Exxon Chief Darren Woods Has Conquered The Woke ESG Giant

Exxon CEO Darren Woods isn’t mincing words or actions as the broader market has finally started to turn its back on the ‘ESG’ fallacy. And we can expect more of the same when Woods speaks at the CERAWeek by S&P Global energy conference in Houston this week.

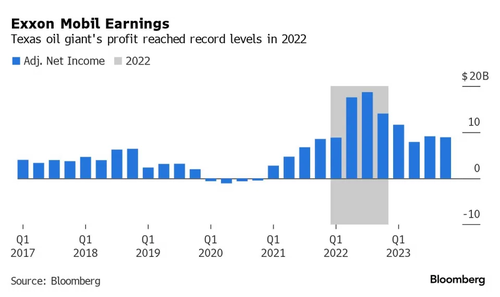

So far this year, Woods initiated arbitration against Chevron Corp. for trying to invest in Exxon’s large offshore oil project in Guyana and has sued investors pushing for emission reductions, according to Yahoo/Bloomberg. Prior to that, he orchestrated a $60 billion acquisition, positioning Exxon as the top U.S. shale producer.

Woods has also intensified his stance on climate objectives, asserting in speeches and interviews that fossil fuels remain essential to fulfill energy needs for the foreseeable future. He argues that achieving net-zero carbon emissions by 2050 is unrealistic, as there’s a general reluctance to bear the costs of cleaner alternatives.

Jeff Wyll, a senior analyst at Neuberger Berman, told Bloomberg: “It wasn’t that long ago it looked like taking the green approach was what the industry needed to attract capital.” But he said the Russia/Ukraine conflict “flipped the switch and energy security became more important. Exxon benefited because they never stepped back from their traditional business.”

As Bloomberg notes, Woods is drawing lessons from his interactions with activist shareholders, leading Exxon to sue climate investors in the U.S. and the Netherlands in January for pushing for emissions reductions. The lawsuit claims the current system for shareholder voting is susceptible to exploitation by activists holding few shares without a focus on long-term value.

He’s also not against openly discussing the challenges of transitioning to a lower-carbon economy, which he did in a recent Fortune podcast. He spoke about the often-overlooked costs of emission reduction efforts and noted that the world has delayed action on finding comprehensive solutions.

Greg Buckley, a portfolio manager at Adams Funds, added: “ESG was popular but I think that return on capital is more popular at the end of the day. Shell and BP found out the hard way.”

“Facts that don’t align with ill-informed prejudice are often infuriating. That doesn’t make them wrong. Someone needs to tell the truth about what it’s going to take to get to a net-zero future,” Emily Mir, a spokeswoman for Exxon, commented.

Dan Yergin, vice chairman of S&P Global added: “The energy companies have demonstrated a discipline in their capital investment and have been responsive to investors. You can see that in their spending and that’s refurbished the social contract between the companies and investors.”

Just weeks ago we noted how Wall Street was starting to ditch its ESG lingo. For some context, peak ESG and related synonyms, such as “climate change” and “clean energy” and green energy” and net zero,” among other terms, peaked at 28,000 mentions in the first quarter of 2022. Ever since, the number of mentions has rapidly plunged. Halfway through the first quarter earnings season, mentions are around 4,800.

Recall, we also wrote last year about the dying off of ESG and “green” investment products. Most recently, at the end of 2023, Goldman Sachs shuttered its ActiveBeta Paris-Aligned Climate U.S. Large Cap Equity ETF.

Bloomberg ETF analyst Eric Balchunas pointed out in late 2023 that “there was just way too much supply for the demand” with the ETF and that “it’s going to get worse too”. Balchunas says the ETF only took in $7 million over the course of 2 years.

We also wrote about Jeff Ubben late last year, who shuttered his sustainability fund – calling traditional climate summitry an “echo chamber” of diplomats. Less than a week before that we noted that $30 billion had been shaved off the value of clean energy stocks over the preceding 6 months.

Finally, we pointed out last year how the ESG grift was reaching endgame after Markus Müller, chief investment officer ESG at Deutsche Bank’s Private Bank stated that sustainability funds should include traditional energy stocks, arguing that not doing so deprives investors of a prime opportunity to invest in the transition to renewable energy.

Tyler Durden

Mon, 03/18/2024 – 13:45

via ZeroHedge News https://ift.tt/E2BJokq Tyler Durden