Chinese Stocks Set To Soar

After the 10-day Lunar new Year holiday, Chinese markets are all set to reopen with China with a positive lead from the Hong Kong and ADR rally last week. as UBS notes, a lot of the press reports has been focused on the improvement in consumption in China, despite the ongoing deflation and property crisis concerns, but as always, the big question remains on the sustainability of any rebound. Very upbeat travel-related data news span from rail trips, online hotel bookings, spending on Meituan, Macau visitation data, and tourism spending. State media reported over the weekend that about 474mn domestic tourist trips were made during the 8-day holiday, up 19% from the same period in 2019. Total tourism spending climbed nearly 8% from that year to CNY633 bn, while domestic trips reportedly rose 34% and spending reportedly increased 47% from 2023.

Not surprisingly, the UBS desk says that it is better buying across the region, with early flows showing a 2:1 buy skew.

Below we dig deeper into the latest market dynamics as summarized by Bloomberg Markets Live reporters George Lei, Henry Ren and Jacob Gu, who lay out the three main things we learned about China last week:

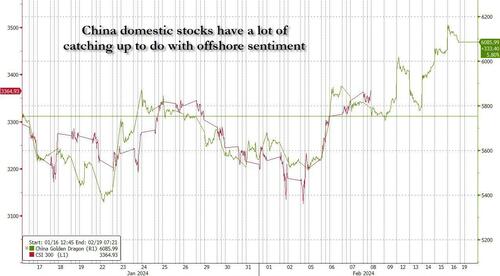

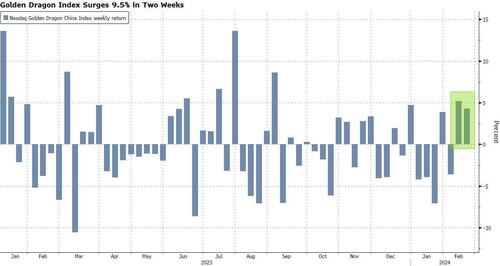

1. A-shares are likely to start the Year of the Dragon with a bang, extending a rally that began before the Lunar New Year hiatus. That’s after investors piled into US-listed Chinese stocks in the week ended Feb. 16, when onshore markets were closed. The Nasdaq Golden Dragon China Index advanced more than 4% in the period, helping drive month-to-date gains for the gauge to almost 10%. In Europe, stocks of luxury brands with exposure to Chinese demand also gained traction last week. For those who don’t hold direct stakes in Chinese companies, buying options has become an increasingly popular trade.

Initial government reports pointed to a nationwide resurgence in road, rail and air travel over the week-long holiday, signaling a possible pickup in consumer spending. Beijing’s next steps to support the economy will come into focus when mainland markets reopen on Monday. The first data point to watch will be Tuesday’s decision regarding the five-year loan prime rate, which could be reduced by 10 basis points, according to consensus economist forecast.

2. Sentiment toward the broader Chinese market appears to be improving after a poor start to 2024. The outlook is becoming “incrementally more positive” and investors should pivot to “risk on” trades on Chinese equities, JPMorgan Chase & Co. said in a research report on Friday.

The MSCI China Index is now trading below the bank’s year-end target of 56 under a bearish scenario, which presents buying opportunities, according to strategists including Wendy Liu and Marko Kolanovic. “If overcapacity sectors do see restricted equity issuance, leading players in the renewables and new energy vehicle ecosystem should benefit,” they wrote. Internet names such as Tencent, Alibaba and Meituan that were among the most net sold by active funds before the Lunar New Year may also see a reversal in flows, they added.

3. While China has been on holiday, global investors have been snapping up cheap options to hedge risks of a bigger-than-expected yuan drop. Societe Generale advised clients on Wednesday to take advantage of “multi-year low” prices and buy three-month USD/CNH risk reversals as protection against a move above 7.25. Yuan’s low volatility is mainly due to PBOC fixing, which hasn’t moved much over the past couple months but could face increasing challenges down the road, according to the French bank.

With US consumer and producer price gauges last month pointing to inflationary momentum, Citigroup, Societe Generale and former Treasury Secretary Larry Summers are all telling investors to brace for the potential of a Fed hike, rather than cuts that have been largely priced in. Depreciation pressure on the Chinese currency looks set to persist.

Tyler Durden

Sun, 02/18/2024 – 20:31

via ZeroHedge News https://ift.tt/1DRX4MK Tyler Durden