Bridge Collapse: Moody’s Cuts Maryland Transportation Authority’s Debt Outlook To Negative

The fallout from the Port of Baltimore bridge collapse has sparked supply chain snarls and economic pains in the Maryland area, forcing Moody’s Ratings to downgrade the outlook of the Maryland Transportation Authority’s debt from “stable” to “negative” because of mounting “uncertainties around the Francis Scott Key Bridge’s replacement project’s costs, including their funding and timing.”

“Any negative impact from the replacement project would be on top of financial metrics that were expected to narrow from capital investments prior to the loss of the bridge,” Cintia Nazima, a Moody’s analyst, noted in a report initially mentioned by Bloomberg.

Moody’s maintained the Aa2 rating for the MTA’s revenue bonds, linked to about $2.2 billion in outstanding debt. Nazima explained that this rating “reflects the essentiality of the authority’s road network, the fundamental strength of the service area, and its history of strong financial and operational management and performance.”

The analyst said the 1.6-mile (2.6-kilometer) Key Bridge comprised about 7% of MTA’s total revenue in 2023. They expect traffic to be rerouted on adjacent highways and tunnels, adding the MTA will likely recapture most of the lost toll revenue.

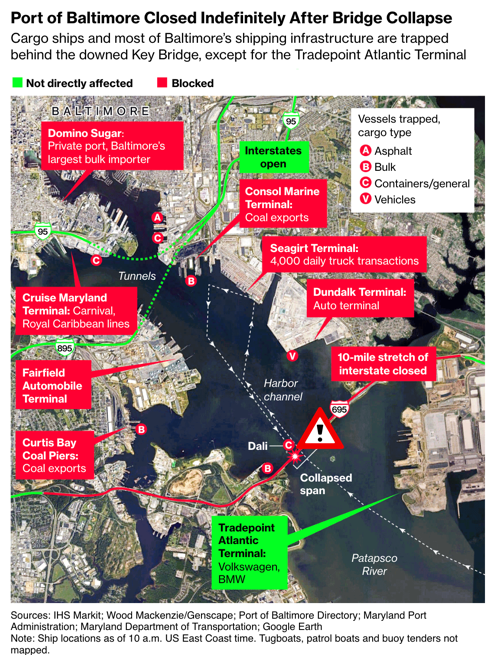

The bridge was the primary land feeder into the Port of Baltimore. It connected the port to the I-95 highway network in the Mid-Alantic.

For more than two weeks (since March 26), container ships, vehicle transport ships, bulk carriers, and other large commercial vessels have been diverted to other East Coast ports. Last week, the US Army Corps of Engineers provided a timeline for reopening the port, potentially at the end of May. However, there is no timeline on when the bridge will be rebuilt, with some figures in the 3-5 years range.

In a separate note last week, Moody’s warned the bridge collapse “has the potential to hurt the transportation and warehousing sector” in the Baltimore region.

How does the MTA recapture the lost toll revenue? Well, higher toll fees, of course.

Tyler Durden

Wed, 04/10/2024 – 18:40

via ZeroHedge News https://ift.tt/oJRnj14 Tyler Durden