Global Markets Are Not Partying Like It’s 1999 Yet

Authored by Simon White, Bloomberg macro strategist,

Global equity markets are not yet as overbought as they were through much of the 1990s on several measures.

US and many other stock markets continue in their seemingly inexorable ascent. Incessant rallies are often controversial – which is maybe one of the reasons they last longer than many expect as higher becomes the pain trade.

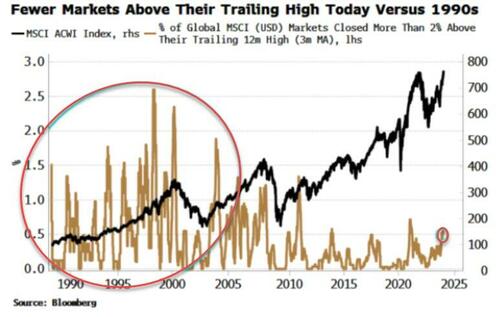

Regardless, if we look back at the 1990s at global markets we can see they are less stretched now than they were back then. Take the percentage of MSCI country indices (in USD terms) trading more than 2% above their trailing 12-month high. This was much more volatile in the 1990s (partly due to lots of new EM indices), and on average higher than it is today (and indeed for much of the past 10-15 years).

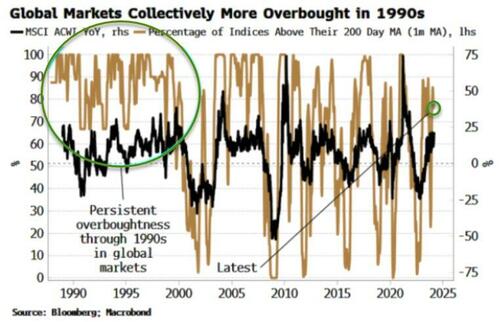

It’s similar if we look at the proportion of MSCI indices trading above their 200-day moving averages. This regularly touched 100% in the 1990s, but currently sits at just over 75% (on a one-month smoothed basis). The last time it hit 100% was in March 2021, within 7% of the MSCI ACWI’s high before the bear market hit in January 2022.

Also, how far indices’ 200-day moving averages were above their price on the eve of the dotcom top in March 2000 was higher than it is today. We can see the US, Europe and Canada’s indices were the most overbought on this measure, with their respective values today much lower.

There are plenty of good arguments why markets, especially in the US, are on borrowed time.

But stocks also have an annoying habit of not doing what many people think they should do. No one should take it as an affront when markets do not accord with their belief or view – it is what it is.

Still, global equities are not yet displaying some of the signs they were in the late 1990s that suggested a market top was imminent.

Tyler Durden

Tue, 03/05/2024 – 07:20

via ZeroHedge News https://ift.tt/evrltpn Tyler Durden