Bitcoin Tops $73,000 After Record-Breaking Billion-Dollar ETF Inflow

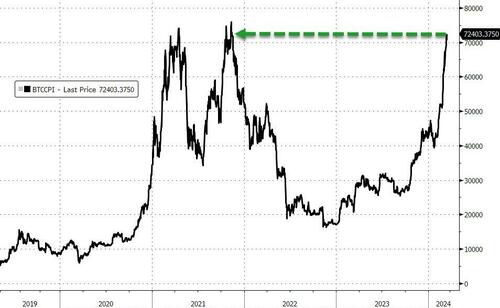

After kneejerking lower by over $4,000 after yesterday’s hot CPI print, bitcoin has recovered all those losses and then some, to top a fresh record high of $73,600 this morning…

Source: Bloomberg

“Bitcoin wiped out overleveraged longs, retested the 2021 cycle high & then bounced back to $72,000,” popular trader Jelle summarized on X, adding that the landscape was now “looking good” for upside continuation.

As we noted on X, the rebound buying came after Bitcoin futures were clubbed like a baby seal on the CPI print:

“There it is: dumping of Bitcoin futures to push prices lower and at the same time record buying via bitcoin ETFs at an artificially lower pric…

…every day, rinse repeat.

Blackrock’s ETF just bought the most bitcoin in one day on record.”

Futs dumping, ETFs and spot buying, day after day, every day pic.twitter.com/3RjW7wzjAO

— zerohedge (@zerohedge) March 12, 2024

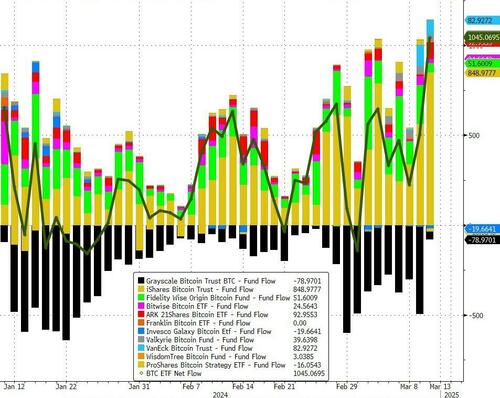

This should not be a total shock after BTC ETFs saw a stunning $1.045BN net inflows yesterday (a record 14,706 BTC demand) as insatiable demand for the cryptocurrency continues….

Source: Bloomberg

“The reasons behind the rally are pretty clear. A rampant demand for the physically-backed ETFs amid a low market depth backdrop,” said Manuel Villegas, digital assets analyst at Swiss private bank Julius Baer.

As issuers buy up large piles of Bitcoin to support their ETFs, the token’s overall circulating supply has begun to dwindle.

Bitcoin’s weekly issuance of roughly 6,300 tokens is “utterly dwarfed” when contrasted against the ETFs’ token demand from past weeks, Villegas said, the latter of which is about 40,000 tokens.

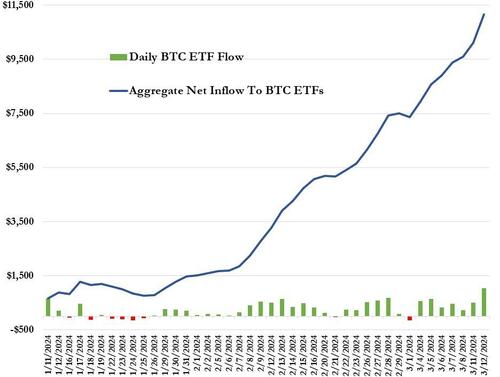

BTC ETF net inflows have now topped $11BN since inception…

The two largest ETFs from BlackRock and Fidelity Investments held in excess of 330,000 BTC as of March 13 — five times what miners added.

Today’s move in bitcoin pushes it closer to its inflation-adjusted record high…

Source: Bloomberg

Other cryptos were also bid, with Ethereum rebounding from yesterday’s decline, test8ng back up near $4100…

Source: Bloomberg

As Bloomberg reports, using Ethereum, the world’s most commercially successful blockchain ecosystem, is about to get much cheaper after the latest software upgrade of the network on Wednesday.

Referred by developers as Dencun, the update is expected to dramatically lower expenses for so-called Layer 2 networks — dozens of chains like Arbitrum, Polygon and Coinbase Global Inc.’s Base that link to Ethereum. A transaction that might have previously cost $1 to post may now cost one cent; another that used to cost cents would now be a fraction of a cent.

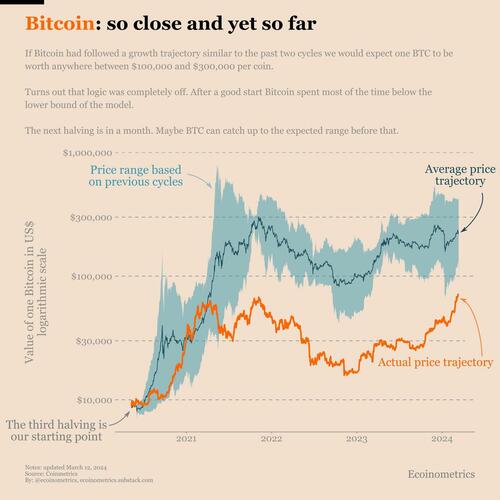

Finally, we note that while Bitcoin has been soaring recently, it is still relatively underperforming its performance ahead of previous ‘halvings’.

As CoinTelegraph reports, Bitcoin is yet to catch up to its growth trajectory from previous halving cycles, according to historical data shared by Ecoinometrics in a March 12 X post:

“If Bitcoin had followed a growth trajectory similar to the past two cycles we would expect one BTC to be worth anywhere between $100,000 to $300,000 per coin.”

Therefore, current price action still has room to run, particularly as the previous all-time high price can now act as the launchpad for more upside before the halving.

Looking ahead, according to a note to clients on Monday, wealth management firm Bernstein expects Bitcoin to break out to around $150,000 following the halving by mid-2025. Bernstein’s analysts Gautam Chhugani and Mahika Sapra now expect the BTC price to “break out” after the halving.

The elevated demand for spot Bitcoin exchange-traded funds (ETFs) has made them “more convinced” about their price target, which they first published in 2023.

“We estimated $10Bn inflows for 2024 and another $60Bn for 2025. In the last 40 trading days since ETF launch on Jan 10, Bitcoin ETF inflows have crossed $9.5Bn already.”

“At this run rate, Bitcoin ETFs would surpass our 2025 inflow estimates within 166 trading days for [the] rest of 2024,” the analysts added.

Bernstein also advised clients to invest in Bitcoin miners, as the recent underperformance “is probably the last window before halving.”

Bernstein’s price target is modest, however, compared to the expectations of Cathie Wood’s ARK Invest, which has “brought forward” its long-term Bitcoin price target of over $1 million.

Tyler Durden

Wed, 03/13/2024 – 09:05

via ZeroHedge News https://ift.tt/lxiz31E Tyler Durden