Bitcoin Blasts Off As ‘Euphoric’ Stocks Do Something They Haven’t Done In 52 Years…

The S&P 500 closed above 5,000 for the first time ever…

…only 39 more green candles to go until the election…

Source: Bloomberg

The S&P 500 jumped 5,000 faster than any other 1,000-point milestone (which of course makes some sense given that they are smaller and smaller percentage changes).

It took 719 sessions for the index to set its latest 1,000-point milestone, much shorter than the 1,227 trading days it needed to get from 2,000 in 2014 to 3,000 in 2019, Bloomberg News reports.

That compares to the 4,168 sessions from 1,000 in 1998 to 2,000 in 2014.

However, as Bloomberg notes, it may take time for the index to settle above 5,000, if history is any guide.

For example, after breaching 2,000 in 2014, the SPX hovered around that level for the next three weeks, only to retreat in the five weeks that followed.

A similar trend can be observed in 2019, when the index crossed 3,000. After rising more, the SPX fell and hovered below it for many weeks after.

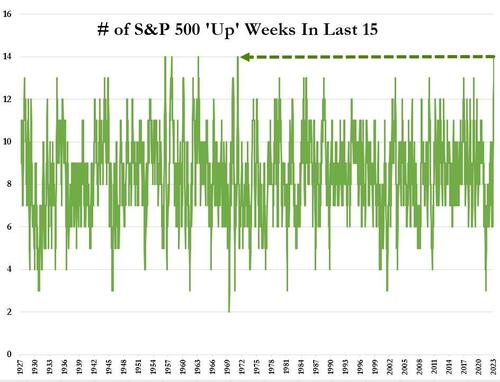

…and the S&P 500 is up for 14 of the last 15 weeks for the first time since March 1972…

But, while the S&P 500 is now up 4% from its prior record closing high in Jan 2022, so is Bitcoin; and the dollar is up 8%… and gold up over 12%. The loser in those two years are bonds which are down over 9%…

Source: Bloomberg

Small Caps were the biggest winners this week – amid a constant short-squeeze – followed by Nasdaq (and the S&P), while The Dow ended the week unchanged….

‘Most Shorted’ stocks ripped higher this week, up over 6% (biggest squeeze in two months)…

Source: Bloomberg

Regional Bank shares ended the week lower, but well of the mid-week lows…

Source: Bloomberg

MAG7 stocks soared for the 5th straight week…

Source: Bloomberg

NVDA just kept on doing what it does…

Source: Bloomberg

…with its market now approaching that of AMZN and GOOGL…

Source: Bloomberg

Tech stocks soared despite yields rising significantly…

Source: Bloomberg

…with the belly of the curve underperforming on the week…

Source: Bloomberg

Rate-cut expectations dropped significantly on the week (with the odds of a March cut below 20% and less than 5 overall cuts now priced in for 2024)…

Source: Bloomberg

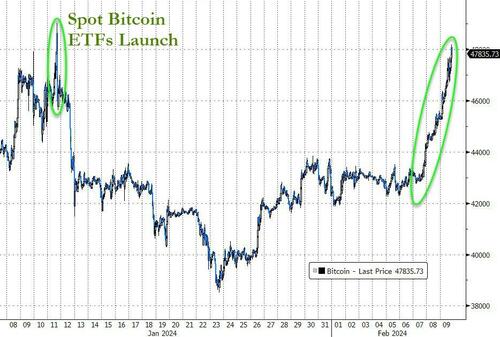

Bitcoin soared back above $48,000 – erasing the ‘sell the news’ post-ETF declines – at its highest ‘close’ since Dec 2021…

Source: Bloomberg

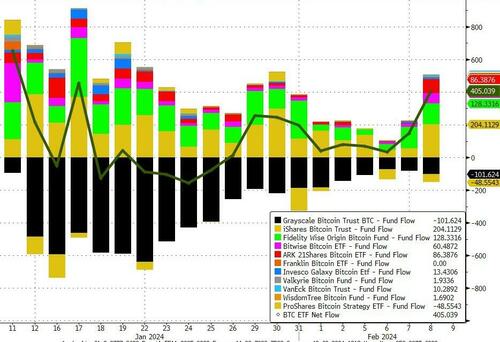

…thanks to the ongoing net inflows into spot ETFs (which in aggregate are now above $2.1BN)…

Source: Bloomberg

The dollar was basically flat on the week, holding gains from last Friday’s post-payrolls surge…

Source: Bloomberg

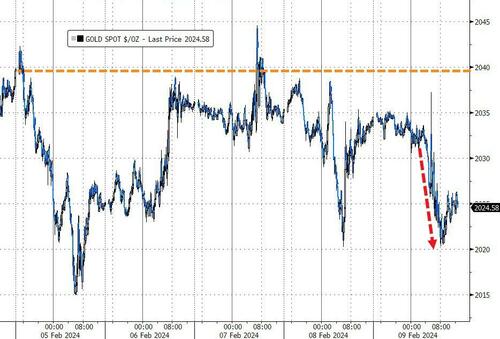

The dollar’s modest gains were gold’s modest losses on the week…

Source: Bloomberg

Oil prices rallied back this week with WTI back above $77 intraday, erasing last week’s punishment…

Source: Bloomberg

Finally, ‘tick tock’…

Source: Bloomberg

NVDA earnings? Bank crisis? CPI re-ignition? Animal-Spirits 2.0?

Source: Bloomberg

March is gonna be lit…

Tyler Durden

Fri, 02/09/2024 – 16:00

via ZeroHedge News https://ift.tt/yKGOY1a Tyler Durden