US Bank Deposits Suffer Biggest Weekly Decline Since 9/11 As Tax Man Cometh

It’s that time of year again and US bank deposits sure showed it…

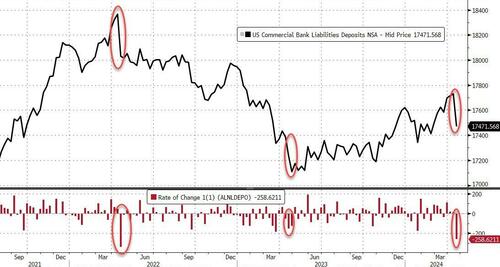

While money-market funds’ total assets fell over $100BN, on a non-seasonally-adjusted (NSA) basis, total bank deposits crashed by a stunning $258BN as Tax-Day cometh. That is considerably more than the $152BN decline last year but less than the $336BN plunge in 2022…

Source: Bloomberg

This makes some sense though as the Treasury Cash Balance rose by around the same amount as taxpayers did their duty and paid their ‘fair share’…

Source: Bloomberg

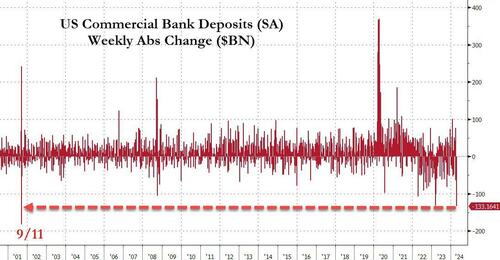

However, on a seasonally-adjusted (SA) basis (i.e. adjusted by the PhDs for the fact that we get large deposit outflows at this time of year to pay taxes), total deposits dropped $133BN – the biggest weekly plunge (SA) since 9/11!

Source: Bloomberg

Excluding foreign deposits, domestic bank deposits plunged on both an SA (-$119BN: Large banks -$99BN, Small banks -$21BN) and NSA (-$241BN: Large banks -$188BN, Small banks -$53BN) basis…

Source: Bloomberg

For context, that is the largest weekly drop in SA deposits since 9/11 and the largest NSA deposit drop since April 2022 (Tax Day).

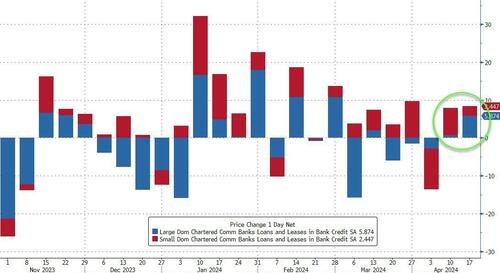

Interestingly, despite the deposit dump, loan volumes increased last week with large banks adding $5.8BN and small banks adding $2.5BN…

Source: Bloomberg

All of which pushed the un-bailed-out ‘Small banks’ back into ‘crisis mode’ (red line below constraint absent the $126BN still in the BTFP pot at The Fed which is slowly being unwound)…

Source: Bloomberg

And so, with rate-cuts off the table – and tapering QT very much back on – we wonder just how much jockeying between Janet (Yellen) and Jerome (Powell) is going on ahead of next week’s QRA and FOMC news…

Tyler Durden

Fri, 04/26/2024 – 17:20

via ZeroHedge News https://ift.tt/zbOXjmq Tyler Durden