Crude-Crash Saves Stocks From CTA-Slaughter; Bonds Bid But Bitcoin Battered

A volatile day for markets (relatively speaking) with crude and crypto the high- low-lights.

Goldman’s trading desk (Lee Coppersmith) noted that for the first time all year, it feels like the market is starting to question the strong growth narrative on the back of weaker earnings this AM: ASML -8% spilling into all Semis; JBHT a bellwether transport -7.5% and KNX -3.5% cut their forecast; Industrial REITs (GSSIREID) -3.2% on back of a neg print in the space. All of this weighing on the Momo trade (GSPRHIM) -2%.

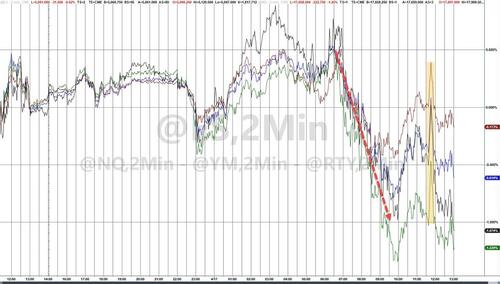

Stocks were sliding early on after the cash open but at around 1055ET the following headline hit: STRIKING IRAN’S NUCLEAR FACILITIES ‘ON THE TABLE’, SAYS EX-MOSSAD INTELLIGENCE CHIEF – SKY NEWS which took stocks down aggressively.

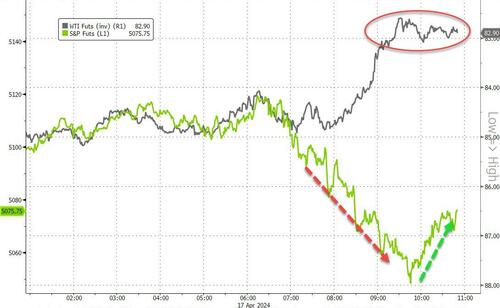

But that was reversed higher as oil prices plunged…

Source: Bloomberg

Oil was drifting lower early on amid a larger crude stockpile build but then Maduro and SPR headlines hit and the price plummeted to three-week lows…

Who could have seen that coming?

Oil got the message. How long before stock algos realize the SPR drain is coming

— zerohedge (@zerohedge) April 17, 2024

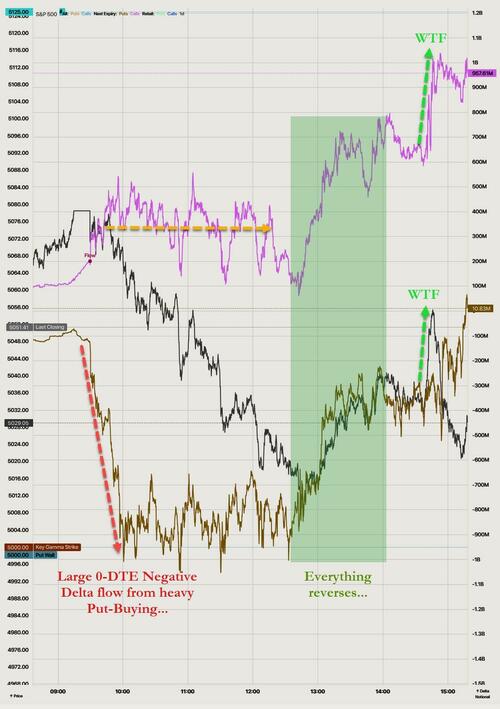

Then around 1440ET stocks went vertical.. because, frankly, no idea at all… and then reversed it just as fast! An almost perfect redux of what we saw yesterday around the same time…

Notably, the driver for that spike was a sudden surge in 0-DTE call-buying…

That did not last long – just like yesterday, and by the close Equities were back near the lows of the day with Nasdaq and Small Caps the biggest laggards. The S&P was down around 0.5% on the day and The Dow was unable to hold unchanged…

The bounce in stocks – thanks to plunging crude prices – rescued stocks critical CTA thresholds that should remain on everyone’s radar: medium term threshold = 4880 (~2.7% below spot). Goldman warns this would trigger >$50bn in SPX supply over 1 month. As a reminder, the short-term CTA sell threshold was 5,135 yesterday.

One more thing before we leave equity-land, VIX ended the day unchanged, while stocks were down quite notably – are we finally seeing some call-unwinds?

Source: Bloomberg

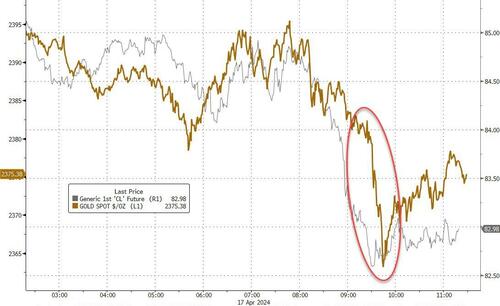

Oddly, gold also started to tumble around the same time as oil plunged…

Source: Bloomberg

Treasuries were very well bid today with a strong 20Y auction further emboldening buyers this afternoon. The belly of the curve outperformed, with 5Y -9bps, 2Y and 30Y -5bps…

Source: Bloomberg

The 2Y Yield thoroughly rejected 5.00% for now…

Source: Bloomberg

While yields tumbled, rate-cut expectations were basically unchanged…

Source: Bloomberg

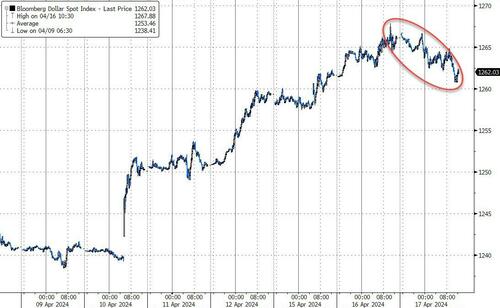

The dollar dropped for the first time in six days – its biggest drop since March 7th…

Source: Bloomberg

But the big move on the day… was in crypto which puked hard along with stocks, losing its $60k handle briefly before bouncing back a bit…

Source: Bloomberg

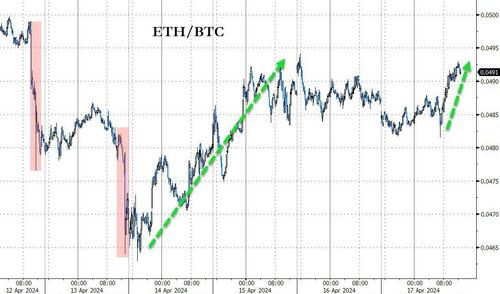

Ethereum outperformed bitcoin on the day, erasing most of its big relative puke last Friday/Saturday…

Source: Bloomberg

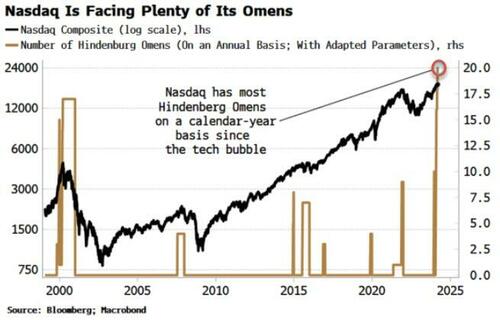

Finally, as we detailed earlier, the market has seen more Hindenburg Omens than in any year since the peak of the

Source: Bloomberg

‘Probably nothing!’

Tyler Durden

Wed, 04/17/2024 – 16:00

via ZeroHedge News https://ift.tt/EDUxLGi Tyler Durden