WTI Retraces Gains After Crude Build; Spreads Signal Physical Market Tightening

Oil prices are extending gains this morning, reversing earlier losses, as reports suggest OPEC+ will rollover its production cuts. This will pressure supply as Red Sea disruptions are triggering widely tracked gauges of the physical market to point to tighter conditions.

Last night’s big crude build, reported by API, was shrugged off (helped by a bigger than expected gasoline draw).

Bulls will be hoping to see a smaller crude build

API

-

Crude +8.428mm (+1.5mm exp)

-

Cushing +1.825mm

-

Gasoline -3.27mm(-1.3mm exp)

-

Distillates -523k (-2.0mm exp)

DOE

-

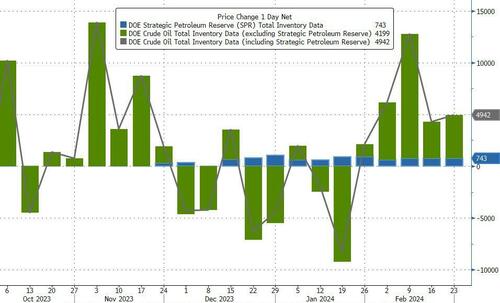

Crude +4.199mm (+1.5mm exp)

-

Cushing +1.458mm

-

Gasoline -2.83mm (-1.3mm exp)

-

Distillates -510k (-2.0mm exp)

Official data showed a smaller Crude build than API (but still more than expected) as well as a decnt build at Cuishing

Source: Bloomberg

The Biden administration has added to the SPR for 12 of the last 14 weeks (+743k last week)

Source: Bloomberg

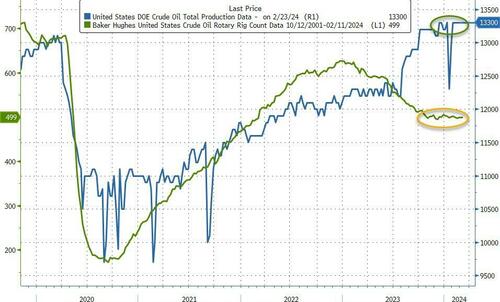

US Crude production was steady at record highs (13.3mm b/d) as rig counts have stopped falling…

Source: Bloomberg

WTI was hovering just above $79 ahead of the official data and extended its retracement on the official data…

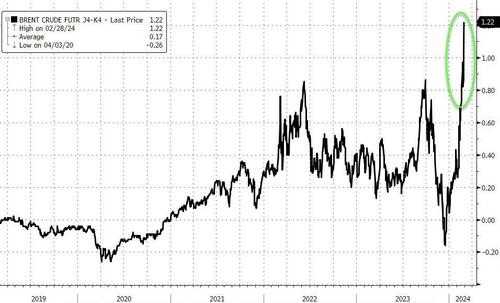

Spreads are “on fire, pointing to tight physical markets,” said Daniel Ghali, a commodity strategist at TD Securities.

WTI prompt spread…

“With Europe taking fewer Middle East barrels due to the extra shipping costs to avoid the Red Sea, there is a preference for short haul and that pool of alternatives is thinner,” said Christopher Haines, an analyst at Energy Aspects.

Brent prompt spread..

Other gauges such as the so-called physical market swaps and the WTI cash roll have also strengthened.

Tyler Durden

Wed, 02/28/2024 – 10:40

via ZeroHedge News https://ift.tt/6kiT7mR Tyler Durden