Renewed Inflation Risks Aren’t Scaring Buyers Yet

By Michael Msika, Bloomberg markets live reporter and strategist

The stock market’s momentum is stalling and soaring commodity prices have brought inflation worries back to the forefront. For now, it’s not enough to prompt Wall Street strategists to change their bullish view.

HSBC strategists led by Max Kettner say any setback is likely to prove temporary, especially given that the market is still pricing in rate cuts this year. JPMorgan’s traders are “tactically bullish” going into the inflation data, says Andrew Tyler, the bank’s head of US Market Intelligence.

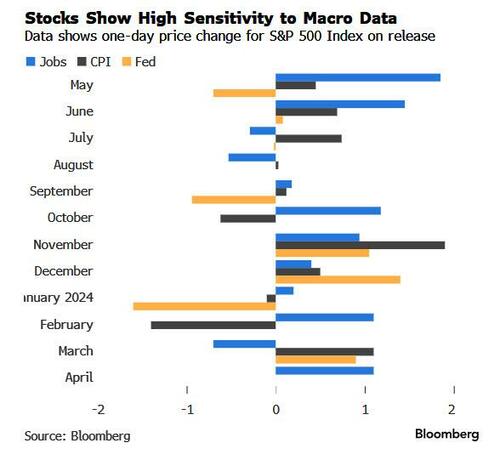

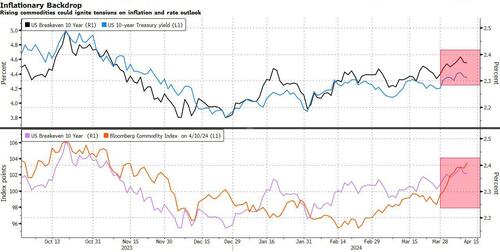

Even so, there are some market worries ahead of the US CPI data and some investors are nervous about stretched valuations before earnings season gets underway. Market momentum has stalled with stocks moving sideways for the better part of a month. Soaring commodity prices are partly to blame as worries shift back to whether persistently high inflation could threaten the rate outlook, especially with recent cautious comments from a number of Fed officials.

To JPMorgan, if the CPI print comes in cooler, it would be a boon for risk assets. Plus, market positioning is supportive given that hedge funds have been selling stocks for several weeks.

They acknowledge it’s harder for inflation to slow, given the strength in the labor market and higher commodity prices, but don’t expect the process to be derailed. “The bull case remains intact with at or above-trend GDP growth, positive earnings growth, and a paused Fed,” they say.

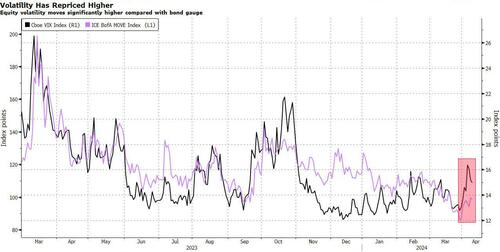

The slight scare of the past few days has made positioning cleaner, with bullish exposure easing, according to Citi. Investors sold $9.4 billion in long S&P 500 positions last week, reversing the flows from the previous week, according to data from quant strategists including Chris Montagu.

Inflation expectations may have been strengthening in the US and in Europe, as demonstrated by breakevens and swap rates creeping higher, but the market hasn’t been complacent. Stock volatility has been on the rise, as has the skew, with greater demand for hedges as we showed in the column yesterday. But crucially, big technical levels are holding firm.

In the meantime, the global economy keeps improving and economic surprises from Europe, the US and China are firmly in positive territory. Even if financial conditions have tightened ahead of the CPI print, they remain on the loose side, still supporting equities at these levels.

“The equity market is now more focused on the better growth outlook, rather than solely on the inflation and rates outlook,” say Barclays strategists including Matthew Joyce. “The growth outlook continues to improve, so any near-term wobble is likely to be trumped by better incoming data.”

Tyler Durden

Wed, 04/10/2024 – 07:21

via ZeroHedge News https://ift.tt/lZTOhyD Tyler Durden