agreed to buy the bulk of Tesco’s banking business in a £600mn deal, as UK supermarket chains accelerate their retreat from an ill-fated expansion into financial services. Barclays said on Friday that it would take on Tesco Bank’s credit cards and unsecured personal loans, totaling about £8.3bn of lending balances. It has also signed a 10-year distribution deal to sell financial products under the Tesco brand. FT

- BOE policymaker Jonathan Haskel, who voted to raise interest rates last week, said he is encouraged by signs that Britain’s inflation pressures might be on the wane but he would need more evidence of a cool-down before changing his stance. RTRS

- Joe Biden’s attempt to address suggestions he has a memory issue backfired with a new gaffe when he confused the leaders of Egypt and Mexico. Biden had summoned reporters to respond to a DOJ report fueling concerns about his age and insisted that his memory was “fine.” BBG

- New York City’s housing crunch is the worst it has been in more than 50 years. The portion of rentals that were vacant and available dropped to a startling 1.4 percent in 2023, according to city data released on Thursday. It was the lowest vacancy rate since 1968 and shows just how drastically home construction lags behind the demand from people who want to live in the city. NYT

- The special counsel investigating President Biden said in a report released on Thursday that Mr. Biden had “willfully” retained and disclosed classified material after leaving the vice presidency in 2017 but concluded that “no criminal charges are warranted.” NYT

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed and were mostly subdued in holiday-thinned conditions ahead of the Lunar New Year. ASX 200 was rangebound amid light catalysts, while RBA Governor Bullock reiterated a focus on bringing inflation down but noted that the Board hasn’t ruled in or out a further rate hike and even touched upon cuts. Nikkei 225 breached 37,000 for the first time since February 1990 amid a weaker currency and earnings updates. Hang Seng was pressured amid losses in property and tech in a shortened trading session and with mainland participants already away for Chinese New Year celebrations.

Top Asian News

- US President Biden’s administration is said to consider restrictions on China EVs to address data security concerns, while the move would be an additional hurdle beyond tariffs to keep out Chinese smart cars, according to Bloomberg.

- BoJ Governor Ueda said the chances are high for accommodative conditions to stay even if negative rates are abandoned, while he added they will pay heed to the health of the balance sheet if exit from stimulus policy draws near.

- RBA Governor Bullock said the Board is focused on bringing inflation down and recent developments in inflation are encouraging but they have some way to go to meet the inflation target and noted while there are some encouraging signs, Australia’s inflation challenge is not over. Bullock also stated the Board hasn’t ruled out a further increase in interest rates but neither has it ruled it in, while she added that inflation doesn’t need to be in the 2%-3% band for them to think about rate cuts and if consumption slows more quickly than expected, it will be an opportunity to cut rates.

European bourses are mixed and trading around the unchanged mark, following a mostly higher APAC lead, with slight underperformance in the CAC 40, hampered by losses in L’Oreal (-6.2%) post-earnings. European sectors are mixed; Healthcare is propped up by gains in Carl Zeiss Meditec (+9.4%) after it reported strong results. Utilities are on the back foot, after Enel (-0.9%) received a downgrade at RBC. US Equity Futures (ES U/C, NQ +0.2%, RTY +0.3) are on a mixed footing, with overall price action mirroring that seen in Europe; Expedia (-13.9%) is lower after it reported a deeper than expected loss in FCF; Take-Two Interactive (-8.6%) suffers after cutting Net Bookings guidance.

Top European News

- UK’s Ofgem says they are considering new rules to reduce the consumer cost which arises from supplier failures, costs claimed under a solar levy would be a liability of the failed supplier.

- Franklin Templeton’s Head of European Fixed Income Zahn says BoE probably needs to cut rates sooner than peers; says he is overweight UK Government bonds.

FX

- The Dollar is contained within yesterday’s 103.95-104.43 range and in close proximity to the 100DMA at 104.17 ahead of US CPI revisions. A dovish release could see a breach of 104.00 and a test of several DMAs with the 200DMA at 103.60; whilst a hawkish release could see a retest of the recent YTD peak at 104.60.

- EUR is yet to break out of yesterday’s 1.0741-1.0788 range. Likely to remain at the whim of the USD. Upside sees 100DMA at 1.0787.

- Steadier trade for USD/JPY after printing a fresh YTD high at 149.57 overnight. Technicians highlight the importance of a close above the 76.4% fib of the Nov-Dec’24 move at 149.17. Resistance ahead of 150.00 comes via 27th Nov. high at 149.67.

- The Kiwi is the G10 outperformer after ANZ bank forecasted that the RBNZ is to raise the OCR in Feb and April; currently 0.614

- PBoC set USD/CNY mid-point at 7.1036 vs exp. 7.1996 (prev. 7.1063).

- Mexican Central Bank kept its interest rate at 11.25%, as expected, with the decision unanimous and it removed the previous guidance about needing to hold the key rate for some time.

Fixed Income

- USTs are at the unchanged mark as relief from the well-received 30yr auction, making it three from three for the week, proved fleeting with focus switching from supply to the US CPI seasonal adjustment; currently flat in 110-22 to 110-30 bounds.

- Bunds are contained/incrementally softer with specifics light into the US main event. Yields are mixed and exhibit no clear bias given the overall tone but the session’s 133.23-133.61 bound includes a new WTD & YTD trough.

- Gilt price action is in-fitting with peers into the US session. BoE’s hawkish dissenter Haskel spoke pre-open and largely echoed the extensive remarks from peer Mann on Thursday; made a new WTD & YTD trough of 97.45.

Commodities

- Crude is holding near yesterday’s highs which saw the contracts settle higher by almost USD 2.50/bbl apiece amid broadening concerns of a widening Middle East conflict as Israel and Hamas have yet to come to a ceasefire agreement; Brent Apr trades around 81.75/bbl (81.36-81.84/bbl range).

- Horizontal trade across precious metals amid light newsflow and a contained Dollar; XAU dipped back under its 50 DMA (USD 2,033.84/oz) but remains within yesterday’s range (USD 2,020.25-2,038.79/oz).

- Mostly softer trade across base metals, in part amid the buoyant Dollar, whilst Chinese markets have also shut for some 10 days amid the Chinese New Year celebrations.

Earnings

- PepsiCo Inc (PEP) – Q4 2023 (USD): core EPS 1.78 (exp. 1.72), Revenue 27.9bln (exp. 28.4bln); plans to buyback around USD 1bln in shares. Shares -1.7% in pre-market trade

- Expedia Group Inc (EXPE) – Q4 2023 (USD): Adj. EPS 1.72 (exp. 1.68), Revenue 2.89bln (exp. 2.88bln). Negative free cash flow USD 415mln (exp. negative USD 192.6mln). Gross bookings USD 21.67bln (exp. 22.0bln). Announces CEO transition plan with Ariane Gorin to succeed Peter Kern as CEO. (Newswires) Shares -14.1% in pre-market trade

- Take-Two Interactive Software Inc (TTWO) – Q3 2024 (USD): EPS -0.54, Revenue 1.37bln (exp. 1.34bln); currently working on a significant cost reduction programme across the entire business to maximise margins. Cuts FY24 net bookings view to 5.25-5.3bln (prev. 5.45-5.55bln, exp. 5.48bln). (Newswires) Shares -8.5% in pre-market trade

- Hermes (RMS FP) – Q4 (EUR): Revenue 3.36bln (exp. 3.29bln). Sales at constant FX +17.5% (exp. +13.7%). FY recurring operating income 5.65bln (exp. 5.52bln). Proposes exceptional dividend of EUR 10/shr. Q4 Americas revenue +21.6% (exp. 12.1%). Q4 total Europe revenue +18.6% Y/Y. Q4 total Asia revenue +14.8% Y/Y. Confirms guidance. Executive Chairman says the Co. is very confident about the Chinese market; sees no interruptions in US trends (Newswires) Shares +4.5% in European trade

- L’Oreal (OR FP) – Q4 2023 (EUR): Sales 10.61bln (exp. 10.89bln), +6.9% (exp. +9.56%). Q4: North Asia comp. sales -6.2%(exp. +7.29%). Europe sales 3.27bln, +11.6%. North America sales 2.84bln, +9.4%. Luxe sales 4.1bln, +0.4% (exp. +4.42%). Consumer product sales 3.7bln, +7.7%. Professional products sales 1.23bln, +6.4%. Dermatological beauty sale 1.5bln, +27.3%. FY23: EPS 12.08 (exp. 13.15), +7.3%. Sales 41.18bln (exp. 44.5bln), +7.3%. Operating margin 19.8%. Op. 8.1bln (exp. 9.08bln, prev. 7.4bln Y/Y). Notes of the stagnating beauty market in China. (FT/Newswires) Shares -5.8% in European trade

- Ubisoft (UBI FP) – Q3 2023-24 (EUR): Sales 606mln (exp. 697mln, prev. 773mln), Net Bookings 626mln (prev. 727mln). Q4 Net Bookings seen “sharply up”, leading to a record annual net bookings figure. Reaffirms FY targets. “Moving forward, we’re gearing up for a very promising line-up for fiscal year 2025, including the upcoming release of Star Wars Outlaws’ in 2024″ (Newswires/ Ubisoft) Shares +17.5% in European trade

Geopolitics: Middle East

- US President Biden said the conduct of Israel’s response in the Gaza strip has been over the top and he is pushing very hard now to get a sustained pause in Gaza.

- White House said negotiations are ongoing regarding a hostage release and ceasefire deal, while it added that Secretary of State Blinken made it clear the US has concerns regarding Rafah operations. The White House also said that President Biden and German Chancellor Scholz will discuss Ukraine, the Middle East and the Red Sea shipping attacks.

- US Central Command said its forces conducted seven self-defence strikes against four Houthi unmanned surface vessels on Thursday and conducted strikes against seven mobile anti-cruise missiles that were prepared to launch against ships in the Red Sea.

- “Iranian militias move weapons and ammunition from Deir Ezzor to fortified Hezbollah positions on the Syrian-Lebanese border in anticipation of US strikes”, according to Sky News Arabia

Geopolitics: Other

- Russian President Putin said Russia has not yet achieved its goals in Ukraine and suggested the US should encourage Ukraine to resume talks, while he was said to sincerely believe that Russia has a historic claim to land in Ukraine. Putin said the US and Russia hold contacts at different levels and that Russia has no interest in Poland, Latvia or anywhere else, as well as noting that WSJ reporter Evan Gershkovich may be freed if the special services agree. Furthermore, he said those in power in the West have come to realise it is impossible to inflict strategic defeat on Russia and are wondering what to do next, while he added that they are ready for this dialogue.

US Event Calendar

- Revisions: CPI

Central Bank Speakers

- 13:30: Fed’s Logan Speaks in Moderated Q&A

DB’s Jim Reid concludes the overnight wrap

Tyler Durden

Fri, 02/09/2024 – 08:23

via ZeroHedge News https://ift.tt/L1xWNcC Tyler Durden