Futures Flat Ahead Of Fed

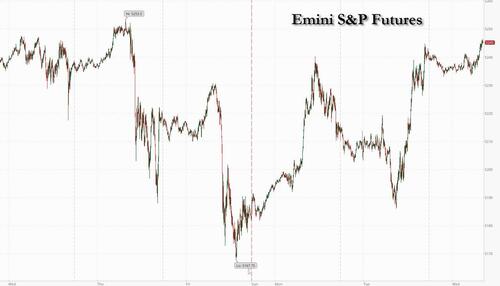

US futures are flat after Tuesday’s record-high cash close, having rebounded from overnight session lows ahead of the Fed meeting where nobody expects any rate change and where some (but not consensus) expect a hawkish move in the dots to signal 2 rate cuts instead of 3 (Goldman and most big banks still expect 3 cuts) as well as gleaning some insight on what the Fed’s QT tapering will look like. As of 8:00am, S&P futures were up 0.1%, reversing an earlier loss of 0.3%, while Nasdaq futures gained 0.3%.

In Europe, most markets are lower with Germany/Italy in the green and the France the biggest laggard as Kering’s Gucci APAC profits fall ~20%, dragging all China-related names down. UK inflation prints dovish to expectations. Intel shares jumped after the chipmaker won almost $20 billion in chips incentives to expand US plants. Meanwhile, the Biden administration is also considering blacklisting a number of Chinese semiconductor firms linked to Huawei after the telecom giant notched a significant technological breakthrough last year. Bond yields are down 1bps as USD strength and yen weakness continues after the cartoonish BOJ’s first rate hike in 17 years paradoxically sent the USDJPY above 151.50, its highest level this decade. Commodities were sold across the board including Ags, Energy, and Metals.

In premarket trading, Mag7 names are mixed and Intel was the standout in Semis space after it won almost $20 billion in federal grants and loans to help fund an expansion of its semiconductor factories on American soil thanks to the Chips Act. Here are some other notable premarket movers:

- Amcor ADRs drop 3.3% after the packaging company announces CEO Ron Delia’s retirement.

- Cannabis stocks rise, with Canopy Growth leading gains in the sector as the company is set to extend gains for a fourth straight session.

- Canopy Growth +15%, Aurora Cannabis (ACB US) +0.5%, Tilray Brands (TLRY US) +4.2%

- Gildan Activewear ADRs advance 2.1%, with the Canadian clothing manufacturer set to extend gains for a second session. The company confirmed on Tuesday it had received an expression of interest and was reviewing the proposal. Bloomberg reported private equity firm Sycamore Partners was exploring an offer.

- International Paper shares gain 1.1% after appointing KKR’s Andrew Silvernail as CEO to succeed Mark Sutton, who has served in the post since 2014.

- Mobileye shares rise 4.7% after the firm deepened its partnership with Volkswagen to accelerate development of automated driving functions, targeting premium offerings for the Audi, Bentley, Lamborghini and Porsche brands.

- Riot Platforms shares gain 2.9% as JPMorgan raised to overweight from neutral, saying the stock offers the best relative upside among Marathon and CleanSpark — the three largest and most liquid US-listed mining stocks.

- Taysha Gene Therapies shares soar 27% after providing preliminary results for two patients who received its experimental gene therapy.

- Tesla shares tick 0.8% higher after the EV maker announced plans to raise the starting price of its locally-made Model Y sport utility vehicles in China by 5,000 yuan ($700) from April 1.

The focus today is firmly on the FOMC decision and the path for US interest rates (full preview here). While the central bank is expected to hold, investors will be parsing commentary to assess how quickly it might start to ease. The decision and economic forecasts will be released at 2 p.m. in Washington. Chair Jerome Powell will hold a press conference 30 minutes later. The Fed’s dot plot of rates projections will be in focus as investors gauge how many cuts policymakers are expecting this year.

“The risk of those dots shifting has grown and if we do see that median move higher, then obviously you’d expect a knee jerk rally in the dollar and a knee jerk move lower in Treasuries and equities,” said Michael Brown, senior research strategist at Pepperstone Group Limited. “With that risk on the horizon, no one has particularly much conviction to do anything much this morning.”

Europe’s Stoxx 600 dropped 0.1% having earlier fallen as much as 0.4%, while the CAC 40 loses 0.6%, led lower by luxury shares after Kering warned that sales at Gucci have fallen about 20% in the first quarter in Asia-Pacific, fueling worries about high-end consumer spending in China. Kering was one of the biggest drops in the Stoxx 600 Index, with LVMH, Burberry Group Plc and Christian Dior SE also seeing losses. Here are some of the biggest European movers Wednesday:

- Johnson Matthey rises as much as 9.7% after the British conglomerate agrees to sell its Medical Device Components business to Montagu Private Equity for £550m

- BASF gains as much as 2.1% as Berenberg upgrades to buy, saying “there can hardly be a more compelling reason” to turn positive than at start of a recovery from a recent slump

- Terna gains as much as 5.5% after the Italian utility presented its strategic plan through 2028, with Goldman upgrading its rating to neutral and highlighting a “positive surprise”

- Lonza rises as much as 5.2% on its purchase of the Genentech biologics manufacturing site in California from Roche for $1.2 billion

- Eutelsat rises as much as 5.7% after the satellite operator announced a partnership deal with Intelsat worth up to $500 million over seven years

- Idorsia soars as much as 18% following FDA approval of its hypertension drug, also known as aprocitentan, which should unlock its next deal, according to Jefferies

- Beneteau rises as much as 6.9%, hitting highest since Sept. 2023, as Oddo says the French sailboat manufacturer’s results are “excellent”

- Bureau Veritas rises as much as 6.6% after the French testing, inspection and certification company outlined its growth ambitions for the coming years

- Kering plunges as much as 15% after the company warned of a steep drop in sales at its Gucci brand, notably in Asia-Pacific, pulling peers in the European luxury sector lower

- FDM Group slumps as much as 12% following the professional services provider’s 2023 results. Numis says challenging conditions remain in place

- Trustpilot falls as much as 9.4% after an offering of 15.5m shares by holder Vitruvian Partners priced at 200p apiece, representing 3.9% discount to Tuesday’s close

Earlier in the session, Asian stocks inched higher as Korean shares rose and Chinese stocks shook off earlier losses. The MSCI Asia Pacific Index gained less than 0.1% with Tencent and Samsung Electronics rising, while SK Hynix and AIA Group declined. Stocks rebounded in Korea after Tuesday’s selloff led by strong gains in some technology and financial services companies. Stocks were closed in Japan for a public holiday. Chinese stocks moved higher after banks left five-year and one-year prime lending rate as expected. Traders are looking for fresh catalysts to extend a rally that is now into its sixth week. Investors await the earnings from Tencent Holdings for further cues on the nation’s corporate earnings trajectory.

“We have seen a base forming” in China markets because of government action, Audrey Goh, head of asset allocation at Standard Chartered Wealth Management, told Bloomberg TV. “Overall the backdrop for Chinese equities still remains quite lackluster. We need a bit more in terms of policy support from the government to entice investors back to the market.”

In FX, the Bloomberg Dollar Index was up for a fifth day for the first time since early January; the pound whipsawed after Britain’s inflation rate fell more sharply than expected. The Bank of England meets on rates on Thursday, but a move is unlikely as policymakers say they need further evidence that price pressures will fall back sustainably. The yen is again one of the weakest of the G-10 currencies for a second day, falling 0.6% versus the greenback, and about to hit a decade low against the greenback.

In rates, Treasury yields are lower across the curve, led by gilts after benign UK CPI data drove a dovish re-pricing in Bank of England rate-cut expectations. Yields are down 1bp-2bp across the curve with 10-year yields falling 1bp to 4.275% after reaching weekly low. Gilts are ~3.5bp richer vs USTs in 10-year sector, after UK inflation slowed more than expected in February. For Fed communications, focus is on potential for changes to policy members’ median projections for fed funds through 2026 and longer run, with traders broadly holding a hawkish set-up to the meeting. Treasury auctions resume Thursday with $16b 10-year TIPS reopening.

In commodities, oil dipped after a two-day gain as an industry group flagged a fall in US crude stockpiles, while gold traded in a narrow band ahead of the Fed.

Bitcoin reversed an overnight loss to trade flat around $64,000.

Today’s US economic data calendar is empty before the Fed rate decision and economic projections at 2pm New York time and Powell’s new conference at 2:30pm

Market Snapshot

- S&P 500 futures little changed at 5,238.25

- MXAP down 0.1% to 174.88

- MXAPJ little changed at 530.06

- Nikkei up 0.7% to 40,003.60

- Topix up 1.1% to 2,750.97

- Hang Seng Index little changed at 16,543.07

- Shanghai Composite up 0.6% to 3,079.69

- Sensex up 0.2% to 72,176.27

- Australia S&P/ASX 200 little changed at 7,695.76

- Kospi up 1.3% to 2,690.14

- STOXX Europe 600 down 0.3% to 503.71

- German 10Y yield little changed at 2.41%

- Euro little changed at $1.0856

- Brent Futures down 0.8% to $86.67/bbl

- Gold spot down 0.0% to $2,156.68

- US Dollar Index up 0.16% to 103.99

Top Overnight News

- As tensions rise with China, Taiwan’s defense minister has hinted that U.S. troops have been training the Taiwanese military on outlying islands that would be on the front lines of a conflict with its neighbor. WSJ

- The Biden administration is considering blacklisting a number of Chinese semiconductor firms linked to Huawei Technologies Co. after the telecom giant notched a significant technological breakthrough last year. BBG

- Benjamin Netanyahu insisted Israel would launch a ground assault on Rafah, despite pressure from the US not to carry out a large operation in the Gazan city where hundreds of thousands of people are sheltering. FT

- UK inflation cools by more than anticipated in Feb, with headline coming in at +3.4% (down from +4% in Jan and below the Street’s +3.5% forecast) while core dipped to +4.5% (down from +5.1% in Jan and below the Street’s +4.6% forecast), although the services CPI ran a bit warmer at +6.1% (down from +6.5% in Jan, but above the Street’s +6% forecast). RTRS

- ECB’s Lagarde says price/wage disinflation progress is occurring, but more time is needed for the central bank to assess the situation, which means the first cut probably won’t come until June at the earliest (“we will know a bit more by April and a lot more by June”). ECB

- FOMC: We suspect that the Fed leadership is still targeting a first cut in June, and this combined with a default pace of one cut per quarter implies that the most natural outcome for the median dot is to remain unchanged at 3 cuts or 4.625% for 2024. We expect the median dots to remain unchanged at 3.625% for 2025 and 2.875% for 2026 as well. We expect the longer run dots to gradually drift higher over time, with a small tick up a bit more likely than not this week. The only significant change to the economic forecasts should be an increase in 2024 GDP growth. GIR

- John Paulson will host a Florida fundraiser for Donald Trump next month, as the former president tries to match Joe Biden’s money operation and pay for a growing pile of legal bills and judgments. FT

- JPMorgan surprised with a 9.5% dividend hike on the back of record annual profit. The firm’s asset-management division named Jonathan Sherman the next head of its US equities business. BBG

- Intel jumped premarket after winning $8.5 billion in US grants — and as much as $11 billion in loans — to help fund the expansion of its domestic factories. The White House is also weighing blacklisting Chinese chip firms linked to Huawei, people familiar said, escalating its campaign to curtail Beijing’s AI and semiconductor ambitions. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded cautiously and mostly rangebound ahead of the FOMC and with Japanese markets closed. ASX 200 struggled for direction as strength in energy was offset by losses in the tech and consumer sectors. KOSPI outperformed as South Korea plans to cut corporate and dividend income tax to encourage a higher shareholder return, while index heavyweight Samsung Electronics (005930 KS) rose over 5% and was helped by reports that NVIDIA looks to procure high-bandwidth memory chips from the Co. Hang Seng and Shanghai Comp. were indecisive as participants digested the latest earnings releases, while Prada (1913 HK) shares slipped in early trade after Gucci owner Kering (KER FP) issued a luxury sector warning amid Asia-Pacific weakness, while the mainland was kept afloat following the lack of surprises from the PBoC’s benchmark LPRs which were maintained at their current levels

Top Asian News

- PBoC reshuffled its Monetary Policy Committee which now includes China securities regulator head Wu Qing and PBoC Vice Governor Xuan Changneng, while the committee also has two new academic members, Huang Yiping from Peking University and Huang Haizhou from Tsinghua University.

- Chinese Foreign Minister Wang Yi said in a meeting with his Australian counterpart that their economies are highly complementary and have great potential, while he stressed that since relations are on the right track, they must not hesitate, deviate or turn back. Furthermore, Wang said regarding China’s sovereignty, dignity and legitimate concerns, that they hope that the Australian side will continue to abide by commitments it has made, as well as respect and properly handle them.

- Australian Foreign Minister Wong said she discussed a range of shared interests with her Chinese counterpart and welcomes progress in the removal of trade impediments with China. Wong added she discussed volatility in nickel markets with China and raised concerns about human rights, including in Xinjiang, Tibet, and Hong Kong, while they will seek to manage differences with China wisely.

- China’s embassy in the UK commented regarding UK Foreign Secretary Cameron’s remarks on Hong Kong’s new law and urged the British side to stop making groundless accusations against the legislation of Article 23, while it added that Hong Kong affairs are purely China’s internal affairs and the British side is not qualified to make irresponsible remarks.

- US is said to consider sanctioning Huawei’s chipmaking network which could be added to the entity list, while the companies that could be blacklisted over links with Huawei include chipmakers Qingdao Si’en, Swaysure, and Shenzhen Pensun Technology, according to Bloomberg.

- Tencent (700 HK/TCEHY) – Q4 (CNY): Revenue 155.20bln (exp. 157.42bln). FY Adj. Net 157.7bln (exp. 152.97bln). FY-end combined MAU of Weixin and WeChat 1.343bln (prev. 1.313bln); Recommended final dividend of HKD 3.40/shr.

- Tencent (700 HK/TCEHY) President says Chinese gaming regulator has approved many licenses since December to show support for the industry; says Q1 video games revenue will be weaker Y/Y.

European bourses, Stoxx600 (-0.2%) are mostly lower, with clear underperformance in the CAC 40 (-0.8%), with Luxury names hampered by Kering (-14.4%). European sectors are mostly lower; Consumer Products and Services is slumped at the foot of the pile after Kering issued a profit warning, which has weighed on peers such as LVMH (-2.9%)/Hermes (-1.9%). US equity futures (ES -0.1%, NQ -0.1%, RTY -0.5%) are softer, with clear underperformance in the RTY, as it pares back yesterday’s gains; Intel (+2.2% pre-market) gains after being awarded approx. USD 20bln in grants by the Biden Administration.

Top European News

- ECB President Lagarde: “Building confidence in the path ahead”; “when it comes to the data that is relevant for our policy decisions, we will know a bit more by April and a lot more by June.”. “Three domestic factors that will be to ensuring that the inflation path evolves as we project: 1. Wage Growth, 2. Profit Margins 3. Productivity Growth”; Echoes rhetoric from the prior ECB meeting.

- EU Council and Parliament provisionally agreed to renew the suspension of import duties and quotas on Ukrainian exports to the EU until June 2025, according to Reuters.

FX

- Dollar is firmer vs. peers as JPY weakness provides support and has led DXY above yesterday’s peak at 104.05 (vs current 104.12). Resistance comes via the March high at 104.29. Fate for USD is likely to be sealed by today’s FOMC meeting.

- EUR is weighed on by the broadly firmer USD with not much in the way of fresh EZ-specific updates as comments from Lagarde reiterate recent remarks. EUR/USD trough yesterday was 1.0834 with 200DMA just above at 1.0838.

- GBP is softer vs. USD but flat against EUR following slightly softer-than-expected UK inflation metrics. Cable has been as low as 1.2690 but is yet to test its 50DMA to the downside at 1.2684.

- Another session of losses for JPY as yesterday’s BoJ hike fails to stop the rot in the absence of a dovish turn from the Fed. USD/JPY has been as high as 151.58 with technicians highlighting the 2023 high at 151.91 and 2022 high at 151.94. Continued upside will prompt speculation of intervention.

- Antipodeans are both softer vs. the USD. AUD/USD is holding above yesterday’s 0.6563 trough, whilst NZD/USD has extended downside to print a fresh YTD low at 0.6031.

- PBoC set USD/CNY mid-point at 7.0968 vs exp. 7.1967 (prev. 7.0985).

Fixed Income

- Gilts gapped higher by 24 ticks to 98.97 after the region’s softer-than-expected CPI numbers. Gilts continued to advance higher reaching a 99.30 peak, before fading the move back towards 99.00.

- Bunds hold a bullish tilt, given the UK data. Thereafter, nothing fundamentally new from ECB’s Lagarde who kept the emphasis on June. Price action generally mirrors Gilts, with Bunds printing a high at 132.34, before eventually fading the move.

- UST price action is in-fitting with the above but slightly more contained overall. USTs remain around the 110-08 mark after Tuesday’s particularly strong 20yr auction with newsflow since thin and the narrative honing in on the FOMC.

Commodities

- A subdued session for crude thus far, amid the broadly risk-averse mood coupled with a stronger Dollar, with the complex giving back some of its recent gains despite the heightened geopolitical tensions and slightly bullish private inventory data.

- Precious metals upside has been capped by the firmer Dollar with participants on standby for the FOMC release, dot plots, and press conference. XAU holds around 2,150/oz within a USD 2,154.55-2,160.30/oz range.

- Base metals are mixed with price action largely dictated by the Greenback and amid the cautious risk sentiment. Price action in Europe has been contained thus far.

- Peru copper production declined 1.2% Y/Y in January to 205,375 metric tons, according to the Mines and Energy Ministry.

- Russian Energy Minister Shulginov says the situation on domestic fuel market is under constant surveillance; measures are being taken to keep gasoline surplus.

- Norway’s Prelim (Feb) oil production 1.897mln BPD (prev. 1.829mln M/M); Gas production 10.4bln CU metres (prev. 11.71bln cu meters M/M).

Geopolitics: Middle East

- US President Biden said the war in Gaza has caused terrible suffering to the Palestinian people and they will continue to lead international efforts to deliver more humanitarian aid to the people of Gaza people, while it was also reported that Defense Secretary Austin will host his Israeli counterpart next week for a bilateral meeting.

- UK Foreign Secretary Cameron said hostages held by Hamas in Gaza must be released and the most important thing now is a pause in fighting to get hostages out and aid in. Cameron stated it is crucial to turn a pause in fighting into a permanent, sustainable ceasefire and that a ceasefire can only be achieved with conditions being fulfilled, while he added they must get Hamas leaders out of Gaza and dismantle their network to ensure a ceasefire lasts, according to a Reuters interview.

- “Israeli media: Blinken to visit Israel on Friday”, according to Sky News Arabia.

- “Agreement on truce in Gaza is not imminent, but there is slow progress in the negotiations”, according to Al Arabiya citing sources

Geopolitics: Other

- China’s embassy in the Philippines said US Secretary of State Blinken’s remarks about the South China Sea ignored facts and groundlessly accused China regarding its activities in the South China Sea. Furthermore, it stated that remarks once again threatened China with the ‘so-called’ US-Philippine Mutual Defence Treaty obligations which China firmly opposes, while China advises the US not to stir up trouble or take sides on the South China Sea issue.

- Taiwan’s Foreign Minister said China has built “enormous” military bases on three islands surrounding Taiwan’s main holding in the South China Sea, according to Reuters.

- US Air Force said it conducted a successful hypersonic weapons test, according to Reuters.

- North Korea leader Kim guided a solid fuel engine test for a new intermediate-range hypersonic missile, according to KCNA.

US Event Calendar

- 07:00: March MBA Mortgage Applications -1.6%, prior 7.1%

- 14:00: March FOMC Rate Decision

DB’s Jim Reid concludes the overnight wrap

As we arrive at another Fed decision day, markets have posted further advances ahead of the announcement, with both the S&P 500 (+0.56%) and Europe’s STOXX 600 (+0.26%) moving higher. However, there were growing warnings under the surface, particularly on the inflation side, as Brent crude oil prices closed above $87/bbl for the first time since October. So it’s clear there are several price pressures in the pipeline, which has led to fresh doubts about whether we’ll get rate cuts by the summer after all. Moreover, there are increasing signs that investors are pricing this in, with US 1yr inflation swaps inching up to 2.64%, their highest level since October, even as bond yields eased off from Monday’s 3-month highs.

When it comes to the Fed’s decision, it’s widely expected they’ll keep rates on hold today. So the main focus will instead be on the latest Summary of Economic Projections, including the dot plot for where officials see rates moving over the next few years. As a reminder, the last dot plot in December pencilled in three rate cuts for 2024, which led to a significant multi-asset rally as investors grew confident that rate cuts were on the horizon. But since then, the inflation reports for both January and February were stronger than expected, with core CPI running at a monthly +0.4%.

Given those developments on the inflation side, there’s been growing speculation about whether the Fed might signal fewer than three cuts in today’s dot plot. Indeed, it’s worth noting that back in December, 8 of the 19 officials already had two rate cuts or less for 2024, so it would only take two other officials to shift hawkishly for the median dot to move up to two cuts. In their preview (link here), DB’s US economists expect the median dot to remain at three cuts in 2024, but they think the Fed will raise their 2025 and 2026 dots slightly to show less easing further out. That will be significant if so, as the post-pandemic dot plots repeatedly moved the dots up or held them steady at every meeting, up until December, when the dots finally moved lower compared to the meeting before. So if this March dot plot does move the dots higher again, it will make the dovish shift in December look more like a blip than a turning point.

We have argued for some time that central banks face an unenviable challenge in calibrating their policy this year given the long and variable policy lags and the extreme nature of the recent inflation shock and accompanying post-Covid structural shifts. In yesterday’s note here , looking at credit cycles across the US and Europe, Peter Sidorov argues that this calibration challenge is the toughest for the Fed, with the US seeing more resilient credit conditions than Europe, but with more of the delayed impact of rate hikes still to play out there. The note is a useful reminder of the challenges the Fed will face going forward so good context ahead of the conclusion of the FOMC today.

Leading up to their final deliberations, markets have managed to post further gains over the last 24 hours, with the S&P 500 recovering from a -0.35% decline after the open yesterday to close +0.56% higher. Energy stocks (+1.08%) led the advance amidst the rise in oil prices, with consumer discretionary (+0.86%) and industrials (+0.82%) also posting strong gains. The broad gains saw 76% of the S&P constituents up on the day, with the equal-weighted S&P 500 up +0.58%. Moreover, even as the Magnificent 7 (+0.36%) lagged the S&P 500, its gain was still enough to take the group up to a fresh all-time high. Finally in Europe, the story was also one of modest gains, with the STOXX 600 up +0.26%. However, both the CAC 40 (+0.65%) and the DAX (+0.31%) saw larger advances, which left both of them at new records as well.

Over on the rates side, US Treasuries rallied before the Fed’s decision, with the 10yr yield (-3.1bps) coming down from its YTD high the previous day to close at 4.29%, with the rally extending after a strong 20yr Treasury auction. But the rally was more prominent at the front end, with the 2yr yield (-4.8bps) down to 4.685% as investors priced in slightly more rate cuts for the remainder of the year. For example, the amount of cuts priced by the Fed’s December meeting rose +2.4bps to 73bps, having closed at its lowest of 2024 so far on Monday, at just 71bps. Still, the last three sessions are the first time since November that markets have priced less 2024 easing than the December median FOMC dot of 75bps.

Meanwhile in Europe, the main story was one of wider spreads, as yields on 10yr bunds (-1.0bps) and OATs (-0.6bps) fell back, whereas those on Italian BTPs (+2.3bps) and Greek bonds (+3.8bps) both moved higher.

Asian equity markets are mostly trading higher this morning led by the KOSPI (+1.30%) which is being propelled by a +4.81% rise in index heavyweight Samsung Electronics. Elsewhere the Hang Seng is reversing initial losses to gain (+0.18%) with the CSI (+0.20%) and the Shanghai Composite (+0.45%) also edging higher. Japan is closed for a public holiday which means no cash US Treasury trading. S&P 500 (-0.11%) and NASDAQ 100 (-0.12%) futures are edging lower.

In FX, the Japanese yen (-0.41%) is extending its losses and trading at a 4-month low of 151.45 and within touching distance of its weakest level since 1990 even after the BoJ moved away from negative interest rates and yield curve control yesterday. Against the euro it’s now at a 16-year low of 164.60. The Yen is still a funder in the global carry trade and yesterday’s inline policy meeting hasn’t changed that yet.

Moving back across the world, over in Canada there was some brighter news on inflation yesterday, as CPI unexpectedly fell to +2.8% in February (vs. +3.1% expected). That helped support an outperformance in Canadian sovereign bonds, with the 10yr yield down -7.4bps on the day. The release also led investors to price in a significantly higher chance of a rate cut by the June meeting, with overnight index swaps moving up the probability from 49% on Monday to 79% by yesterday’s close. Looking forward, the next inflation release comes from the UK this morning shortly after we go to press, which will be in focus ahead of the Bank of England’s next decision tomorrow.

Elsewhere on the data side, US housing starts rose by more than expected in February, up to an annualised rate of 1.521m (vs. 1.440m expected), whilst building permits also rose to an annualised rate of 1.518m (vs. 1.496m expected). Over in Germany, the ZEW survey also came out for March, with the expectations component up to 31.7 (vs. 20.5 expected), which is its highest level since February 2022.

To the day ahead now, and the main highlight will be the Federal Reserve’s policy decision and Chair Powell’s subsequent press conference. Otherwise, data releases include UK CPI for February, Italian industrial production for January, and the European Commission’s preliminary consumer confidence indicator for the Euro Area in March. From central banks, we’ll also hear from ECB President Lagarde, and the ECB’s Lane, De Cos, Schnabel, Nagel and Villeroy.

Tyler Durden

Wed, 03/20/2024 – 08:30

via ZeroHedge News https://ift.tt/DagwsA7 Tyler Durden