Fed Says Bank Deposits Exploded Higher Last Week (As NYCB Hit The Fan)

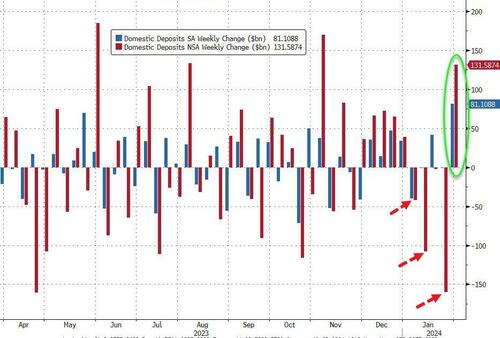

Even before the last week’s chaos surrounding New York Community Bancorp, US bank deposits (non-seasonally-adjusted) had been collapsing. But this week – amid the chaos – deposits exploded $147BN higher (NSA)…

Source: Bloomberg

On a seasonally-adjusted basis, total deposits rose a stunning $101BN last week – the biggest weekly increase since June 2021…

Source: Bloomberg

And excluding foreign deposits, domestic banks saw the largest deposit inflows since May 2021 (+$81BN SA) with Large banks +$61.5BN and Small banks +19.5BN. On an NSA basis, domestic deposits jumped $131BN, with Large banks adding $103BN and Small banks adding $28BN…

Source: Bloomberg

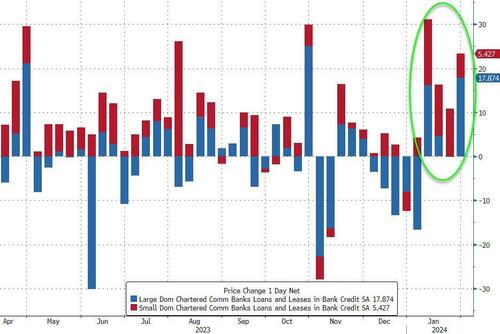

On the other side of the ledger, loan volumes increased for the 4th week in a row with large banks adding $17.9BN and Small banks adding $5.4BN…

Source: Bloomberg

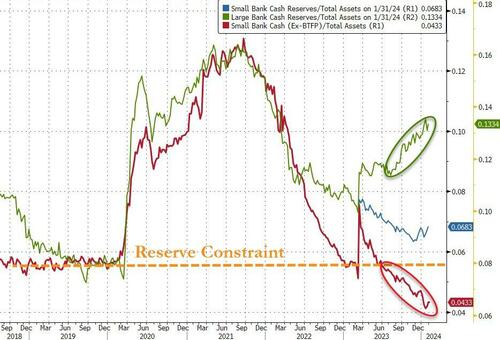

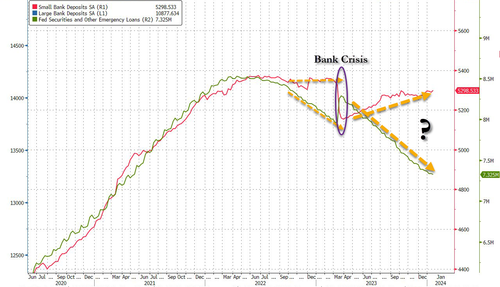

And finally, as a reminder – despite the rebound off the lows this week in regional bank shares, which must mean everything is awesome, right? – the regional bank crisis is still very much alive as evidenced by the red line below (without The Fed’s imminently expiring BTFP facility)…

Source: Bloomberg

…what else are big banks (green line) going to do with all that cash burning a hole in their pockets?

The bottom line is – this looks a lot like a ‘Small Bank’ crisis. The last time this happened, the crisis sparked a sudden $300BN ‘run’ in small bank deposits…

Source: Bloomberg

Is The Fed ‘hoping’ for a controlled bank-run this time – so as many small bank deposits are drained voluntarily, before they are drained all at once in a panic (and the Reverse Repo facility is empty, unable to provide any cushion)?

Tyler Durden

Fri, 02/09/2024 – 16:40

via ZeroHedge News https://ift.tt/mZCgOu6 Tyler Durden