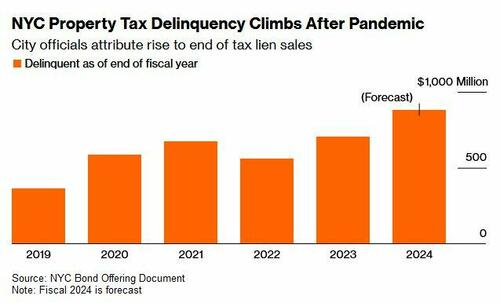

NYC Delinquent Property Taxes Approach $1 Billion After Expiration of Tax-Lien Punishment

While New York City embarks on a program to hand out some $53 million in prepaid debit cards to illegals, the city has estimated that overdue property taxes are set to reach their highest level ever, jumping 30% to over $880 million at the end of the fiscal year in June, vs. three years ago. City officials attribute this to the expiration of a tax-lien sales program that would punished delinquencies by allowing the city to sell liens on single-family homes and condos after three years of nonpayment, according to a Tuesday offering document for a city general obligation bond sale cited by Bloomberg.

Under the program created by former Mayor Rudy Giuliani in 1996, and which expired in March 2022, liens slapped on delinquent properties would be discounted and packaged into securities sold to a third-party trust, which borrows money from investors to pay the city upfront, and then assumes responsibility for collecting the outstanding property tax through debt servicing companies (plus fees and interest). After the investors are paid back, the city was entitled to collect additional revenue from fees and interest payments.

45% of New York’s tax revenue and 30% of overall funds for the current $114 billion budget come from property taxes – which is expected to top $32.7 billion in the current fiscal year.

“It’s not just the absolute dollar amount that I think should worry us all,” city Finance Commissioner Preston Niblack said at a March 4 City Council finance committee hearing, adding that people have realized “there are no consequences for not paying your property taxes.”

“That just can’t be allowed to continue,” he said.

To be sure, the rise in unpaid property taxes comes as New York’s office market continues to struggle. The overall vacancy rate for Manhattan office space stood at 22.5% in November, the highest on record, according to the city’s January financial plan.

Rent-regulated apartments are also facing stress after a 2019 law sharply reduced landlords’ ability to raise rents. -Bloomberg

The tax-lien program faced pushback from community activists and even state Attorney General Letitia James, who said in December 2020 that “additional fees can quickly turn a relatively small tax lien into an overwhelming financial burden, eventually pushing homeowners into foreclosure,” referring to a mandatory 5% surcharge, legal fees and a 9% or 18% interest rate that compounds daily.

Between 2018 and 2022, the city collected $260 million from the tax-lien program, according to the city’s bond offering document.

A better solution?

Bloomberg further reports that the city’s Department of Finance is working on legislation that would reauthorize tax-lien sales, ensuring that homeowners don’t face foreclosure or eviction.

“We look forward to working with the [City] Council on this important issue and look forward to a new, more equitable form of property tax enforcement,” said Department of Finance spokesman, Ryan Lavis.

The City Council, meanwhile, said in a statement that it’s working with the “Administration, advocates, impacted communities, and all stakeholders to advance policies that address outstanding charges while supporting the economic health of homeowners, our communities, and the City.”

The biggest offenders include a 16-unit Cobble Hill, Brooklyn rental building which owes $52.2 million of the $880 million estimated delinquency. There’s also a 49-unit Bronx apartment building which owes $24.7 million.

“We have to do something,” said City Council Member Gale Brewer, who represents the Upper West Side of Manhattan. “People should pay their taxes.“

Tyler Durden

Thu, 03/28/2024 – 17:20

via ZeroHedge News https://ift.tt/0WMbv8c Tyler Durden