“Consolidate Or Get Eaten”: Wall Street Finally Embracing Shale After $250 Billion In Oil Deals Last Year

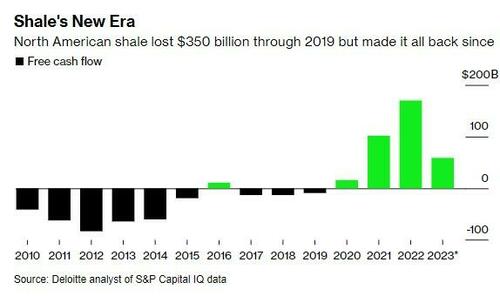

It’s no sooner than we’ve been documenting the collapse of ESG and ‘clean green investing’ on Wall Street, than the world of finance seems ready to give a big warm embrace to shale drillers.

It’s almost as if money managers wind up chasing wherever the best returns are. Imagine that…

Bloomberg wrote last week that shale is now in an ‘arms race’ with Diamondback Energy Inc.’s takeover of Endeavor Energy Resources LP announce last week capping $250 billion in oil and gas deals last year.

Diamondback, self-proclaimed as “the must-own” stock in America’s wealthiest oil region, saw its stock soar 11% within hours, defying the usual downturn faced by acquiring companies. This surge signaled strong investor endorsement – something the street hasn’t seen in oil for years.

Mark Viviano, a managing partner at Kimmeridge Energy Management Co. told Bloomberg: “It has become a big-company game. Now you have an arms race for operational scale and investor relevancy.”

The report noted that as the shale industry evolves during a period where energy constitutes only 3.8% of the S&P 500 Index, despite the U.S. leading in global oil production with 45% more crude than Saudi Arabia, the sector has seen significant consolidation.

The number of publicly traded shale companies has decreased by 40% in six years to about 50, Warwick Investment Group LLC notes.

Kate Richard, chief executive officer at Warwick, said: “It’s kind of like Pac-Man right now: consolidate or get eaten. We’re probably going back to the ‘70s, where there were seven to 10 major players in the US.”

Diamondback CFO Kaes Van’t Hof added: “It put us in a new weight class, which is a good thing in this business. The perception is that bigger means more durability.”

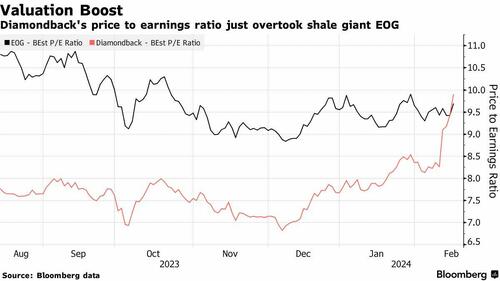

Following the deal’s revelation, Diamondback now trades at 9.9 times earnings, surpassing EOG, which opted out of the current acquisition frenzy. This leap will elevate Diamondback from 275th to approximately 150th in the S&P 500 by market value, capturing the attention of major investors eager for greater involvement in the Permian Basin, the abundant oil field across Texas and New Mexico.

Deloitte’s Teresa Thomas commented: “Big buyers are likely to spearhead a fresh wave of efficiency gains driven by technological advancements in both production and cost management.”

Endeavor founder Autry Stephens is now set to become America’s richest oil magnate after the deal closes. Sam Sledge, CEO of Midland concluded: “He’s one of the last original wildcatters, funding things out of your own back pocket and taking risk. We’re playing a different game now.”

Tyler Durden

Wed, 02/21/2024 – 21:20

via ZeroHedge News https://ift.tt/yYXw0cv Tyler Durden