Fed Remains On Hold, But ‘Dots’ Reveal Hawkish Bias

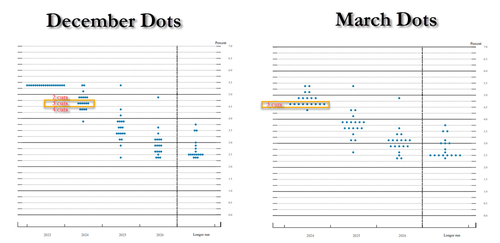

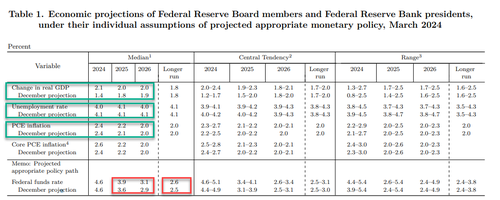

Tl;dr: No change for rates, barely any change in the statement, upgraded economic growth, but big ‘signals’ from the Dot-Plot with 2024 remaining the same (3 rate-cuts) but 2025, 2026, and beyond all seeing higher rates (less cuts).

2024 Median dot: unchanged at 3 cuts, but composition changed…

-

2 officials saw no cuts (unch)

-

2 officials sew one cut (one more than in Dec)

-

5 officials saw two cuts (unchanged)

-

9 officials saw three cuts (up from 6 in Dec)

-

1 saw four cuts (down from five who saw 4 or more cuts in Dec)

…literally one voter stood between 50bps and 75bps in cuts in 2024…

…and the so-called neutral rate is higher…

…and implicit admission that the inflation target will eventually be lifted.

* * *

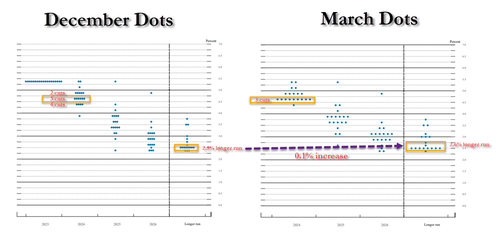

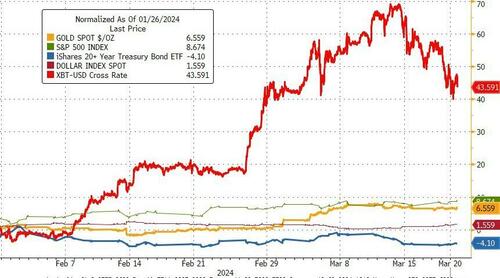

Since the last FOMC meeting (Jan 31st), bitcoin has been the big winner (and bonds the biggest loser). Gold and stocks have outperformed even with the dollar rising modestly…

Source: Bloomberg

Even more notably, stocks have rallied since the last FOMC meeting despite a plunge in 2024 rate-cut expectations from 6 to 3 (in line with The Fed’s December dot-plot), much of whicfh is thanks to the incessant jawboning down of expectations by an endless series of Fed speakers…

Source: Bloomberg

…quite a disconnect since the last FOMC meeting…

Source: Bloomberg

Perhaps more problematically, US macro data has disappointed while inflation expectations have soared…

Source: Bloomberg

Stagflation, anyone?

So, what will The Fed do?

Well they won’t be cutting rates today (or hiking them), but it’s the dots that will be the catalyst for any market moves.

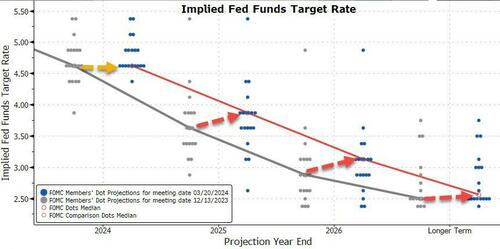

2024 is on a knife-edge as just 2 dots moving higher will shift the median to just 2 rate-cuts, which would likely disappoint the market (but the consensus is for The Fed to leave the 2024 dots and will adjust the longer-term dot).

As Goldman’s Josh Schiffrin (Head of Macro Trading Strategy) noted:

“I think the longer run dot will move up today’s meeting. The continued strong performance of the economy even at ‘restrictive’ levels of short rates, the evolution of the economy post covid (for example high level of fiscal spending) and the fact that several fed speakers have indicated they are open to the idea that neutral has risen leads me to believe the long run dot will rise over the next few years starting at today’s meeting.”

So, what did The Fed do?

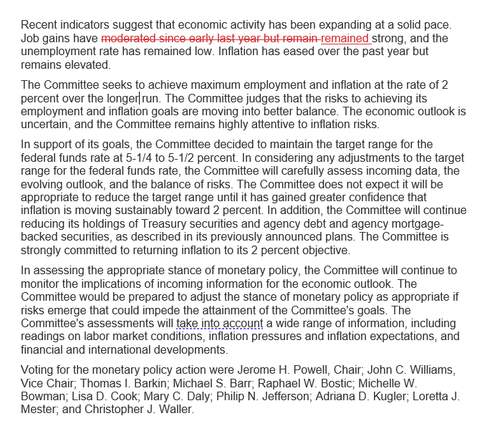

As expected, The Fed left rates alone

-

*FED HOLDS BENCHMARK RATE IN 5.25-5.5% TARGET RANGE

But it’s all about the dots…

-

*FOMC MEDIAN FORECAST SHOWS 75 BPS OF RATE CUTS IN 2024 TO 4.6%

-

*FOMC MEDIAN RATE FORECAST FOR 2025 RISES TO 3.9% FROM 3.6%

While The Fed kept its median dot at 3 cuts for 2024, beyond that the dots signal considerably less aggressive Fed rate-cutting. We also note that while the median 2024 dot remained the same, 8 Fed voters were for 50bps or less in Dec, now it’s 9. The Fed now expects one less rate-cut in 2025 and 2026… and the so-called ‘neutral’ rate has also been increased.

Policymakers now think the economy will grow 2.1 percent this year, up from the 1.4 percent forecast in December.

They also expect the unemployment rate will end the year at 4 percent, down slightly from previous estimates.

They also predict inflation will end the year at 2.4 percent – in line with previous estimates – and won’t hit the Fed’s 2 percent target until 2026.

Read the full redline below (barely any red)…

Tyler Durden

Wed, 03/20/2024 – 14:00

via ZeroHedge News https://ift.tt/ITZz1iL Tyler Durden