Only The US Can Destroy The US Dollar

Authored by Russell Clark of the Capital Flows and Asset Markets substack

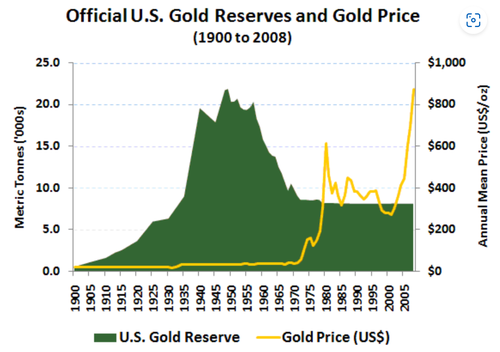

Being the reserve currency has enormous benefits. And in the entirety of financial history, the US is the first and only fiat reserve currency. Sterling, and any other reserve currencies derived their value from the ability to maintain their value to gold. With the two World Wars, the US came to be seen as the government most able to honour its commitments, and saw huge inflows of gold, but in the 1960s, gold started to flow back to Europe and elsewhere, and in essence, Nixon decided that higher interest rates needed to maintain the link to gold price was not worth the effort, and cut the link to gold price.

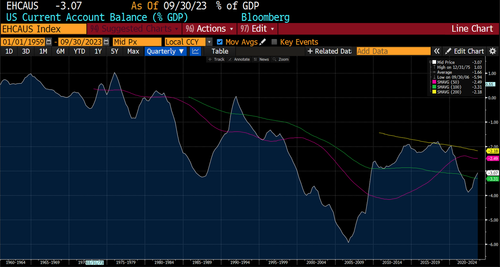

Moving from a gold based currency to a fiat currency has had enormous benefits for the US. First of all is that it no longer needs to ever run a current account surplus. That is it never needs to reduce consumption or imports, which is a huge political benefit. The norm since 1980 is for the US to have a current account deficit.

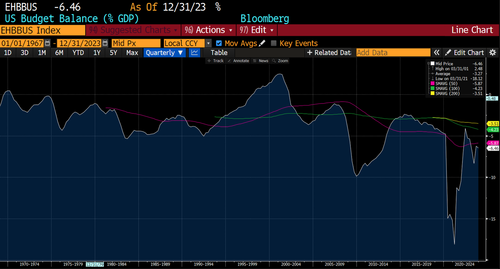

The US also does not need to balance the budget. The budget was balanced in 2000, but this was probably now seen as a tactical error on the part of the Democrats.

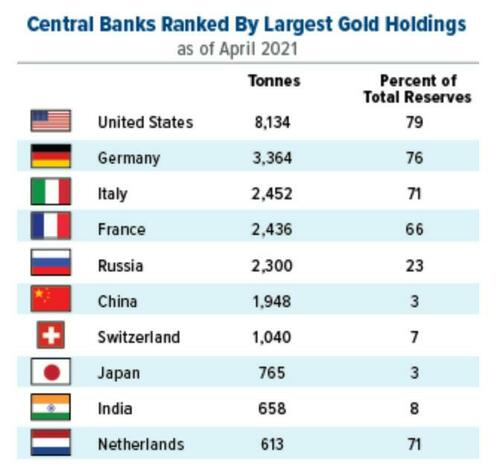

What I find most interesting about the transition from gold to US treasury backed financial system is how Asian nations, despite a long history of using gold, accepted this system. China and Japan have some of the largest foreign reserves in the world, but their holdings of gold are limited. Even India holds a relatively small amount of gold as foreign reserves.

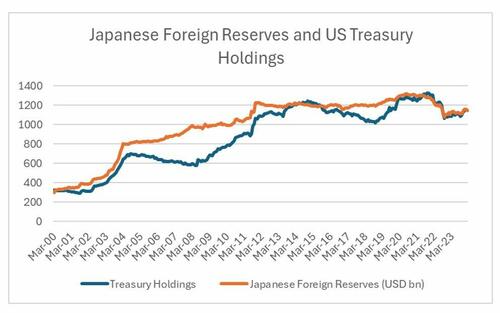

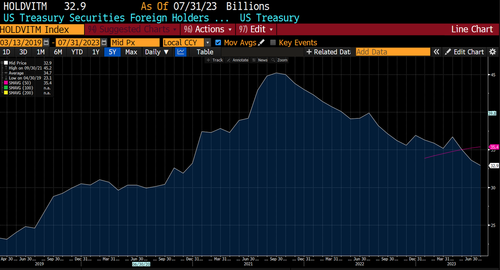

Japan is the most interesting, where almost all of its foreign reserves are held as US treasuries. Unfortunately US treasury data on foreign holders only begins in 2000, but I have no reason not to believe the Japanese were big buyers in 1990s as well.

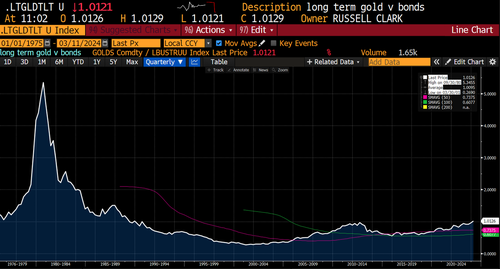

Why do the Japanese only buy treasuries? Well for most of the time since 1980, treasuries have been much better investments than gold. They offer an income stream, they are very liquid, and they have a natural pull to par, which means that there is never a need to book a loss – which will have powerful appeal to bureaucrats. From 1980 to 2000 long dated treasuries consistently outperformed gold, while from 2000 its has been far more of mixed bag.

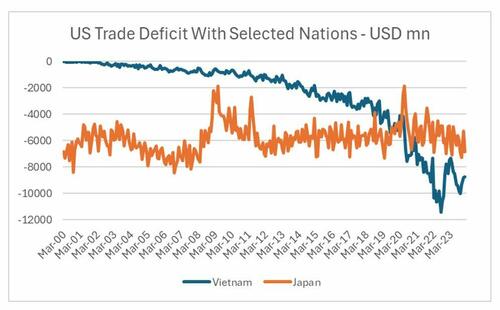

Typically when people talk about reserve currency status, they talk about the size of the US economy or its military might, and basically imply that this can never end, so US dollar reserve status is forever. I think about the US dollar as a reserve currency I think it is something more akin to Microsoft, or Google. The product is not that good, the management is of debatable quality, but because everyone else uses it, its just too hard to switch. Given the infrastructure, and ease of using the US dollar for almost all financial transactions, why would anyone bother to use a different system? And even as US trade deficits exploded this just left more money for Asian exporters to recycle back into treasuries. The flywheel worked for all parties.

As pointed out in the last post, the US itself has started the process of creating a parallel financial system, by basically trying and failing to cut off Russian energy exports from the US financial system. For years the Russian wanted to price their oil in non-US dollar form, and made little headway, but the US basically did the job for them.

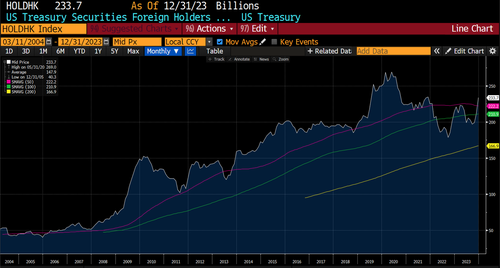

What would be the next step in the US dismantling the US centric financial system? For years I have wondered why the Hong Kong dollar has remained pegged to the US dollar. Why not just repeg to Chinese Yuan? Hong Kong could then sell large chunks of its foreign holdings, and reducing the scope of the US to influence trade in HK.

Of course changing from USD to peg to a CNY peg would be hassle for all the existing contracts and present financial and legal problems, which no doubt would fan more resentment of Beijing in Hong Kong. A far better solution for Beijing would be for the US government to begin sanctioning HK businesses, and changing the legal status of HK, a process that has begun under the Trump administration. All this involves doing is China integrating Hong Kong into its political system, and the US will predictably react. It is hard to see how this process could be reversed.

The problem for the US is that Russia has been cut off from the US financial system, and not imploded. That makes the fear of sanctions more tolerable. The Euro/Ruble exchange rate, which is as a good of as a measure for Russian economic health shows that the sanctions have had an effect, but not as dramatic as hoped. That is there is life after sanctions.

The political calculation for US attitude towards China is now very difficult. The more financial sanctions that it applies to China, the more it weakens the case for the US treasury as a reserve asset, but without applying sanctions, China has a chance to continue to grow to be the largest economy in the world. We can already see a change in behaviour in Asian governments. Vietnam has been a huge beneficiary of the move away from China. It now runs a huge trade surplus with the US. This is larger than Japan.

But we do not see Vietnam accumulating treasuries likes South Korea, Japan or China.

There is no guarantee that all this money will end up in gold. But whenever I see GLD/TLT trade well, I feel that the US is losing ground.

As mentioned previously, the US politically and culturally probably feels compelled to defend its position at the largest economy in the world. Can it do this without losing its special status as the reserve currency of the world? Without a political collapse in China, I doubt it.

Tyler Durden

Mon, 03/11/2024 – 20:20

via ZeroHedge News https://ift.tt/IhczgNl Tyler Durden