7 More States Sue To Block ‘Most Generous Ever’ Student Loan Program

Authored by Bill Pan via The Epoch Times (emphasis ours),

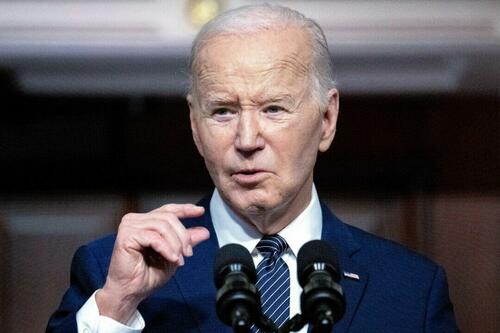

President Joe Biden faces a fresh lawsuit from a seven-state coalition challenging his “most generous ever” federal student loan repayment plan, under which millions of borrowers would have a monthly bill of $0.

In their complaint, filed on April 8 at a federal court in Missouri, the states argued that what the Biden administration calls the SAVE plan is another unlawful attempt to force Americans who incurred no college debt to shoulder the bill for those who did.

“Just last year, the [U.S.] Supreme Court struck down an attempt by the President to force teachers, truckers, and farmers to pay for the student loan debt of other Americans—to the enormous tune of $430 billion,” the complaint stated, noting that the high court’s 6-3 majority explicitly ruled that the president should not bypass Congress to implement a decision with such profound impact on the country’s economy.

“Undeterred, the President is at it again, even bragging that ’the Supreme Court blocked it. They blocked it. But that didn’t stop me,’” it added.

The lawsuit was spearheaded by Missouri, along with Arkansas, Florida, Georgia, North Dakota, Ohio, and Oklahoma. It comes just weeks after Kansas and 10 other Republican-led states filed a separate challenge to the same plan.

“With the stroke of his pen, Joe Biden is attempting to saddle working Missourians with a half trillion dollars in college debt,” Missouri Attorney General Andrew Bailey, a Republican, said in a statement on April 9.

“The United States Constitution makes clear that the President lacks the authority to unilaterally ‘cancel’ student loan debt for millions of Americans without express permission from Congress.”

Citing an estimate by the Wharton School at the University of Pennsylvania, Mr. Bailey said the SAVE plan would cost Americans $475 billion over 10 years—$45 billion more than the initial student loan cancellation plan the Supreme Court shot down last June.

Specifically, according to the elite business school, about $200 billion of that cost will come from payment reduction for the $1.64 trillion in loans already outstanding in 2023. The remaining $275 billion comes from reduced payments for about $1.03 trillion in new loans that will be extended over the next 10 years.

“We estimate a take-up rate for future loans of 70 percent, implying that about $645 billion in future loans will be subsidized,” Wharton researchers said. “About 6.57 percent of future borrowers, or 4.98 percent of total predicted loan volume, will never have to make any payments under SAVE.”

According to the latest update from the U.S. Department of Education, SAVE has enrolled over 7.7 million people since it launched last August.

Like the existing income-driven repayment (IDR) option it replaces, SAVE can provide an affordable monthly payment based on income and family size before the eventual discharge of the remaining balance. Its current enrollees include 4.5 million people whose monthly bill was lowered to zero dollars, in addition to about 150,000 borrowers who had their entire debt wiped out.

Under SAVE, those who borrowed $12,000 or less only need to make payments for 10 years before becoming eligible for the final forgiveness, or an additional year for every $1,000 borrowed above $12,000.

In other words, anyone who took out $21,000 or less in undergraduate loans can have their debt erased on a shorter timeline than the standard 20 years.

With the end of his first term now in sight, President Biden has not fulfilled the 2020 campaign promise to cancel up to $20,000 in student loan debt for every borrower.

In his April 8 trip to Wisconsin, one of the battleground states that could play a pivotal role in his likely November rematch with former President Donald Trump, President Biden touted his effort so far to deliver that promise, which he said would be “life-changing” for more than 30 million borrowers.

“Too many Americans, especially young people, are saddled with unsustainable debts in exchange for a college degree,” he said.

“The ability for working and middle-class folks to repay their student loans has become so burdensome [that] a lot can’t repay for even decades after being in school.”

Republicans, meanwhile, denounced the Biden administration’s actions as a scheme to save dwindling support among young voters.

“Biden wants to use your tax dollars to buy votes because more and more young people are supporting President Trump,” Michael Whatley, chair of the Republican National Committee, said.

Tyler Durden

Wed, 04/10/2024 – 07:20

via ZeroHedge News https://ift.tt/oxQ48LI Tyler Durden