Bitcoin, Bullion, & Black Gold ‘Hot’; Bonds, Banks, & Big-Tech ‘Not’

Higher rates didn’t matter to long-duration (tech) stocks yesterday, but apparently, absent macro data today, it does (bond prices and stock prices fell together)…

Source: Bloomberg

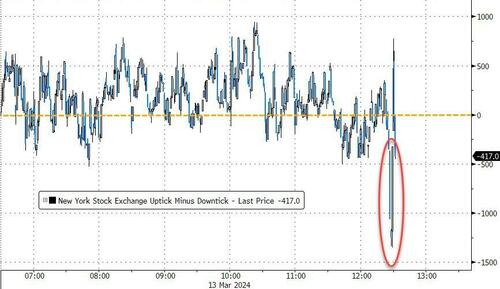

Mid-week, mid-month, and mid-way between earnings meant a pause in the euphoria today with Small Caps leading and Nasdaq lagging…until about 30 minutes before the close when a massive sell-program hit (ahead of tomorrow’s PPI and Retail Sales?). The Dow and Small Caps managed to bounce back to modest gains while Nasdaq and S&P ended red…

The sell program that suddenly hit at around 1525ET was the largest in over three weeks…

Source: Bloomberg

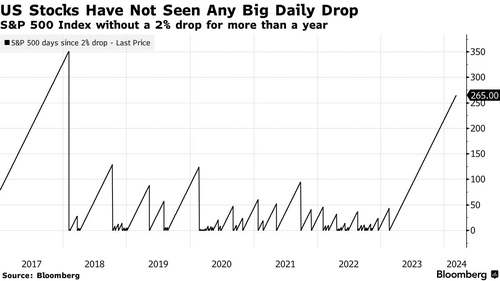

While the S&P 500 was down today, it has now been 266 days without a 2% daily drop…

Source: Bloomberg

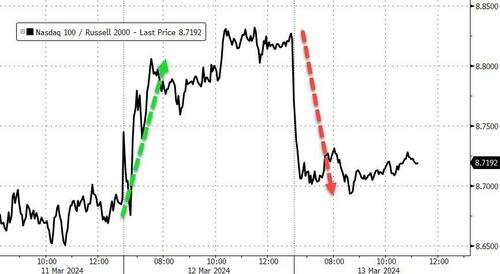

Nasdaq reversed yesterday’s relative outperformance to Small Caps…

Source: Bloomberg

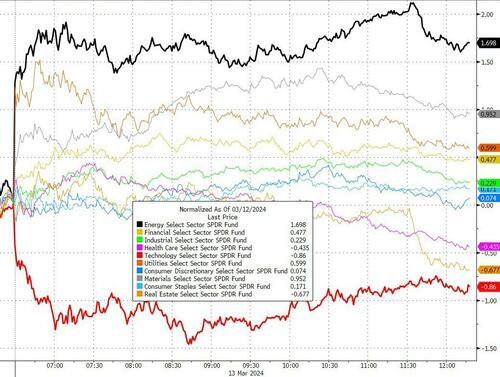

A peak under the hood of the market today does reveal a more dynamic picture… Pro-cyclical sectors like Energy and Materials are outperforming today, while Tech is the worst performing subsector.

Source: Bloomberg

Notably, 5 of the Magnificent 7 are underperforming today and while they recovered from their lows, the Mag7 basket was lower on the day, finding resistance at the post-payrolls print open…

Source: Bloomberg

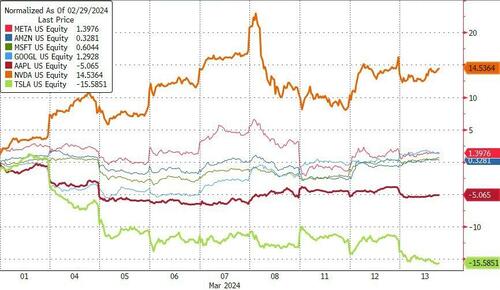

NVDA continues to lead in March and TSLA lag…

Source: Bloomberg

‘Most Shorted’ stocks were insta-squeezed up to Friday’s close at today’s open, then faded back…

Source: Bloomberg

Bank stocks opened ‘hot’ but ended ‘not’… on the day that The Fed’s BTFP expires…

Source: Bloomberg

Treasury yields were higher across the curve once again (all up uniformly around 4bps), continuing the recent weakness…

Source: Bloomberg

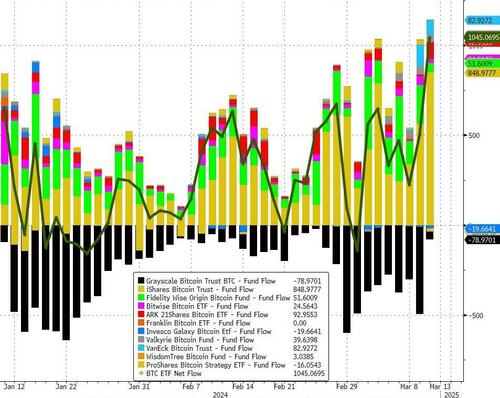

One of today’s biggest stories was the record net inflow into BTC ETFs yesterday – above $1BN for the first time since inception…

Source: Bloomberg

And that helped send Bitcoin to new record highs above $73,000, bouncing back hard from yesterday’s CPI-driven dive…

Source: Bloomberg

Bitcoin $73K .. like clockwork pic.twitter.com/mb9ZTrRI9b

— PlanB (@100trillionUSD) March 13, 2024

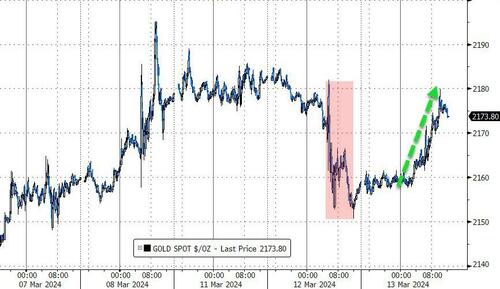

Gold also rallied today, erasing yesterday’s losses…

Source: Bloomberg

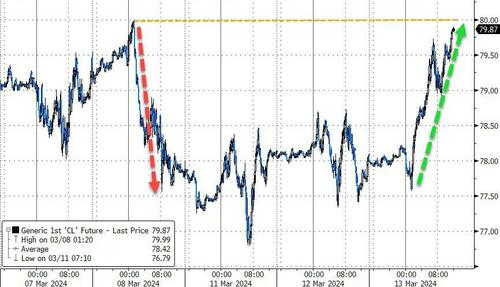

Oil prices also surged back today, up to Friday’s pre-payrolls highs…

Source: Bloomberg

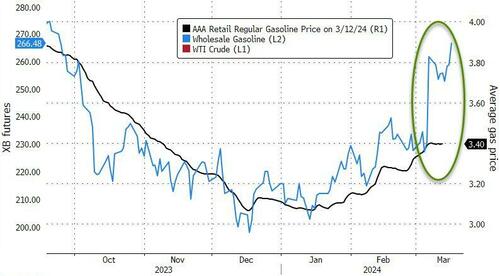

And worse still for President Biden, wholesale gasoline prices are soaring (another big draw today), which means pump prices are going to start rising very soon…

Source: Bloomberg

Finally, we’re sorry but this doesn’t get old…

Source: Bloomberg

There’s only one way this ends… and it won’t be with ‘happy tissues‘…

Tyler Durden

Wed, 03/13/2024 – 16:00

via ZeroHedge News https://ift.tt/lXc3ZUe Tyler Durden