Largest Oil ETF Hit With Record Outflow On Subsiding Geopolitical Risk Premium

A reduced geopolitical risk premium for Brent crude this week is likely one of the main drivers resulting in the largest daily outflows for the US Oil Fund ETF. Tensions between Iran and Israel have subsided in recent days, and it’s entirely possible the White House is busy mediating both sides to ensure a wider conflict doesn’t rocket Brent prices above $100/bbl.

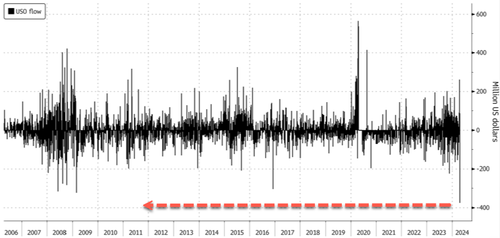

Bloomberg data shows that the US Oil Fund experienced the most massive daily outflow ever on Tuesday, with investors pulling a record $376 million, exceeding the outflow of $323 million set in 2009. Though as the chart below shows, there was a huge inflow just a day or two ago…

“The timing of this activity coincides with a general easing of immediate tension in the Middle East over the weekend,” John Love, chief executive officer of USCF Investments, told Bloomberg. USCF Investments is the firm that manages USO.

What happened here? USO’s total assets decoupled and negatively diverges from oil prices (a similar picture to what we have seen in gold as physical demand soars as paper demand ebbs).

Love said, “Given how high tensions were prior to the strike, it’s likely this was an event-driven selloff.”

Brent crude prices topped $91/bbl in early April and traded above the $90/bbl level through the mid-point of April as Iran and Israel volleyed missiles and bombs at each other in an unprecedented escalation between the two countries. However, the turmoil appeared more or less theatrics than anything else. Prices have since faded to the $87-$88/bbl level.

“Brent crude oil prices have retreated from their recent highs following a perceived de-escalation in the Israel-Iran conflict, and we continue to expect prices to remain range-bound over the coming months given current fundamentals,” Goldman’s Jenny Grimberg wrote in a note to clients on Wednesday.

Grimberg shifted up her Brent price floor to $75bbl from the previous line of $70/bbl to reflect OPEC’s increasingly strong influence on the market, softening US supply, a more robust demand outlook, and ongoing geopolitical risks. She also adjusted her price forecasts for 2H24/2025 to $86-$82/bbl (from $85-$80/bbl).

“That said, we maintain our $90/bbl ceiling on prices, owing partly to ample OPEC+ spare capacity, which limits upside price risk,” she added.

On Thursday, in a separate note, MUFG Bank’s Ehsan Khoman outlined a “reduced geopolitical risk premium” impacting Brent prices but said, “a broader risk-off tone is being overshadowed by bullish US crude inventory numbers, with front-end Brent pricing consolidating below the USD90/b handle.”

Khoman pointed out that oil bulls are sitting comfortably with prices over the 50-day moving average of $86/bbl.

He expects Brent to trade between the $80/bbl and $100/bbl range for the rest of the year primarily because of “effective OPEC+ market management” on the supply side, adding that the lingering risk remains geopolitics in the Middle East.

That said, the largest USO daily outflow ever is likely not an ominous sign of a major trend change in crude prices but rather just a cooling of the geopolitical risk premium. A combination of lingering threats in the Middle East and OPEC+ market management will keep prices elevated.

Tyler Durden

Thu, 04/25/2024 – 11:05

via ZeroHedge News https://ift.tt/QVC8Ae0 Tyler Durden