JPMorgan Slides After Dimon Warns On Net Interest Income, Outlook Disappoints

Q1 earnings season officially opened moments ago when JPM became the first mega bank to reports results, and even though JPM beat on across the board – and even unexpectedly released reserves instead of setting money aside for yet another quarter – the stock is lower by ~3% after Jamie Dimon had some gloomy words about the bank’s net interest income (which dropped in Q1) and the bank’s NII outlook for 2024 missed estimates. But before we get to all that, let’s start with the Q1 historicals which were solid across the board:

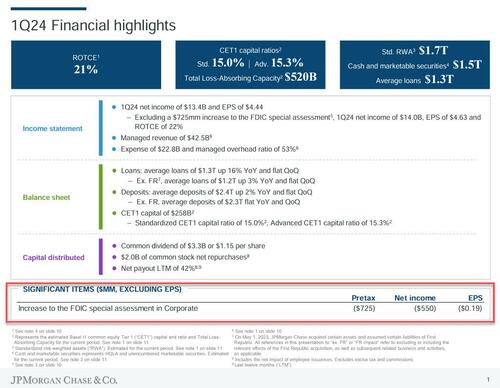

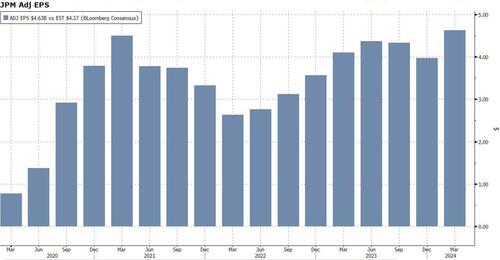

- Q1 Net Income of $13.4 billion, up 6% from $12.6 billion a year ago and stronger than the median estimate, which translated into EPS of $4.44 (and $4.21 ex the impact of First Republic), beating estimates of $4.15; JPM clarified that “excluding a $725 million increase to the FDIC special assessment,” net income would have been $14 billion or $4.63 a share.

- The EPS of $4.44 would be the second highest in the company’s history, and the highest in three years, going back to Q1 2021 when JPM reported a record $4.50.

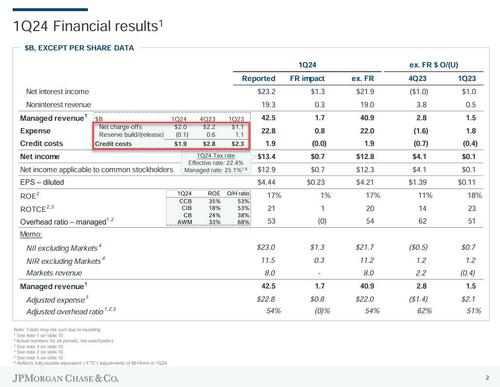

- Q1 Adjusted revenue $42.55 billion, +8.2% y/y, and beating the estimate of $41.64 billion

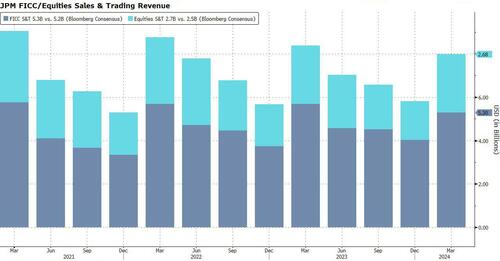

- FICC sales & trading revenue $5.30 billion

- Equities sales & trading revenue $2.69 billion

- Investment banking revenue $1.99 billion

- CIB Markets total net revenue $7.98 billion, estimate $7.71 billion

- Advisory revenue $598 million

- Equity underwriting rev. $355 million

- Debt underwriting rev. $1.05 billion

- Corporate & investment bank IB fees $2.00 billion

- Net charge-offs $1.96 billion, up from $1.1 billion a year ago, but below the estimate $2.2 billion

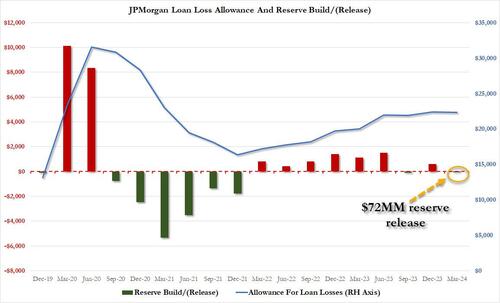

- Provision for credit losses $1.88 billion, lower by 17% y/y, and far below the estimate $2.78 billion, thanks to a reserve release of $72 million, vs a $1.1 billion reserve build in Q1 2023.

Needless to say, the reserve release was a very favorable swing factor in the company’s bottom line: a year ago, the reserve build was substantially higher, and rightfully so: charge offs have nearly doubled since then, rising from $1.1BN to $2.0BN.

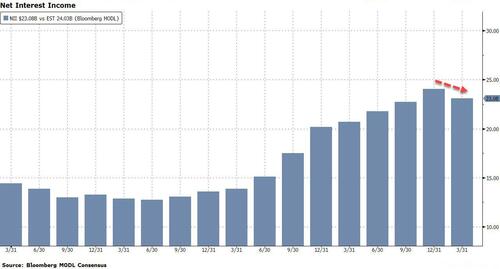

Going down the release, we find that the first unpleasant data, with JPM reporting that managed net interest income was $23.20 billion, just missing the estimate of $23.22 billion, with compensation expenses rising to $13.12 billion, and also above the estimate of $12.62 billion. There was some mode bad news in JPM’s net yield on interest-earning assets which came at 2.71%, missing the estimate 2.75%. The silver lining: JPM reported total non-interest expenses $22.76 billion, which were below the estimate of $22.99 billion.

Summarizing all the Q1 headline results we get the following:

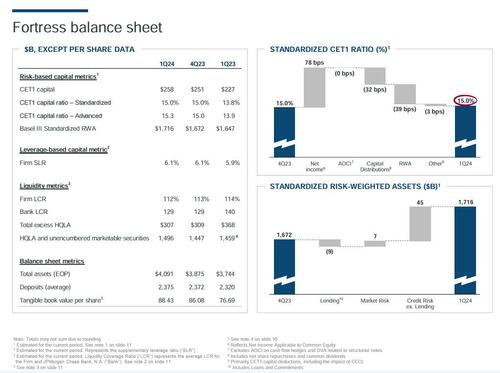

It wouldn’t be a JPM report if the bank did not have a slide about its “fortress balance sheet” and this quarter was no difference as the bank reported Standardized CET1 ratio 15%, above the estimate of 14.9%, boasting standardized risk-weighted assets of $1.716 trillion, and a “total loss-absorbing capacity” of $520 billion.

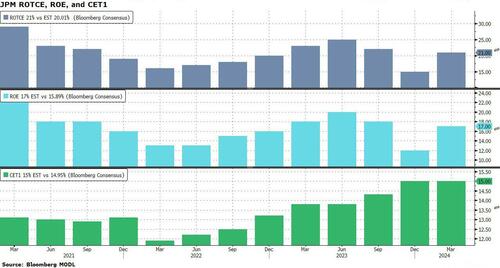

For the quarter, ROE hit 17% — or ROTCE at 21%.

There was more disappointment in the bank’s balance sheet where loans came in at $1.31 trillion, flat QoQ and missing the estimate $1.33 trillion, while total deposits were also flat at $2.43 trillion, above the estimate $2.4 trillion.

Before we continue, let’s take a closer look at Jamie Dimon’s brief but intense statement. As usual, he starts off with the bragging: he calls Q1 a “strong” first quarter, touts last month’s 10% boost to the dividend, calls the bank’s capital ratio “exceptionally high” and says its “peer-leading returns” gives “capacity and flexibility” for reinvestment and returning capital. (He also mentions that “fortress” balance sheet, as he always does.)

But – and this may explain the drop in the stock price – he also mentioned net interest income’s 4% decline, and that “as expected” NII excluding markets “declined 2% sequentially due to deposit margin compression and lower deposit balances, mostly in CCB.” He’s playing it cool as he adds: “Looking ahead, we expect normalization to continue for both NII and credit costs”

It wasn’t immediately clear what Dimon means by “deposit margin compression” with Bloomberg speculating that this is JPM’s way of saying deposits are going to be more expensive and that net-interest income will fall, something which the bank’s disappointing NII outlook confirms (see below).

We continue reading Dimon’s statement, where he next goes on to boast about the “strong underlying performance” in the units. First up is CCB, where “client investment assets were up 25% excluding First Republic” but what he doesn’t say is that average deposits were down 7%. The bank is being a little tricky by cushioning the news this way: “Average deposits down 3%, or down 7% excluding First Republic”, which of course is to be expected in a time of shrinking Fed reserves, which as we have shown countless time show up immediately in bank deposit balances. (On the flip side, Bloomberg notes that those client investment assets were up 46% when you’re not “excluding” First Republic.)

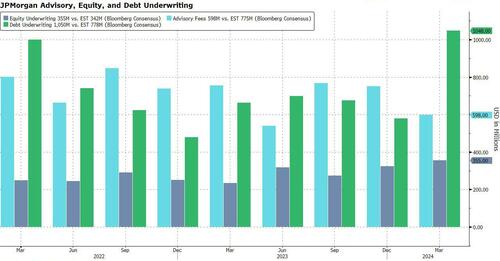

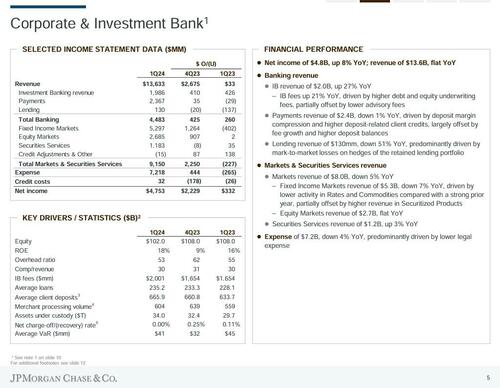

Dimon then turns to the Corporate and Investment Bank, where “IB fees increased 21%, reflecting improved DCM and ECM activity.” There was more good news: “In CB, we saw strong growth in Payments fees,” and Dimon adds that there was “a significant number of new client relationships.” Lastly, Dimon looks at AWM, where “asset management fees were up 14% with continued strong net inflows.”

Digging further into investment banking: Total IB fees came in at $2 billion this quarter, up 21% YoY, “driven by higher debt and equity underwriting fees, partially offset by lower advisory fees.” The strength came from debt underwriting results:

- Advisory: $598 million (missing estimates of $775M),

- Equity Underwriting: $355 million for equity underwriting (beating estimates of $342M)

- Debt Underwriting: $1.05 billion (beating estimates of $778 million)

Elsewhere, we also read in the earnings presentation find the following detail:

- Payments revenue of $2.4B, down 1% YoY, driven by deposit margin compression and higher deposit-related client credits, largely offset by fee growth and higher deposit balances

- Lending revenue of $130mm, down 51% YoY, predominantly driven by mark-to-market losses on hedges of the retained lending portfolio

Digging a little bit deeper into the Bank’s CIB division, we find JPM’s “crown jewel”, sales and trading, where Q1 trading revenue was nearly $8 billion, down 7% YoY but up from the $7.71 billion analysts expected for the first three months of 2024.

And summarizing the results:

Going back briefly to Dimon’s statement we find another “stormy weather” forecast, which is worth a closer look:

“Many economic indicators continue to be favorable,” the CEO said, but he says the firm is “alert to a number of significant uncertain forces.” What are they?

“First, the global landscape is unsettling – terrible wars and violence continue to cause suffering, and geopolitical tensions are growing.

Second, there seems to be a large number of persistent inflationary pressures, which may likely continue.

And finally, we have never truly experienced the full effect of quantitative tightening on this scale.

We do not know how these factors will play out, but we must prepare the Firm for a wide range of potential environments to ensure that we can consistently be there for clients.”

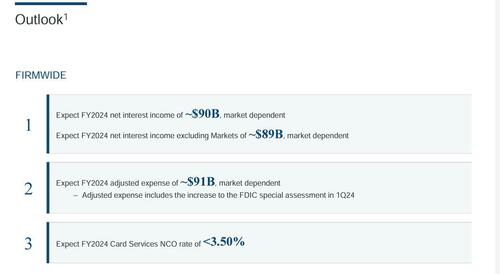

Maybe Dimon has a reason to be gloomy and it was revealed on the last page of the investor presentation where the JPM revealed its 2024 NII forecast of $90BN – a number which is “market” dependent, excluding markets the NII may be even lower at $89BN – both of which came in below the market consensus of $90.7BN (the market was expecting JPM would further increase its guidance here), a rare miss for the bank which still continues to derive all sorts of benefits from last year’s First Republic gift courtesy of the FDIC.

Putting it all together, and the market reaction was one of a rare disappointment, because while JPM beat on most metrics as it usually does, the decline in Net Interest Income, the miss in total Loans, and especially the disappointing Net Interest Income, and you get a stock that dropped as much as 3.7% premarket (it has since trimmed losses a bit). A key focus for analysts heading into earnings was the company’s net interest income outlook for the full year, and there’d been optimism from some analysts that the lender would boost its guidance on the metric.

The full earnings presentation is below (pdf link).

Tyler Durden

Fri, 04/12/2024 – 08:14

via ZeroHedge News https://ift.tt/xBC0ivV Tyler Durden