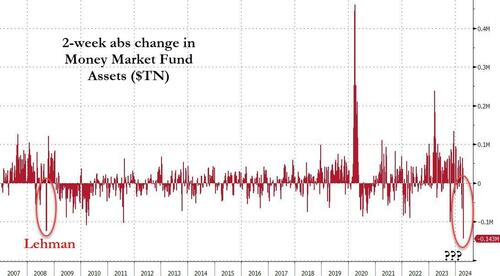

Money-Market Fund Assets See Largest Outflows Since ‘Lehman’

Total money-market fund assets plunged by $112BN in the last week as Tax-Day demands took the total assets below $6 Trillion for the first time sine January (to $5.97 Trillion)…

Source: Bloomberg

Corporate taxes collected from April 11 through April 17 totaled $100.7 billion, Treasury data show.

While Tax-Day’s impact matters obviously, we note that this is the largest weekly drop in money-market fund assets since Lehman (Sept 2008) and the biggest two-week drop (-$143BN) on record…

Source: Bloomberg

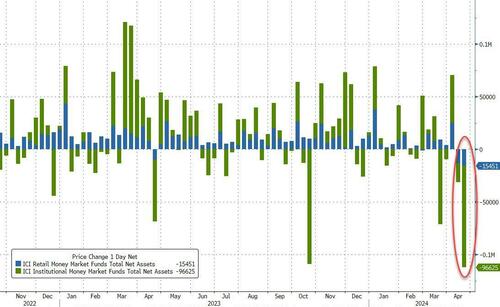

Much of the decline in money-market fund assets was led by institutional outflows that totaled $96.6BN in the week ended April 17 – the largest drawdown since an extended tax-filing deadline in mid-October. Retail investors pulled about $15.5 billion out of money-market funds../.

Source: Bloomberg

In a breakdown for the week to April 17, government funds – which invest primarily in securities like Treasury bills, repurchase agreements and agency debt – saw assets fall to $4.8 trillion, a $99 billion decline.

Prime funds, which tend to invest in higher-risk assets such as commercial paper, meanwhile, saw assets fall to $1.01 trillion, a $12 billion decline.

Still, cash is expected to continue piling into money funds as long as the Federal Reserve keeps rates on hold – and this week has seen rate-cut expectations tumble further…

Source: Bloomberg

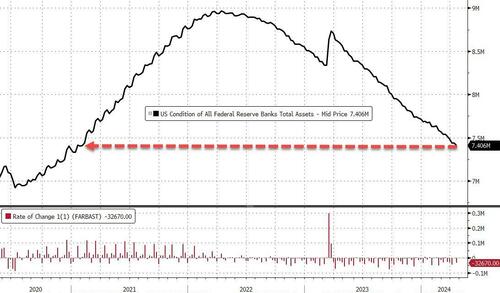

The Fed’s balance sheet shrank to its smallest since February 2021…

Source: Bloomberg

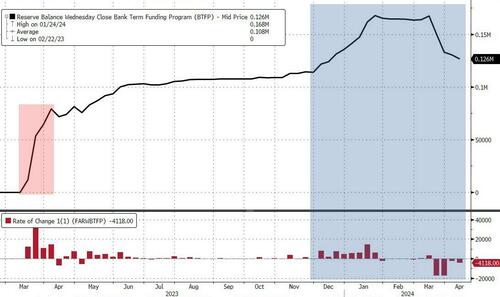

As The Fed starts discussing tapering QT and usage of The Fed’s bank bailout facility (now expired but these are 12 month term loans) fell by $4.1BN more to basically erase all the late-period arb-driven inflows, leaving a huge $126BN hole in bank balance sheets still being filled by this…

Source: Bloomberg

Finally, we note that bank reserve at The Fed slipped last week as it appears the reality for US equity market cap is starting to dawn…

Source: Bloomberg

While there may be no rate-cuts anytime soon… will The Fed taper QT in a big enough manner to avoid that recoupling?

Tyler Durden

Thu, 04/18/2024 – 16:44

via ZeroHedge News https://ift.tt/jNLBHzx Tyler Durden