Victims Will “Never” Be Whole Thanks To SBF’s “Dumpster Fire” – FTX Caretaker CEO Rages

Authored by Martin Young via CoinTelegraph.com,

FTX restructuring officer and CEO John Ray III has slammed an attempt from Sam Bankman-Fried’s lawyers to reduce his sentence, arguing victims “have suffered and continue to suffer.”

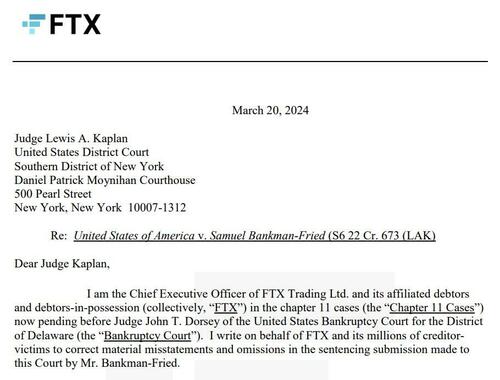

Ray wrote to Judge Lewis Kaplan on March 20 in a victim impact statement on behalf of FTX and its “millions of creditor victims” to “correct material misstatements and omissions in the sentencing submission” from Bankman-Fried.

The letter comes after Bankman-Fried’s lawyers argued on March 19 that the 40-to-50-year sentencing guide from United States government prosecutors was too harsh.

Ray argued that Bankman-Fried’s claims that FTX was solvent at bankruptcy and that no money was lost were “categorically, callously, and demonstrably false.”

“Customers still will never be in the same position they would have been had they not crossed paths with Mr. Bankman-Fried and his so-called brand of ‘altruism.’”

Ray stated he has led an extensive team that has spent over a year “stewarding the estate from a metaphorical dumpster fire” to a company approaching a plan “that will return substantial value to creditors.”

“Mr. Bankman-Fried’s victims will never be returned to the same economic position they would have been in today absent his colossal fraud,” he added in another part of the letter.

Screenshot of letter from John Ray III to Judge Kaplan. Source: Courtlistener

Ray took over the embattled exchange in November 2022 and detailed the extensive work done by an army of lawyers to recover assets, cooperate with investigations, and position the firm, which now plans to return all value to creditors.

This recovery doesn’t erase the immense harm caused by Bankman-Fried’s crimes, however, Ray said.

He stated when he took over as CEO that there were only 105 Bitcoin left on FTX, against customer entitlements of nearly 100,000 BTC.

“Why were the Bitcoins missing?” he questioned before stating that a jury has “concluded beyond a reasonable doubt that Mr. Bankman-Fried stole them and converted them into other things.”

Ray claimed that Bankman-Fried considered conflicting public relations strategies after bankruptcy, including blaming the restructuring team while also claiming to want to work with them to repay creditors.

Ray said that it was only because of the Chapter 11 bankruptcy case that the firm had assets that could rebound in value, referring to the recent crypto market rally.

“Make no mistake; customers, non-governmental creditors, governmental creditors, and non-insider stockholders have suffered and continue to suffer,” he concluded.

Bankman-Fried’s lawyers argued that a 40-to-50-year sentencing proposal for a “non-violent offense” was “medieval” while requesting that it be reduced to around five to six and a half years.

Bankman-Fried was found guilty of seven charges relating to various fraud and money laundering brought against him by the United States government, almost a year after the collapse of the crypto exchange.

He’s set to be sentenced on March 28.

Tyler Durden

Thu, 03/21/2024 – 21:40

via ZeroHedge News https://ift.tt/N9MSnvq Tyler Durden