‘Cocoa Could Double From Here’ – Oil-Bull Andurand Gets Greedy On Chocolate

Oil trader Pierre Andurand suffered record losses last year in the commodities world, though the money manager has so far crushed it on the cocoa trade.

Bloomberg reports Andurand opened a “small, long position” in cocoa futures in early March. Since then, prices have soared as much as 73%. People familiar with the trade did not specify where the famed oil trader opened the position or whether he’d taken profits.

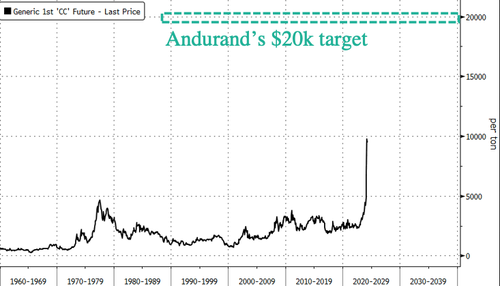

Futures in New York have jumped as high as $10,300 a ton in recent weeks, surging from the $6,000 level in early March.

Andurand emailed Bloomberg that cocoa prices “could break $20,000 later this year.” Hyperfinlating cocoa prices are caused by drought and disease, which are ravaging the world’s largest cocoa farms in West Africa.

Andurand said his analysts forecast cocoa bean production globally to be down at least 18% on the year, compared to most analysts’ expectations of 10-11%.

“This means that we will finish the year with the lowest stocks-to-grinding ratio ever, and potentially run out of inventories late in the year,” he warned.

Per Bloomberg:

The firm sees that ratio — which measures stockpiles relative to annual demand — will end the 2023-24 season around 16% in a base-case scenario. That would push the indicator below the previous record low set in the mid-1970s, when prices hit $5,000 a ton — equivalent to about $26,000 when adjusted for inflation, according to Bloomberg calculations.

Any higher cocoa prices and chocolate makers, like the US Hershey Company, will see demand destruction. Soaring cocoa prices are already weighing on the company’s stock.

This once-in-a-generation cocoa crisis will likely result in higher prices. Have the folks at r/WallStreetBets figured out about this trade?

Tyler Durden

Thu, 04/04/2024 – 22:40

via ZeroHedge News https://ift.tt/WIt9BXQ Tyler Durden