Futures Jump As Tech Giants Soar, Yen Plummets After BOJ Refuses To Prop Up Crashing Currency

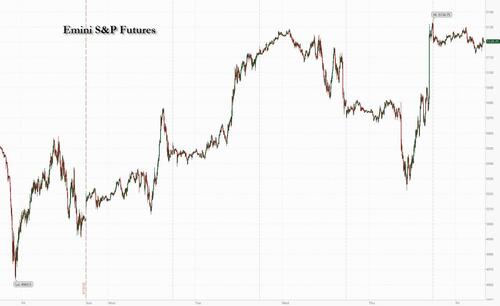

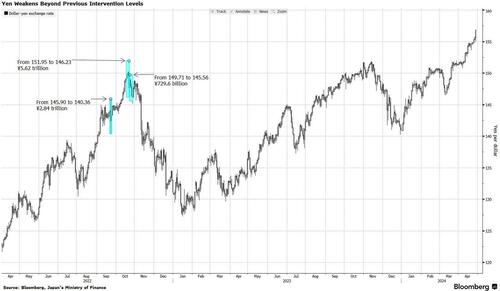

In a rollercoaster 48 hours to close the week, yesterday’s early market slump (after the disappointing Meta guidance) has been fully reversed and stock futures are now pointing sharply higher after blockbuster earnings from Microsoft and Alphabet with attention now turning to the release of US personal consumption data – the Fed’s preferred measure of inflation, where a hotter-than-expected reading after Thursday’s weaker GDP figures may signal US rates will remain higher for longer. As of 7:40am, S&P futures are 0.7% higher while Nasdaq futures gain 1.1%. The positive sentiment carried into European trading, with tech stocks leading equity gains, with miners outperforming as copper hit $10,000 a ton for the first time in two years. Traders are also speculating as to whether Japan will intervene to support the Yen after the currency slid to a 34-year low before rebounding after the central bank kept rates on hold and Ueda said nothing to prop up the currency in what Deutsche Bank has called a policy of “benign neglect.” Later in the day, attention will shift. Elsewhere, the USD is higher and bond yields are slightly lower. In commodities, oil and precious metals are higher; base metals and Ags are mixed. Today, key focus will be the March PCE release at 8.30am ET, where consensus expects headline PCE and core PCE to both rise +0.3% MoM.

In premarket trading, Google parent Alphabet surged as much as 12%, poised to add more than $230 billion to its market capitalization and exceed $2 trillion in valuation. Microsoft rose 4% after the software giant reported third-quarter results that beat expectations, a sign that AI is fueling growth and demand. The companies trounced Wall Street estimates with their latest quarterly results, fueled in part by demand for AI services. In other earnings-related moves, Exxon fell 1.2% after missing EPS but smashing revenue estimates, while Intel slumped more than 7% after providing weaker-than-anticipated guidance. Here are some other notable movers:

- Atlassian shares slide 5.3% after the application software company said co-founder Scott Farquhar is stepping down as co-CEO after 23 years.

- Boyd Gaming shares fall 14% after the regional casino operator reported adjusted earnings per share for the first quarter that missed the average analyst estimate.

- Chinese stocks listed in the US rise, reflecting a rally in Hong Kong as Asian big tech names get a boost following robust earnings from Alphabet and Microsoft. Alibaba +2.0%, Baidu +2.6%, PDD Holdings +2.5%, JD.com +5.0%, NetEase +1.7%, Trip.com +3.1%, KE Holdings +3.3%, Bilibili +5.4%

- Cloud software stocks rise following better-than-expected sales in Microsoft and Google’s cloud divisions. Datadog +4.9%, Snowflake +3.5%, MongoDB +3.8%, Cloudflare +2.3%

- Enphase Energy (ENPH US) shares rise 2.9% as Barclays upgrades its recommendation to overweight from equal-weight, saying the solar-equipment manufacturer is nearing an inflection point.

- Intel shares drop 7.3% after the chipmaker’s second-quarter outlook was weaker than anticipated, underlining the difficulties the company has had in executing a turnaround.

- KLA Corp shares rise TKTK after the semiconductor equipment supplier’s third-quarter earnings beat estimates and outlook for the fourth quarter was strong, prompting analysts to raise their price targets.

- Marathon Digital shares rise 3.3% after the company increases year-end hash rate target to 50 EH/s from 35-37 EH/s.

- Mobileye shares fall 3.0% after a downgrade to underweight at Morgan Stanley in the wake of the company’s results.

- Roku shares fall 4.8% as the streaming-video platform company said it expects adjusted Ebitda to moderate in the second half of the year, after reporting first-quarter results that beat expectations.

- Snap shares surge 24% after the social-media company reported first-quarter results that beat expectations and gave an outlook that is stronger than forecast, helping to ease concerns about its growth.

- T-Mobile shares waver after the carrier’s results received a mixed reception from analysts, who said that the earnings were overall solid, but were disappointed that the company didn’t raise its guidance for postpaid phone subscribers as it looks raise prices.

- Teladoc Health shares drop 4.4% after a second-quarter forecast missed estimates. The healthcare services company also reported a first-quarter gross margin that fell short of expectations.

While earnings remain center stage, the focus Friday will also be on US data, with the Fed’s preferred measure of inflation of particular interest. Treasury yields dipped following yesterday’s bond-market losses when stagflationary GDP data pushed back expectations for policy easing. A gauge of the dollar was steady.

“We have a precarious situation where the earnings of a few big companies are driving sentiment on the entire market,” said Justin Onuekwusi, chief investment officer St James Place Management. “We have seen a bit of volatility driven by earnings as well as rate decreases being priced out and that’s likely to continue.”

Almost 80% of S&P 500 firms that have reported so far have beaten analysts’ earnings estimates, according to JPMorgan strategists. Still, stock price reactions have been underwhelming, with better-than-expected results seeing below average upside, while those missing estimates are being penalized by more than usual, the strategists wrote. More than 50% of S&P 500 companies have yet to report.

A big highliight of the overnight session was the latest collapse in the Japanese yen which fell to a fresh cycle low near 157 versus the dollar after the Bank of Japan stood pat on interest rates and Governor Ueda did little to push back against recent weakness in the press conference. The yen’s slump to a record low versus the dollar has left traders on guard for any hints of intervention from Japan. The yen swung sharply from the day’s low to near its high amid jittery trading in the wake of the Bank of Japan’s decision to keep monetary policy unchanged.

“Should the yen fall further from here, like after the BOJ decision in September 2022, the possibility of intervention will increase,” said Hirofumi Suzuki, chief currency strategist at Sumitomo Mitsui Banking Corp. “It is not the level but it’s the speed that will trigger the action.”

European stocks rose along with US equity futures: the Stoxx 600 is up 0.6%, with technology and construction sectors leading gains, while chemicals and insurance subgroups are the biggest losers. Thyssenkrupp shares jumped after Czech billionaire Daniel Kretinsky’s EP Corporate Group agreed to buy a fifth of the German manufacturer’s troubled steel unit. Miners outperformed as copper hit $10,000 a ton for the first time in two years. Here are the biggest movers Friday:

- Saint-Gobain shares gain as much as 6.3% after the French building-materials producer reported first-quarter sales that were slightly above expectations, according to Oddo. Separately, management is seeing signs of bottoming out for new build markets in Europe

- NatWest rises as much as 5.2% after net interest income and pretax operating profit for the first quarter beat the average analyst estimate

- Amundi soars 7%, most in two years, after the French asset manager reported net inflows for the first quarter that beat the average estimate. Citi analysts expect mid-single digit consensus upgrades. KBW called the results “solid.”

- Electrolux shares gain as much as 7%, the most since December, after first-quarter figures from the Swedish maker of domestic appliances weren’t as bad as feared, with an operating loss of SEK720 million, versus an expected SEK809 million

- Jeronimo Martins soars most in six months after Ebitda margin erosion in 1Q was smaller than analysts expected, showing that Portuguese retailer can withstand competition pressure in Poland as well as negative impact from slowing inflation

- Airbus shares fall as much as 3% to the lowest since early March after its first-quarter results were significantly below estimates, even as the planemaker reiterated its full-year targets

- IMCD’s shares sink as much as 10%, the most since March 2020, after the specialty chemicals and ingredients company reported first-quarter operating Ebita that missed estimates. ING says the story was “underlying quite weak.”

- Hexagon shares fall as much as 4.4% after the software firm reported sales and operating profit that missed estimates, while saying that demand will remain mixed in the near term

- ConvaTec Group shares decline as much as 7.2% after the medical equipment maker was downgraded to reduce by analysts at Peel Hunt, which has growing concerns about its wound care products in the US

- Yara shares fall as much as 6.9%, the lowest intraday since May 2020, after the Norwegian agricultural chemicals firm reported adjusted Ebitda below estimates

Earlier in the session, Asian stocks rose, headed for their best week since November, as investors cheered upbeat earnings from technology firms and sentiment on China continued to improve. Japanese stocks rose as the Bank of Japan left interest rates unchanged. The MSCI Asia Pacific Index rose 0.8%, with TSMC and Tencent among the biggest boosts. The gauge extended its weekly gains to more than 3%. Stocks rose in mainland China and Hong Kong, with the Hang Seng China Enterprises Index poised for its best week since April 2015. Signs of an improving Chinese economy, better corporate earnings and Bejing’s support measures have spurred inflows from global funds.

- Hang Seng and Shanghai Comp. were underpinned by strength in tech and property, while the constructive mood was also facilitated by a meeting between US Secretary of State Blinken and Chinese Foreign Minister Wang where it was stated that the US-China relationship has stabilised although negative factors are building.

- ASX 200 underperformed after the prior day’s losses caught up with the index on return from holiday.

- Nikkei 225 was initially choppy and briefly dipped into negative territory as participants braced for the BoJ policy announcement and whether the central bank flags a reduction in bond buying, but then surged as the central bank kept policy settings unchanged and refrained from any major hawkish surprises.

In FX, the dollar was slightly lower, as all the action was in the Japanese yen which cratered to a fresh 34 year low near 157 versus the dollar after the Bank of Japan stood pat on interest rates and Governor Ueda did little to push back against recent weakness in the press conference. USD/JPY did swing sharply lower to sub-155 before swiftly rebounding in jittery trading amid heightened speculation that authorities may intervene in the market.

In rates, treasuries climbed, paring some of Thursday’s post-data drop. US yields are richer by up to 2bp across long-end of the curve with 5s30s spread around 8bp, tighter by around 1bp on the day; 10-year yields around 4.685%, down 1.5bp on the day with bunds outperforming by 1bp in the sector.

In commodities, oil prices advance, with WTI rising 0.4% to trade near $83.90 a barrel. Spot gold rises 0.7% to around $2,350/oz. Copper hit $10,000 a ton for the first time in two years.

Looking at today’s calendar, the US session highlight is the March personal income/spending (8:30am); we algo get the April revised University of Michigan sentiment (10am) and April Kansas City Fed services activity (11am). Fed members are in self-imposed quiet period ahead of May 1 policy announcement

Market Snapshot

- S&P 500 futures up 0.8% to 5,121.00

- STOXX Europe 600 up 0.6% to 505.47

- MXAP up 0.7% to 172.65

- MXAPJ up 0.8% to 536.04

- Nikkei up 0.8% to 37,934.76

- Topix up 0.9% to 2,686.48

- Hang Seng Index up 2.1% to 17,651.15

- Shanghai Composite up 1.2% to 3,088.64

- Sensex down 0.7% to 73,833.99

- Australia S&P/ASX 200 down 1.4% to 7,575.91

- Kospi up 1.1% to 2,656.33

- German 10Y yield little changed at 2.60%

- Euro up 0.2% to $1.0748

- Brent Futures up 0.2% to $89.21/bbl

- Brent Futures up 0.2% to $89.21/bbl

- Gold spot up 0.6% to $2,347.56

- US Dollar Index down 0.10% to 105.49

Top Overnight News

- BOJ leaves rates unchanged, as expected, and retained its guidance from Mar about purchasing gov’t bonds (there had been some speculation of a taper or a hint of one). WSJ

- Japan’s Tokyo CPI for April cools far more than anticipated, coming in +1.8% ex-food/energy vs. the Street +2.7% and down from +2.9% in March. BBG

- China’s foreign minister says the relationship w/the US was starting to stabilize but that “negative factors” were increasing. NBC News

- Eurozone inflation expectations over the next 12 months ticked down to 3% (from 3.1%), hitting the lowest level since Dec 2021. ECB

- The ECB is likely to need extra interest rate cuts if global borrowing costs are pushed up by the US Federal Reserve maintaining its restrictive monetary policy stance, a top eurozone policymaker has said. Fabio Panetta, head of Italy’s central bank, said that if the Fed keeps rates on hold longer than markets expect, or even raises them, it would be “likely to reinforce the case for a rate cut [by the ECB] rather than weakening it”. FT

- Donald Trump’s allies are quietly drafting proposals that would attempt to erode the Federal Reserve’s independence if the former president wins a second term, in the midst of a deepening divide among his advisers over how aggressively to challenge the central bank’s authority. WSJ

- Walmart’s CEO says inflation continues to cool: “At Walmart, we are now seeing prices that are in line with where they were 12 months ago. I haven’t been able to say that for a few years now. The last few weeks, we’ve taken even more prices down in areas like produce and meat and fresh food”. ABC News

- Annualized US core PCE inflation accelerated to 4.5% over the last three months, but underlying trends are less alarming. The Q1 acceleration mostly reflected one-off surprises in acyclical categories where costs pass-through with long lags, and forward-looking indicators are at target-consistent levels. Progress therefore appears delayed but not reversed, and we forecast that core PCE inflation will slow to 2.2% on a sequential annualized basis in 2024Q2-Q4. GIR

- Microsoft and Alphabet jumped premarket after stellar earnings and expectations for a surge in cloud revenue fueled by AI demand. Execs at both companies said they plan to spend more on AI. BBG

Earnings

- Alphabet Inc (GOOGL) Q1 2024 (USD): EPS 1.89 (exp. 1.51), Revenue 80.54bln (exp. 78.59bln); board authorised Co. to repurchase up to an additional 70bln and declared a cash dividend of 0.20/shr. Shares +11.5% in pre-market trade

- Microsoft Corp (MSFT) Q3 2024 (USD): EPS 2.94 (exp. 2.82), Revenue 61.86bln (exp. 60.8bln). Shares +4.1% in pre-market trade

- Intel Corp (INTC) Q1 2024 (USD): Adj. EPS 0.18 (exp. 0.14), Revenue 12.70bln (exp. 12.78bln). Shares -7.5% in pre-market trade

- Snap Inc (SNAP) Q1 2024 (USD): Adj. EPS 0.03 (exp. -0.05), Revenue 1.19bln (exp. 1.12bln). Shares +23.5% in pre-market trade

- TotalEnergies (TTE FP) Q1 (USD): Adj. Net 5.11bln (exp. 5bln). Adj. EBITDA 11.5bln (exp. 11.1bln). Plans a USD 2bln share buyback Q2; Cash flow from operating activities 2.2bln (prev. 5.1bln Y/Y); Dividend +7% Y/Y

- Airbus (AIR FP) Q1 24 (USD): Adj. EBIT 600mln (exp. 789mln), Revenue 12.80bln (exp. 12.87bln), Gross Orders 170 (prev. 156), Net Orders 170 (prev. 142), Deliveries 142. Reaffirms 2024 guidance.

A recap of overnight news courtesy of Newsquawk

APAC stocks were mostly higher as the region digested recent market themes including disappointing US data, strong big tech earnings and the BoJ policy announcement. ASX 200 underperformed after the prior day’s losses caught up with the index on return from holiday. Nikkei 225 was initially choppy and briefly dipped into negative territory as participants braced for the BoJ policy announcement and whether the central bank flags a reduction in bond buying, but then surged as the central bank kept policy settings unchanged and refrained from any major hawkish surprises. Hang Seng and Shanghai Comp. were underpinned by strength in tech and property, while the constructive mood was also facilitated by a meeting between US Secretary of State Blinken and Chinese Foreign Minister Wang where it was stated that the US-China relationship has stabilised although negative factors are building.

Top Asian News

- Chinese Foreign Minister Wang said in a meeting with US Secretary of State Blinken that the China-US relationship has stabilised but negative factors are building, while he added that sliding into conflict with the US would be a lose-lose situation that they ask the US not to interfere with China’s internal affairs. Furthermore, Blinken said there is no substitute for face-to-face diplomacy and they need to avoid miscalculations, while he hopes the US and China can make progress on agreements, citing fentanyl, military-to-military ties and AI risks.

- US is pushing allies in Europe and Asia to tighten restrictions on exports of chip-related technology and tools to China amid rising concerns about Huawei’s development of advanced semiconductors, according to FT sources. US wants Japan, South Korea, and the Netherlands to use existing export controls more aggressively, including stopping engineers from their countries servicing chipmaking tools at fabs in China.

- ByteDance reportedly prefers shutting down the app rather than a sale if it exhausts all legal options and the algorithms TikTok relies on are deemed core to ByteDance’s overall operations, making the sale of the app unlikely, according to Reuters sources.

European bourses, Stoxx 600 (+0.5%) are entirely in the green, though trade has been contained at session highs, as participants await March’s US PCE at 13:30 BST. European sectors are almost entirely in the green, with the exception of Chemicals, following poor IMCD (-9.1%) results. Tech tops the pile, with optimism lifted following strong large-cap Tech earnings in the US. US Equity Futures (ES +0.7%, NQ +0.9%, RTY +0.1%) are entirely in the green, with the NQ outperforming, benefitting from significant pre-market strength in both Google (+11.1%) and Microsoft (+3.6%), after reporting strong earnings after-market.

Top European News

- ECB’s Panetta said they must weigh the risk of monetary policy becoming too tight, while he added that timely and small rate cuts would counter weak demand and could be paused. Furthermore, he stated that hesitations in adjusting rates would hurt investment and productivity, while large rate cuts could create a credibility issue.

- ECB Consumer Inflation Expectations survey (Mar) – 12-months ahead 3.0% (prev. 3.1%); 3-year ahead 2.5% (prev. 2.5%). Economic growth expectations for the next 12 months 1.1% (prev. -1.1%)

- SNB Chair Jordan said SNB has been successful in fight against inflation; uncertainty remains elevated and shocks can occur at and time

BOJ

- BoJ kept its policy settings unchanged with the short-term interest rate target at 0.0%-0.1%, as expected, with the decision made unanimously, while it dropped the reference from the statement that it currently buys about JPY 6tln worth of JGBs per month but stated that it will conduct JGB, commercial paper and corporate bond buying in line with the decision in March. BoJ said it must be vigilant to FX and market moves and their impact on the economy and prices but noted no excessive behaviour is seen in Japan’s asset market and financial institutions’ practices. Furthermore, it stated that if trend inflation rises, the BoJ will likely adjust the degree of monetary easing but also added to expect accommodative monetary conditions to continue for the time being. In terms of the latest Outlook Report, Board Members’ Real GDP median forecast for Fiscal 2024 was cut to 0.8% from 1.2% but the Fiscal 2025 median forecast was maintained at 1.0%, while the Core CPI Fiscal 2024 median forecast was raised to 2.8% from 2.4% and Fiscal 2025 median forecast was raised to 1.9% from 1.8%.

- PRESS CONFERENCE: BoJ Governor Ueda said easy financial conditions will be maintained for the time being; Weak JPY so far is not having a big impact on trend inflation. Difficult to gauge timing of future rate hikes. Weak JPY so far is not having a big impact on trend inflation. Reduction in JGB buying in the future is in sight. Will not comment on FX moves

FX

- USD is around flat, and holding within a 105.40-71 range. USD was initially being propped up by JPY softness post-BoJ, although that has abated somewhat, amid Yen intervention speculation.

- JPY is the clear laggard across the majors following the BoJ policy announcement overnight, which provided no hawkish surprise. USD/JPY took another leg higher amid BoJ Ueda’s press conference, before being slapped down to sub-155 levels, a few hours later. Some will likely view the move as intervention but we are yet to see any official confirmation of this.

- EUR is flat vs. the USD and breached yesterday’s 1.0740 best. If the pair ventures higher, 1.0756 from April 11th is the next potential target.

- Antipodeans are firmer vs. the USD and outmuscling peers alongside the favourable risk environment. AUD/USD has gained a firmer footing above its 200 and 50DMAs at 0.6526 and 0.6532 respectively with focus now on a potential approach of 0.66

- PBoC set USD/CNY mid-point at 7.1056 vs exp. 7.2449 (prev. 7.1058).

Fixed Income

- USTs are a touch firmer after yesterday’s data induced losses, which sent the Jun’24 UST to a contract low of 107.04. Today’s trade has been contained within a 107.04-108.01 range, with all eyes on March’s US PCE metrics later.

- Bund price action has been following USTs and attempting to recoup recently lost ground which has been inspired this week by a combination of better data and speak from hawkish ECB members. Bunds are so far respecting yesterday’s 129.53-130.38 range.

- Gilts are firmer and in-fitting with global peers in an attempt to claw back recent losses. However, with a lack of UK-specific drivers, UK paper will likely remain at the whim of global peers.

Commodities

- A relatively tame session thus far for the crude complex following Thursday’s choppy trade, as participants await monthly US PCE metrics; Brent Jun’24 range between 89.08-69/bbl.

- Precious metals are firmer amid the softer Dollar and ahead of the US PCE data, with spot silver narrowly leading vs spot gold. XAU topped yesterday’s peak (USD 2,344.93/oz) to trade in a current intraday range between USD 2,326.36-2,352.30/oz.

- Base metals are stronger across the board amid bullish momentum after copper crossed key levels, with the broader complex underpinned by the softer Dollar and broader risk appetite; 3M LME copper is posting gains of over USD 100/t at the time of writing after mounting the key USD 10,000/t mark to levels last seen in 2022.

- India Oil Minister said cartel of oil producers are responsible for current volatility in the market; oil producers are cutting down and holding back production, according to ETNow.

Geopolitics: Middle East

- “US Secretary of State Blinken to visit Israel on Tuesday”, according to Sky News Arabia

- Hezbollah said it shelled an Israeli force with artillery at the site of Al-Malikiyah and achieved a direct hit, according to Al Jazeera.

Geopolitics: Other

- US official said the US could announce as soon as Friday USD 6bln in new weapon purchases for Ukraine.

- North Korean leader Kim supervised the test-firing of multiple launch rockets, according to KCNA.

- China’s Defence Ministry said Chinese and French militaries established a dialogue mechanism for cooperation between theatre commands, according to Reuters.

US Event Calendar

- 08:30: March PCE Deflator MoM, est. 0.3%, prior 0.3%

- March PCE Core Deflator MoM, est. 0.3%, prior 0.3%

- March PCE Deflator YoY, est. 2.6%, prior 2.5%

- March PCE Core Deflator YoY, est. 2.7%, prior 2.8%

- 08:30: March Personal Income, est. 0.5%, prior 0.3%

- March Personal Spending, est. 0.6%, prior 0.8%

- March Real Personal Spending, est. 0.3%, prior 0.4%

- 10:00: April U. of Mich. Sentiment, est. 77.9, prior 77.9

- April U. of Mich. Current Conditions, prior 79.3

- April U. of Mich. Expectations, prior 77.0

- April U. of Mich. 1 Yr Inflation, prior 3.1%

- April U. of Mich. 5-10 Yr Inflation, est. 3.0%, prior 3.0%

- 11:00: April Kansas City Fed Services Activ, prior 7

DB’s Jim Reid concludes the overnight wrap

It’s been a volatile 24 hours in markets, but in spite of a selloff yesterday, there’s increasing positivity this morning thanks to strong results from Microsoft and Alphabet after last night’s close. Both companies exceeded revenue and earnings expectations, with Alphabet seeing the larger beat on profitability, as their growth was boosted by demand for cloud computing and AI-related offerings. That’s seen Alphabet rise by over 11% in after-hours trading, while Microsoft is up more than -4%, having both been down in the main session yesterday. In turn, futures on the S&P 500 are currently up +0.81%, which is a significant turnaround from yesterday, as the index closed -0.46% lower, and that was only after recovering from initial losses that had pushed it down -1.60%.

That positivity has continued into Asian markets overnight, which comes as the Bank of Japan left their interest rates unchanged at their latest meeting. That’s seen the Japanese Yen weaken further, and it’s currently trading at 156.11 per dollar, which is its weakest level since 1990. Front-end government bond yields have also fallen overnight in Japan, with the 2yr yield down -0.7bps to 0.29%. And for equities, all the major indices have risen, including the Nikkei (+0.74%), the KOSPI (+1.10%), the Hang Seng (+1.98%), the CSI 300 (+1.03%) and the Shanghai Comp (+0.79%).

Before that overnight reversal, markets had struggled yesterday, as challenging data and poor earnings led to a notable selloff. That meant investors pushed back the timing of rate cuts yet again, and the 2yr Treasury yield (+7.1bps) closed at 4.998%, so almost at 5% for the first time since mid-November. That was mainly driven by the Q1 US GDP release, which had the unfortunate combination of a downside surprise on growth, and an upside surprise on inflation. As we found out in 2022, that stagflationary mix can potentially be a bad recipe for markets, so it wasn’t a surprise to see equities and bonds lose ground simultaneously even if equities have since been busy making up their initial losses.

In terms of the details, growth came in at an annualised rate of +1.6% (vs. +2.5% expected), which is the slowest growth since Q2 2022. But more alarmingly for markets, core PCE surprised on the upside, with an annualised rate of +3.7% in Q1 (vs. +3.4% expected). Headline PCE was also strong, at +3.4% in Q1, and core services ex housing (a measure Fed Chair Powell has cited in the past) was at +5.1%. So whichever way you crunch the numbers, this clearly isn’t the sort of inflation momentum where the Fed could be comfortable cutting rates. We’ll get the monthly US PCE numbers for March today within the spending report as well. If you’re looking for positives on growth, final private domestic sales came in at 3.1%, with the slowing in headline GDP growth coming from net exports, inventories and government spending. So domestic demand still holding up well. However you could argue that just ties in with the strong inflation component.

Unsurprisingly, that release meant markets dialled back the odds of rate cuts anytime soon. For instance, the chance of a rate cut by the July meeting fell from 50% the previous day to 34% afterwards. And for the year as a whole, futures are now pricing in just 34bps of cuts by the December meeting, down from 43bps the previous day and 67bps at the start of the month. So futures are now pricing the most hawkish profile we’ve seen to date in this hiking cycle, at least in terms of where rates are set to be by the end of 2024. Indeed for the first time, the first 25bp cut isn’t fully priced in until the December 2024 meeting.

With investors pricing out rate cuts, US Treasuries slumped and yields hit their highest levels of 2024 so far. In particular, the 2yr Treasury yield (+7.1bps) saw a closing value of 4.998%, having reached 5.02% intra-day. And similarly, the 10yr yield was up +6.2bps to 4.70%, although this morning it’s since come down -1.0bps to 4.69%. Bear in mind that just after Christmas, the 10yr yield hit an intraday low of 3.78%, so it’s moved up by almost 100bps from that point now. At the same time, there was a decent spike in real yields, with the 10yr real yield (+4.4bps) reaching a post-November high of 2.28%.

That trend was echoed in Europe, where investors lowered their expectations for ECB rate cuts this year, and now see just 68bps of cuts by December’s meeting, down -5.5bps on the day. As in the US, that meant 10yr yields hit new YTD highs, with those on 10yr bunds (+4.1bps) up to 2.63%, 10yr OATs (+3.7bps) up to 3.13%, and 10yr gilts (+2.8bps) up to 4.36%. For now at least, a June rate cut from the ECB is still seen as an 84% probability, but from Monday we’ll start to get the flash CPI prints for April, so it’ll be interesting to see if that changes anything.

For equities, this backdrop meant it was a tough day across the board even if the recovery was steady as the US session progressed. All the major indices fell, including the S&P 500 (-0.46%), the NASDAQ (-0.64%) and the Dow Jones (-0.98%). Rebounds by Nvidia (+3.71%) and Tesla (+4.97%) helped limit and reverse the earlier larger losses. But Meta (-10.56%) was the worst performer in the entire S&P 500 following its earnings release the previous day, meaning that the Magnificent 7 (-1.19%) underperformed despite the gains for Nvidia and Tesla. IBM (-8.25%) lost significant ground after its release the previous evening as well.

Over in Europe, the STOXX 600 (-0.64%) also saw a decent decline, although the FTSE 100 (+0.48%) was again an exception as it hit another record high, aided by a surge in Anglo American (+16.10%), which was the index’s best performer after BHP proposed a takeover. The proposed deal would bring together two of the world’s largest mining companies and create a clear number one globally. Our mining team think the deal rationale is about global scale and growth in copper, a structurally tight commodity which is key to future global electrification. Copper prices have risen by +17.6% so far this year, and overnight they’re trading at their highest level since April 2022. The mining team’s note (link here) runs through the deal terms and other talking points.

Looking at yesterday’s other data, the US weekly initial jobless claims fell to 207k in the week ending April 20 (vs. 215k expected), which is their lowest level in a couple of months. Otherwise, pending home sales grew by +3.4% in March (vs. +0.4% expected), reaching a 13-month high.

To the day ahead now, and data releases include US PCE inflation for March, along with personal income and personal spending. In addition, there the University of Michigan’s final consumer sentiment index for April, and in the Euro Area, we’ll get the M3 money supply for March. Finally, earnings releases include Exxon Mobil and Chevron.

Tyler Durden

Fri, 04/26/2024 – 08:18

via ZeroHedge News https://ift.tt/4Pv6ojq Tyler Durden