Bitcoin & Black Gold Bid As Stagflation Fears Wreck 52-Year-Old Equity Win-Streak

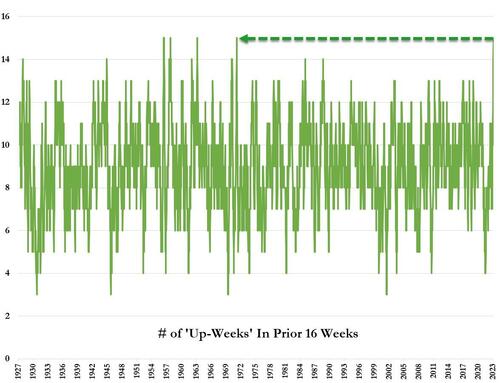

The S&P 500 was on course for its 15th positive week of the last 16, but a late-day sell-off spoiled the historic streak which hasn’t happened since March 1972.

Here’s what that streak would have looked like… but no more!

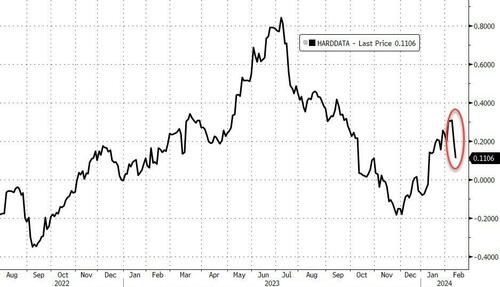

This occurred in a week that saw hotter-than-expected inflation (CPI and PPI), but weaker-than-expected retail sales, industrial production, and housing activity – which all sounds very stagflation-y.

All of which pushed ‘hard’ data to its biggest weekly decline since the first week of October…

Source: Bloomberg

But, based on the lagged impact of the dramatic easing of financial conditions last year, we suspect this ‘weak’ week is a blip and economic ‘animal spirits 2.0’ continues for another month at least…

Source: Bloomberg

Rate-cut odds fell (hawkishly) this week with even June now only a 60% chance of being the first cut…

Source: Bloomberg

And the market is pricing a 50-50 chance of 3 or 4 rate-cuts for the year, sliding less-dovishly this week…

Source: Bloomberg

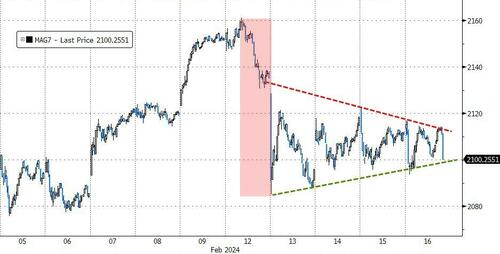

While stocks ripped back from the CPI puke on Tuesday, they were unable to build on gains…

And that left Nasdaq the week’s biggest loser, Small Caps the biggest winner while the S&P limped lower and The Dow clung to unchanged…

After Tuesday’s bloodbathery, the short-squeezers returned with avarice. But, today they seemed to run out of ammo as OpEx wiped away all the long gamma…

Source: Bloomberg

SMCI entered a bear market (down over 25% from its highs today)…

MAG7 stocks ended the week lower, unable to re-gather any momentum from the CPI-spill…

Source: Bloomberg

Treasury yields were higher across the curve this week after hotter than expected CPI, jobless claims, and then PPI…

Source: Bloomberg

But, as the chart above shows, the short-end notably lagged, leaving the yields curve to an ugly bear flattener. The 2s30s curve is back at its most inverted in 2024…

Source: Bloomberg

Mortgage rates surged back up to two month highs…

Source: Bloomberg

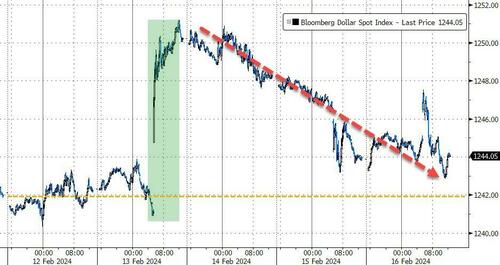

The dollar ended the week higher, but barely, after giving back all the CPI spike gains…

Source: Bloomberg

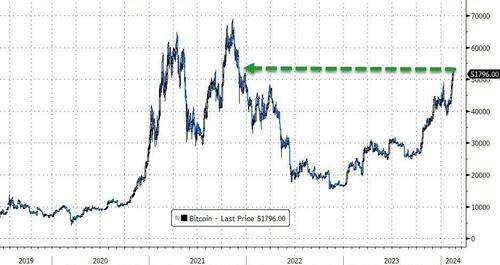

Bitcoin rallied (8%) back above $52,500 this week (its highest since Nov 2021), the fourth straight week of gains for the largest crypto currency…

Source: Bloomberg

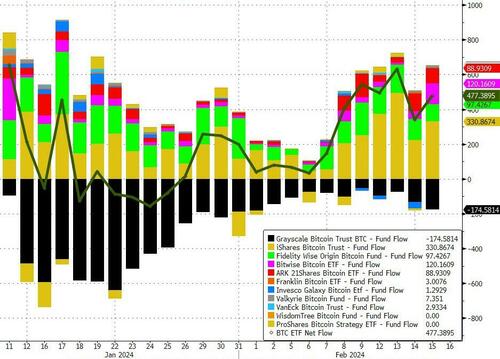

On the heels of over $2BN of net inflows into spot bitcoin ETFs this week…

Source: Bloomberg

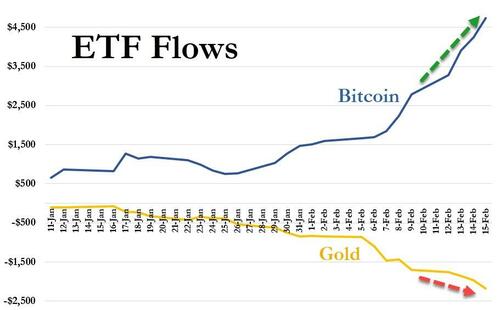

Notably, bitcoin ETFs have seen almost $5BN of net inflows since inception and during that time, Gold ETFs have seen net outflows of over $2BN…

So it’s not a total surprise that gold ended lower on the week, even though it bounced back notably above $2000 (spot) after the CPI clubbing…

Source: Bloomberg

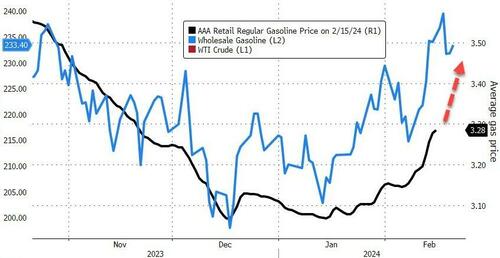

Oil prices rallied for the 4th week of the last 5, with WTI back above $79 and it highest close since the first week of November…

Source: Bloomberg

Meanwhile, this happened to XOM…

Source: Bloomberg

And don’t expect gas prices to help CPI anytime soon (or Biden’s re-election hopes)…

Source: Bloomberg

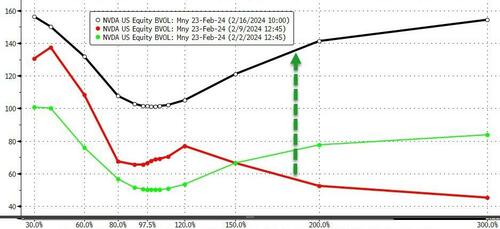

Finally, the most important single-stock earnings print in years is imminent. We are of course talking about NVDA. The current skew for the stock’s options is pretty balanced between upside and downside, but as the chart below shows, in the last week, upside (calls) have been aggressively bid…

Source: Bloomberg

As Goldman’s Brian Garrett noted, with an 11% implied move, the quantum of market cap priced for gain or loss is equivalent to stock number 37 in the SP500 ($200bn+).

Monday is a market holiday, so at least stocks won’t actually trade higher that day, but next week promises to be another fun one.

Tyler Durden

Fri, 02/16/2024 – 16:00

via ZeroHedge News https://ift.tt/eRLI1uM Tyler Durden