Michael Burry Liquidates Semiconductor “Big Short” During Epic Meltup; Here’s What He Bought

We’ll leave it to others to decide if Michael Burry is one of the biggest one hit wonders of his generation, but last quarter, when the Big Short liquidated his big S&P and QQQ put shorts at a loss, and when he doubled down with a short on semiconductor stocks instead in the form of SOXX puts, we said that his latest trade “may have been an even bigger flop than Burry’s ill-timed bet against the SPY and QQQ.”

Michael Burry Liquidates “Big Short” After Suffering Big Loss; Doubles Down With Bet Against Semiconductors https://t.co/6C2sApKydn

— zerohedge (@zerohedge) November 14, 2023

We can now confirm that Burry’s latest trade was indeed was a giant flop, because as one look at a chart of the Philly Semiconductor index shows, it’s been a one way train for semis (primarily NVDA) higher since Burry’s bearish bet.

And in fact, if he had held on to the puts, Burry would have been on the other side of a nearly 50% surge.

However, as a 13F filing filed earlier today reveals, Burry did not hold on to said SOXX put and instead liquidated the position some time in the fourth quarter, which as of Sept 30, 2023 had a notional equivalent of 100,00 shares of $47.4 million and was the fund’s largest position.

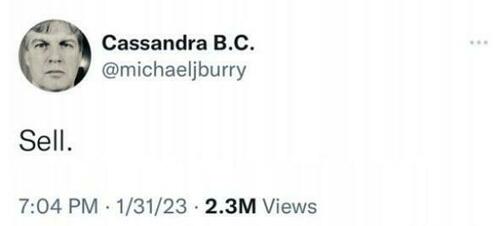

So having dumped his biggest long, maybe Burry – who a year ago infamously said simply “sell“…

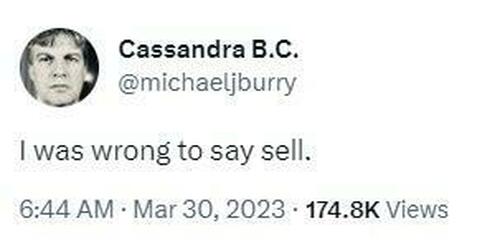

… only to correct himself a few months later when stocks stormed higher…

… has had enough of waiting for an “imminent” market crash (and buying puts after puts), and instead after he was long just 11 stocks at the end of Q3, he has since more than doubled his longs to 25 stocks worth a total notional value of $94.6 million (it is unclear what if any shorts he may have had at the same time since SEC regulations still bizarrely do not require the publication of bearish stock bets).

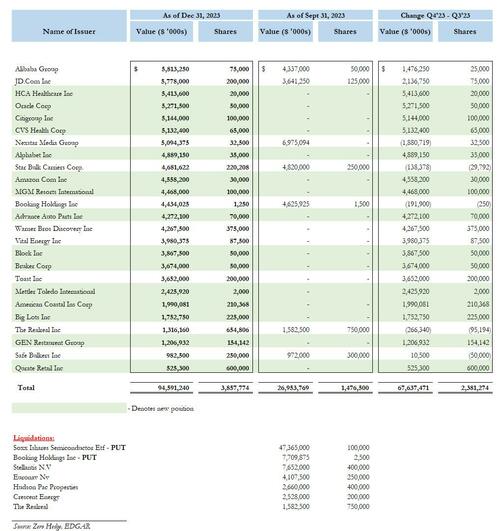

What did he buy? Well, in keeping with a tradition of almost entirely overhauling his entire portfolio every quarter, he added to what were his top two legacy positions (Chinese internet giants Alibaba and JD.Com), which the family office bailed on the second quarter of 2023 only to jump back in later in 2023, but most of the remaining top 10 names were new positions, including stakes in HCA Healthcare, Oracle, Citigroup, CVS, Alphabet, Amazon and MGM Resorts, all of which were worth more than $4 million.

Below is a full list of what Burry held as of Dec 31, 2023.

Tyler Durden

Wed, 02/14/2024 – 16:45

via ZeroHedge News https://ift.tt/soDiNla Tyler Durden