Nearly 20% Of Recent San Francisco Home Sales Were Underwater

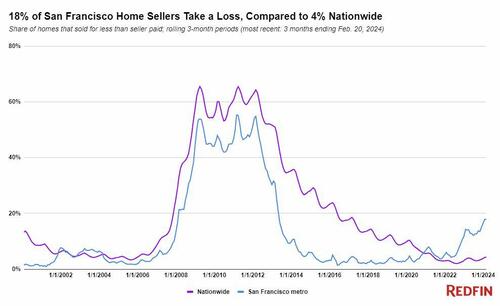

Nearly 20% of homes sold in San Francisco during the three months ending Feb. 29 sold at a loss. What’s more, the typical SF homeowner took $155,500 less than they bought it for, which is 400% more in dollar terms than the nationwide median loss of $39,912 over the same period, Redfin reports, citing an internal analysis of county records and MLS data across the US.

San Francisco home sellers are far more likely than sellers in the rest of the country to lose money because home prices there have dropped dramatically since the pandemic homebuying boom. Still, the Bay Area is home to the most expensive real estate market in the U.S.

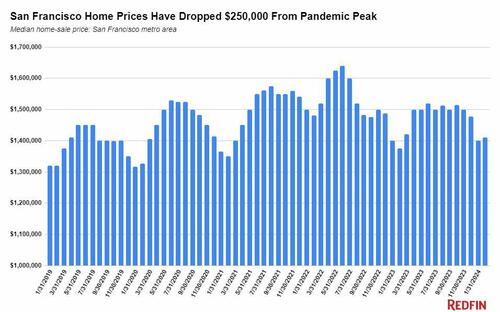

San Francisco’s median sale price peaked at $1.66 million in April 2022, and has since fallen 15% ($250,000) to $1.41 million as of February. The typical person who bought in San Francisco at nearly any point in 2021 or 2022, when the housing market was red hot due to ultra-low mortgage rates, would have taken a loss if they sold during the first few months of this year. –Redfin

“Home prices have fallen from their peak, especially when it comes to condos,” said real estate agent Christine Chang. “It’s not just because mortgage rates are high. San Francisco has lost some of its appeal post-pandemic. A lot of tech employers and big-name retailers have moved out of the city, and some of my clients have reported they’re leaving the area because they don’t feel as safe as they used to.“

Meanwhile…

According to the same report, Detroit came in second in terms of homes selling at a loss (10.8%) during the three months ending February 29, followed by three other Rust Belt and Midwestern metros: Cleveland (8.2%), St. Louis (8.1%) and Chicago (7.9%).

Sellers in those places are more likely than most to lose money because, like in San Francisco, home prices have fallen quite a bit from their pandemic peak. In Detroit, for instance, the median sale price is down roughly 20% from its pandemic peak.

Additionally, housing markets in Detroit and Chicago have suffered because they’re typically among the U.S. metros homebuyers are most likely to leave. -Redfin

Least likely to take a loss?

Homeowners in New England and Southern California were least likely to sell at a loss – with just 1.2% of homeowners who sold during the same period losing money.

This is followed by Boston, Anaheim, CA, Fort Lauderdale, FL, and San Diego, where roughly 2% of homes sold for less than the seller originally paid in each of those metros.

That said, the vast majority of sellers are still profitable on their home sales – even in San Francisco, where 82% of sellers took in more than they paid – with the typical seller banking $482,000 more than their cost basis over the period analyzed. Nationwide, 96% of sellers are postive on their sales, with a median gain of $196,016 thanks to the national media home price sitting just 5% below the all-time high set in mid-2022.

Tyler Durden

Thu, 04/11/2024 – 23:20

via ZeroHedge News https://ift.tt/UlXBdx2 Tyler Durden