Goldman Says Office Tower Prices Must Plunge 50% For Housing Conversion To Make Sense

As office tower vacancies continue to rise nationwide, many of these buildings are becoming economically nonviable workspaces, raising the question of what can be done with millions of square feet of underutilized space. Simultaneously, the US housing market faces a severe shortage, leaving investors and lawmakers to ponder whether underutilized office space can be transformed into multifamily buildings.

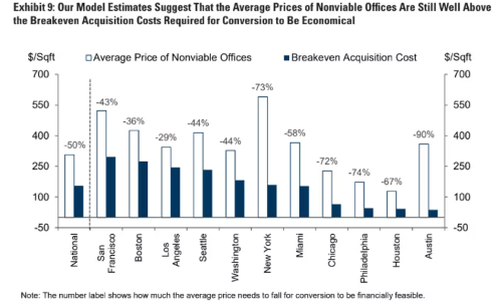

Goldman analyst Jan Hatzius uses a discounted cash flow model to show that the current acquisition costs of office towers are still too high for conversion to multifamily buildings, indicating that offices will likely remain underutilized in the medium term.

Hatzius pointed out that the viable point where office tower conversions would make financial sense would be a further price decline of 50%.

About 4% of the nation’s office buildings could be slated for conversion projects into housing, with the share expected to jump as the office vacancy rate is forecasted to reach 18% in 2033 from about 14% this year.

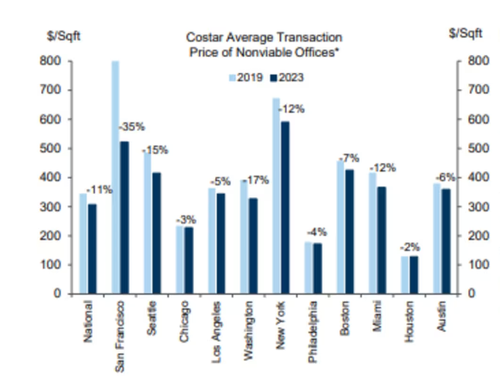

Many of these nonviable towers are still overvalued and not cheap enough for conversion because of financing costs. Even with San Francisco’s office industry in a meltdown and prices having already tumbled 35% since 2019, these levels are still too high.

Goldman’s definition of a nonviable office tower is that it must be located in a suburban area or central business district and built before 1990 but has not been renovated since 2000. Each tower must have a vacancy rate above 30%.

Based on Goldman’s model, Hatzius’ team suggests “that converting a nonviable office that is priced at the average current level will result in a $164 loss” per square foot, adding, “This means that current office prices would need to fall by that much, to around $154 per [square foot] or by 50%, for the cost to be fully covered by the stream of discounted future revenues.”

With that in mind, a structural downshift in office demand has occurred in recent years because of the widespread adoption of hybrid work, among other factors, including an exodus of cities by companies whose employees no longer feel safe in imploding progressive-controlled metro areas.

The CRE crisis is far from over (read prior GS report on “heightened CRE risks“). And remember the dominoes began falling last month.

Tyler Durden

Wed, 02/28/2024 – 21:20

via ZeroHedge News https://ift.tt/Jp7KgVf Tyler Durden