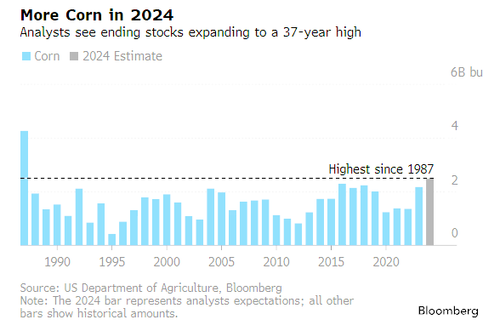

Corn Drops To 3-Year Low As Supplies Expected To Surge To 1987 Levels

Corn futures hit a three-year low as traders waited for the US Department of Agriculture’s annual outlook forum on Thursday. The USDA’s initial outlook for the coming season could show higher domestic crop supplies and elevated spring plantings.

According to Bloomberg, USDA’s annual outlook forum is expected to project the largest domestic stockpile since 1987.

Traders have already been pricing in a dismal outlook, with money managers holding the largest bearish bet in almost five years. Corn for March delivery has nearly roundtripped all Covid gains.

A survey of Bloomberg analysts expected the upcoming 2024-25 season will reach upwards of 2.493 billion bushels. This will exert continued downward pressure on US farmers and force them to decrease spring plantings of corn in favor of planting more soybeans.

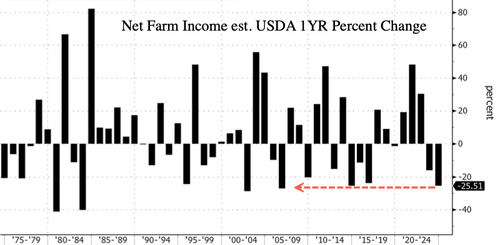

Meanwhile, in a separate USDA report, new forecasts show US farmers are poised for another year of financial misery, facing the most significant decline in incomes in almost two decades as grain prices slide and US dominance in ag exports wanes.

USDA forecasts net farm income, a broad measure of profits, to plunge $39.8 billion, or 25.5%, to $116.1 billion in 2024. This follows a forecasted decrease of $29.7 billion, or 16%, from 2022 to $155.9 billion in 2023.

If the estimate holds, farmers face the largest income drop since 2006 and back-to-back years of financial pain.

“With this expected decline, net farm income in 2024 would be 1.7 percent below its 20-year average (2003–22) of $118.2 billion and 40.9 percent below the record high in 2022 in inflation-adjusted dollars,” USDA wrote in the report.

What could reverse sliding grain prices? More Black Sea destabilization…

Tyler Durden

Fri, 02/16/2024 – 05:45

via ZeroHedge News https://ift.tt/b4co0Kz Tyler Durden