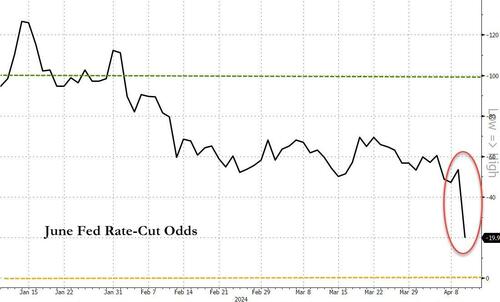

Surveying The Post-CPI Market Carnage…

The odds of a June Fed rate-cut have been eviscerated by this morning’s narrative-crushing CPI prints with the market now pricing a less-than-1-in-5 chance of a cut…

Source: Bloomberg

Morgan Stanley economist Ellen Zentner is the first sellside to warn her June rate-cut call is in jeopardy.

“The upside surprise in core CPI is moving the inflation data further away from the convincing evidence the Fed needs to start cutting in June. Dependent on the PPI data tomorrow, this print tilts the Fed toward a later start to the cutting cycle than our current forecast for June.”

This guy got proper-fucked…

Someone today placed a record size trade in SOFR futures one day before CPI…baller move 🔥👇 pic.twitter.com/NbC0KSDGBB

— Edward Bolingbroke (@EddBolingbroke) April 9, 2024

Expectations for 2024 rate-cuts collapsed – now less than two cuts priced in…

Source: Bloomberg

All of which sent stocks reeling lower…

With the S&P at almost one-month lows…

The dollar spiked…

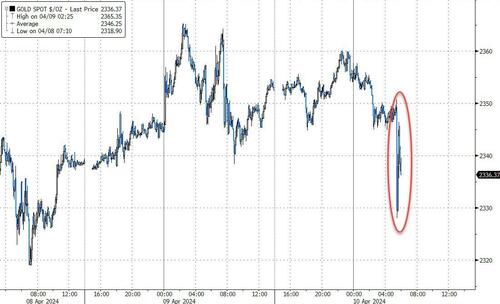

Gold dropped…

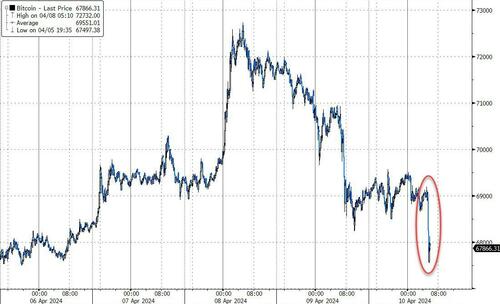

…as did crypto…

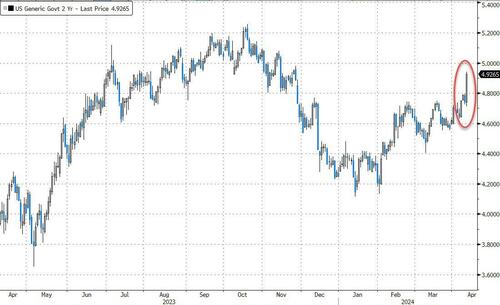

And bond yields exploded higher (2Y +19bps!)…

2Y Yield is closing in on 5.00% once again…

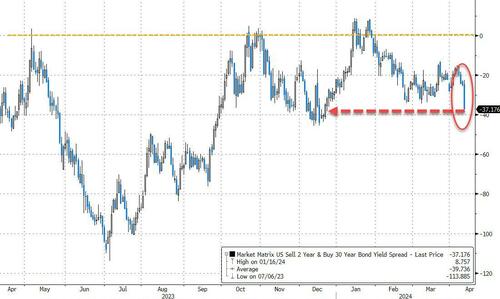

The yield curve dramatically bear-flattened to its most inverted since Dec 2023…

Now, we just await the spin on how this is actually not so bad and rate-cuts are still somehow on the table… hey we have to get Biden re-elected somehow, right!!

Tyler Durden

Wed, 04/10/2024 – 09:02

via ZeroHedge News https://ift.tt/w7gGuRT Tyler Durden