Nominal Retail Sales Soared In March As Gas Prices Spiked

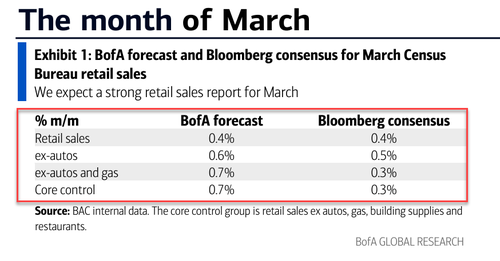

Ahead of today’s retail sales print, BofA’s practically omniscient analysts forecast a hot-hot-hot core print…

…and they were massively correct.

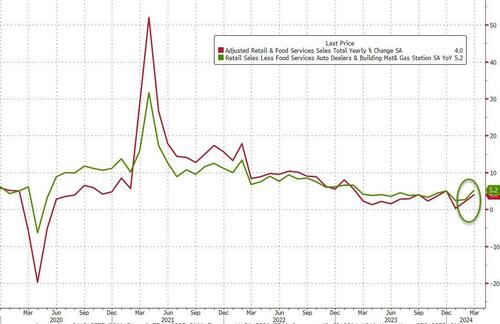

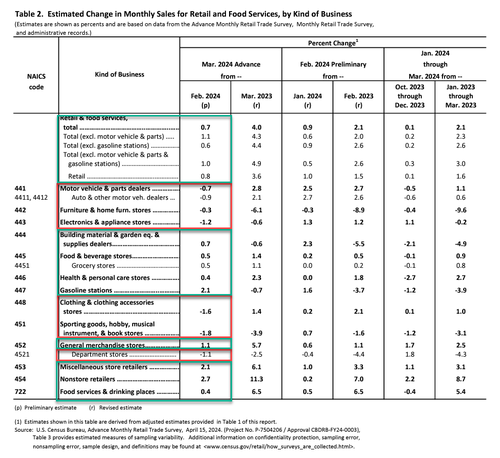

After last month’s surprise headline surge in retail sales (on the back of Motor Vehicle & Parts), consensus was for another monthly increase (but at a slightly slower pace). However, (nominal) retail sales soared 0.7% MoM (+0.4% exp), dragging the YoY change up 4.0%…

Source: Bloomberg

Interestingly, on an NSA basis, YoY retail sales slowed and gasoline station sales are actually down (albeit modestly)…

Source: Bloomberg

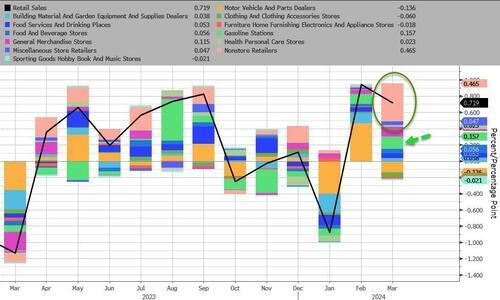

The core retail sales prints were even more dramatic – Ex-Autos +1.1% MoM (+0.5% exp) and Ex-Autos & Gas +1.0% MoM (+0.3% exp)…

Source: Bloomberg

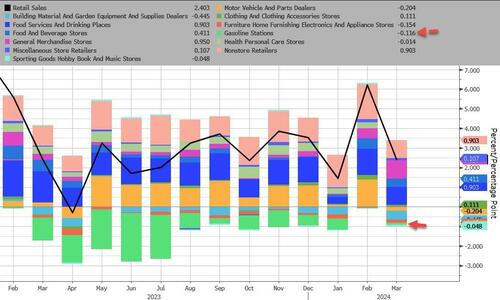

Under the hood, Motor Vehicles & Parts plunged the most (after last month’s surge) while Nonstore Retailers (internet retail) and Gas Stations soared the most…

Source: Bloomberg

Department Stores & Electronics & Appliances also saw sales plunge last month…

The crucial core-control group – used in GDP calculation – ripped higher by 1.1% MoM – its biggest beat since Feb 2023…

Source: Bloomberg

Finally, bear in mind that these data are all nominal – not adjusted for the surge in prices of everything, especially gasoline – so are Americans spending more… for less.

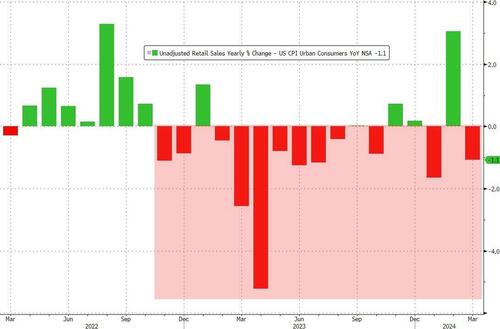

Adjusted (crudely) for inflation, this was a big drop in ‘real’ retail sales (non-seasonally-adjusted). REAL retail sales have declined for 12 of the last 17 months…

Source: Bloomberg

Translation: on a crude basis (Ret Sales NSA – CPI), Americans aren’t buying more shit.

Tyler Durden

Mon, 04/15/2024 – 08:40

via ZeroHedge News https://ift.tt/XhJfYkI Tyler Durden