The Secular Trend In Treasuries Is Breaking Down

Authored by Simon White, Bloomberg macro strategist,

For all of the risk aversion boosting Treasuries today, the 40-year bond bull market is receding further into history as the bear market tightens its grip.

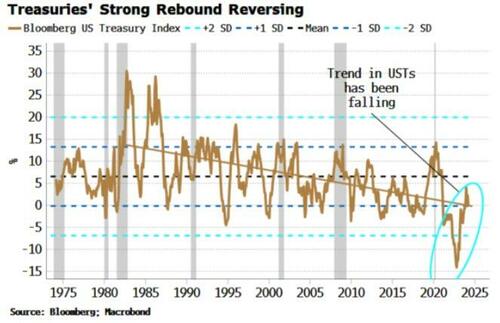

The mean growth rate in USTs is falling, leaving bonds still overbought and therefore subject to more downside.

Bond prices have trended upwards for most of past 45 years in one of the longest bull markets in history.

But the shift to an inflationary regime has wiped 15% from Treasuries since their 2020 peak in one of the worst drawdowns in their history.

Not only have prices been breaking down, so has the growth rate. The annual change in USTs is mean reverting, but as the chart below shows that mean has clearly been falling. That leaves Treasuries more likely to rebound less than before, and thus start to sell off earlier.

The current rebound off the very oversold conditions in late 2022 already looks to have faded.

We are now back in a selling-off phase as the growth rate oscillates around a lower mean (as low as 0%, from over 5% before).

That makes owning Treasuries a grim prospect, exacerbated by the still-low chance of a near-term recession in the US, and resurgent inflation.

Tyler Durden

Fri, 04/12/2024 – 12:40

via ZeroHedge News https://ift.tt/7Bgsai5 Tyler Durden