“Bye Bye, Babies… Bye Bye, Workers”: Can Europe Slow The Impact Of Its Aging Society

By Erik-Jan van Harn and Maartje Wijffelaars of Rabobank

Summary

- Europe’s population is aging and this will stunt economic growth in the coming decades.

- Challenges are arising for social welfare, debt sustainability, and even strategic autonomy.

- Potential remedies for the declining workforce differ per country, but overall, there are no easy solutions.

- To protect the welfare state, maintain sustainable public finances, and support Europe’s quest for strategic autonomy, higher productivity growth seems essential.

The demographic transition

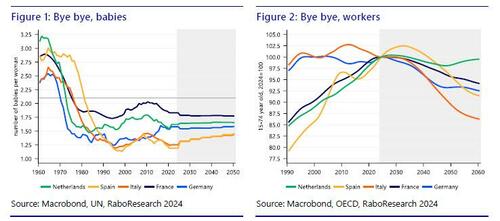

Change is often accompanied by difficulty and discomfort. Most of us are focused on the transitions that are most visible to us: the energy transition, a changing world order, or technological progress. However, there exists another, less conspicuous transition: that of demographics. Over the past six decades, fertility rates have plummeted, while life expectancy has surged to unprecedented levels. These shifts have fundamentally altered Europe’s demographic landscape and, consequently, its workforce.

Although Europe isn’t unique in this matter, it faces a pressing demographic challenge. Despite government efforts to boost fertility rates, progress remains limited. Cultural, sociological, and economic factors stubbornly outweigh incentives offered by governments. As we grapple with this persistent issue, what can we expect?

In this report, we delve into three key questions:

- How will demographics impact the structural economic growth of major member states?

- What challenges arise from this demographic shift?

- What strategies can be employed to address these challenges?

Assessing the current landscape

The labor market has been significantly strong in recent years. Unemployment rates have reached historic lows and more people have entered the workforce. But as we assess the current landscape, Europe’s long-term demographic prospects appear less than optimistic.

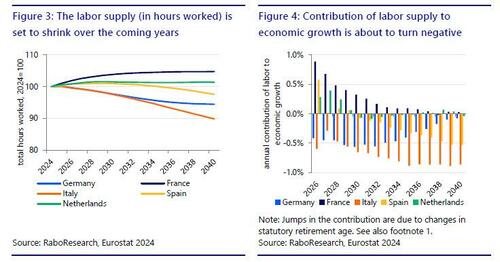

Demographics are shifting across the continent, although the impact on labor supply varies across countries. While some nations, like France, are projected to experience relatively benign demographic effects, others – such as Germany and Italy – face a less rosy outlook. For Germany, the annual labor contribution to economic growth is projected to average around -0.5% until 2035, due to the departure of baby boomers and Generation X from the workforce (see figure 4). In Italy, the challenge persists after 2035, as fertility rates and net migration are expected to remain lower than in Germany.

Spain and the Netherlands find themselves in an intermediate position. They also grapple with an aging population and its implications for the economy, but less so than Italy and Germany in the coming two decades. In both Spain and the Netherlands, it will take until 2030 before labor supply – in hours – will start to contract. But whereas labor’s annual negative contribution will remain very small for the Netherlands, it is set to grow for Spain as time progresses.

Age is just a number, but numbers do matter

Over the past decade, a growing supply of labor has played a pivotal role in driving economic growth, especially given the relatively modest productivity gains. Any decline in or negative impact on labor’s contribution could significantly impede overall economic growth. While weaker growth in the short-term may not pose an immediate crisis, sustained challenges could emerge with respect to public services, debt sustainability, and Europe’s strategic autonomy.

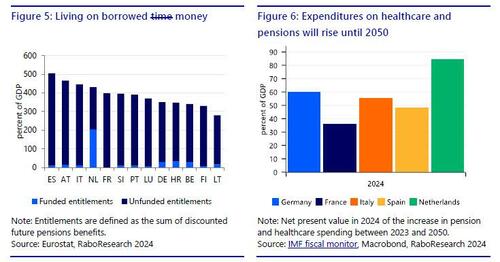

Public services and pensions

As demographic projections unfold, the number of workers available declines, and the balance between retirees and active workers shifts. Currently, there is about one retiree for every three workers in the Eurozone, but this is projected to decline to two workers by 2040. This change could strain the affordability of public services. For instance, healthcare costs are expected to rise as the population ages (see figure 6), while tax revenues may stagnate or grow at a slower pace. Another concerning issue is the sustainability of pension systems. Across most European countries, pensions operate on a pay-as-you-go model, where retirees’ benefits are funded by the contributions of the currently employed. In theory, this system functions smoothly. But as the proportion of retirees increases relative to the workforce, the burden on today’s contributors becomes substantial.

Some countries have included automatic changes to the contribution, benefits, or statutory retirement age to alleviate some of the strain on public finances when needed. In the Netherlands and Italy, for example, the statutory retirement age is linked to life expectancy. While these measures dampen the blow to some extent, the burden for public finances will likely remain large and is still projected to grow in multiple countries. This burden is especially problematic if wide access to early retirement lowers the effective retirement age, as is the case in Italy.

The Netherlands stands out from its European counterparts. Approximately half of its pension entitlements are privately funded, offering a unique approach to addressing this challenge

Debt sustainability and strategic autonomy

An aging society also poses challenges to public debt sustainability. Without substantial increases in productivity growth, we can expect a slowdown in economic growth and, consequently, a decrease in tax revenues. Simultaneously, expenditures on healthcare and pensions will rise, as illustrated in Figure 6. These trends, all else being equal, will lead to a rise in the primary budget deficit and a decrease in the affordability of debt, measured by the ratio of interest payments to revenues. A growing part of revenues will be allocated to servicing interest costs on existing debt. Corrective spending in other areas and/or tax measures will likely be necessary to prevent the overall budget balance from spiralling out of control, which would simultaneously raise financing needs and public debt. Higher productivity growth may lessen the need for austerity, as it would generate higher tax revenues with the same amount of labor, but that’s not a given. It is certain, however, that higher productivity growth makes higher taxes less painful. Furthermore, productivity and efficiency gains in the health sector could dampen the increase in healthcare spending. As such, faster productivity growth could actually be crucial to prevent a negative downward spiral between austerity measures and growth in some countries.

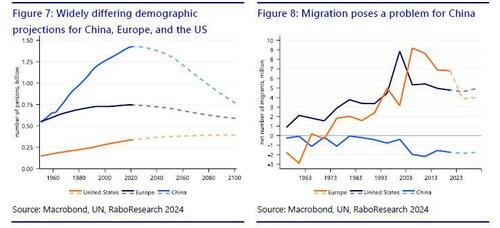

The demographic decline will also have implications for the geopolitical aspirations of the European Union. Firstly, it will directly impact the deterioration of debt sustainability just when the EU’s strategic agenda requires substantial investments in military capabilities, the energy transition, and industrial development. Beyond the direct effects on debt servicing capacity, the demographic decline in Europe will also result in a shift in the EU’s relative geopolitical power. The EU currently boasts the world’s largest single market, and companies conform to EU product standards as a consequence. Therefore, the EU holds a position as a regulatory superpower. However, as Europe’s consumer market shrinks in the coming decades, likely so will the power derived from it. This obviously also holds for the other forms of soft power that Europe (still) commands, such as its cultural and democratic values.

The good news for the EU with respect to its relative power on the world stage is that Europe’s problems aren’t unique and that low fertility rates and aging societies are prevalent in many countries worldwide. For instance, if current trends continue, China’s population is expected to halve in the coming decades. These long term projections are inherently uncertain, but it’s easy to argue that the demographic situation is even worse in China than it is in Europe. In addition to lower fertility rates, China also suffers from emigration. On the other hand, the United States experiences a relatively higher influx of migrants and notably higher fertility rates than Europe. With respect to demographics, the United States have the advantage.

Can we avert the decline in labor supply?

The future doesn’t look too rosy for some countries, but luckily, the changes are predictable and relatively slow. This leaves room for policy intervention. But what can governments do to avert or at least slow the projected decline in labor supply (in hours)? In broad terms, three key factors shape the total labor supply within an economy: the working age population, the participation rate, and the hours worked per worker.

Working age population

First, we consider the working-age population. In the long term, the primary drivers are the fertility rate and net migration. Recent campaigns in countries such as Denmark, Italy, and China have underscored the challenge of increasing fertility rates. You simply cannot force people to have babies and decisions are determined by multiple factors including nature, culture, and economics. Even if successful, the effects of such campaigns may take up to two decades to materialize.

Migration represents another avenue to bolster the working-age population. Spain is a good example of a country where migration mitigates the effect of an aging population. However, this path is not without hurdles. Populist sentiments in some countries have made foreign workers less welcome. Furthermore, to fully counteract the decline in the working-age population, a substantial influx of migrants would be necessary. For Germany, this could mean accommodating between 200,000 and 400,000 workers annually over the coming decades. It is no given that European countries will be able to find qualified workers abroad so easily, as language and cultural barriers further complicate things.

An alternative approach involves redefining the concept of “working age” by raising the statutory retirement age. France, for instance, elevated its retirement age from 62 to 64 last year. While this strategy proves highly effective, recent experience also highlights the contentious nature of such adjustments. French President Emmanuel Macron had to water down his initial proposal to raise the retirement age to 65, when nationwide protests crippled the country. In Italy, a 2011 pension reform linked the retirement age to life expectancy, leading to a statutory retirement age of 67 as of 2019. Yet the age at which workers actually retire is quite some years earlier, as subsequent governments have opened a door to early retirement.

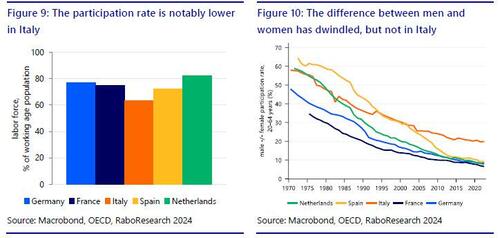

Participation rate

What if we could harness a larger share of our working-age population, i.e. raise the participation rate? The truth is that for most large member states, there appears to be limited room for improvement, as participation rates are high and relatively comparable. Italy is a notable outlier, however. Coincidentally, Italy also faces significant challenges. The key lies in the participation of Italian women in the labor force. Where the participation rate for Italian men closely mirrors that of other major European economies, the participation rate for Italian women is much lower. The gap in the participation rate between men and women is around 10% for most European countries, but for Italy it’s more than double that figure. If Italy can encourage more women to join the workforce, it may partially mitigate the pressing issue of its declining working age population.

Average hours worked

What if workers simply worked more? In comparison to Asia or North America, Europeans are often both ridiculed and envied for their extended summer holidays and nine-to-five work mentality. While there is some truth to this perception, significant variations exist within the Eurozone.

Consider Greece, where workers log an average of over 1,900 hours per year – approximately 8% more than their counterparts in the United States. Conversely, in Germany for example, employees annually work around 500 hours less than in Greece. However, convincing European workers to increase their hours isn’t easy, as the trend currently leans in the opposite direction – though Italy has bucked that trend since the pandemic. While composition effects of the workforce play a role, there also appears to be a structural shift in Europeans’ work-life balance. If anything, the tightness of the labor market and historically low share of people wanting to work more hours than they do, suggests it is more an issue of supply rather than demand. So encouraging Europeans to work more hours will require robust incentives. Governments are exploring how to reverse the current trend, but haven’t had much success yet.

Which measures would have the biggest impact?

Thankfully, the demographic changes unfolding across Europe are both predictable and quantifiable. This foresight grants governments a crucial window of opportunity to take action before challenges escalate. Our analysis has delved into the three factors determining the labor supply: working-age population, participation rates, and average hours worked per worker. To assess what can be done, we tune each variable separately. While isolating these effects may be unrealistic, it does clearly show which areas countries can improve in.

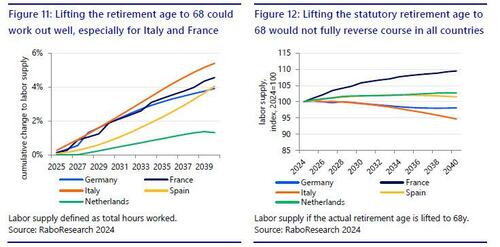

Increase the statutory retirement age

Let’s look at the impact of changes to the working-age population. Raising the retirement age will certainly not be a popular measure. Yet given Europe’s current political climate, it might be more feasible than significantly increasing net migration. We’ve raised the statutory retirement age to 68 by 2034 across all countries in this exercise.

This adjustment would particularly benefit Italy and France. While Italy boasts a relatively high statutory retirement age (67 years and 3 months), only a fraction of Italians work until that age due to early retirement provisions. Given the size of this cohort, a higher actual retirement age could make an impact, but would still fall short in fully reversing the demographic challenges.

France stands in a different position. The country would largely benefit from the fact that its current retirement age falls well below 68, and its relatively positive demographic prospects could further improve.

For the Netherlands, Germany, and Spain, the effect is more modest. These countries already maintain higher participation rates for the specific age cohort compared to others. Unsurprisingly, adjusting the retirement age alone won’t fully counteract the demographic decline in Germany either.

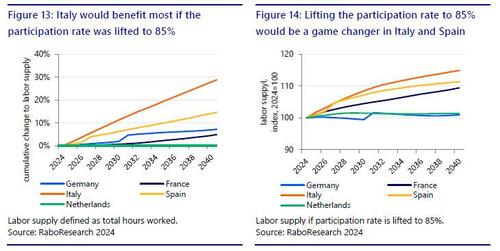

Increase the participation rate

Another approach worth considering is boosting labor participation rates. Our analysis assumes a gradual improvement in the participation rate for the working-age population, aiming for an ambitious target of 85%, which is in line with the participation rate in the Netherlands.

As anticipated, this adjustment would yield remarkable results for Italy. The participation rate is projected to surge by over 20%-points (or more than 30% in relative terms), providing a much-needed boost. Remarkably, this increase could even reverse the anticipated decline in the labor supply, fostering growth. Spain would also benefit, albeit to a lesser extent. Since we raised the participation rate to the Dutch level, there’s no impact for the Netherlands. But of course, and in contrast to the statutory retirement age, governments cannot simply “press a button” to raise the activity rate. It may require a host of measures and incentives that work both on the demand and supply side of the labor market.

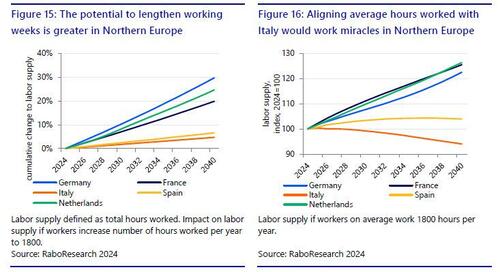

Increase the average hours worked

During the pandemic, average hours worked per worker in the Eurozone experienced a significant decline and in many countries, they haven’t returned to pre-pandemic levels. In some countries, the decline follows a trend that already started (long) before the pandemic. In others, a clear intensification or “new” trend is visible. In our scenario, we assume that average hours worked rises to 1800, just above the average hours worked in Italy.

The impact would be most pronounced in Western Europe, where workers currently log fewer hours. For instance, in Germany, this change would lead to a 30% increase in the labor supply. In Southern Europe, where workers already put in more hours on average, the effect would be less pronounced. Such a dramatic increase in hours worked in Western European countries would very likely lead to a worsening of other parameters, like the participation rate, as we will show in the next paragraph. Still, it underscores the potential for improvement from this perspective.

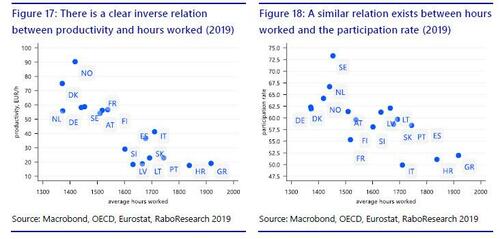

No silver bullet, just a silver tsunami

While the data above appears promising, we can hardly expect these factors to improve in isolation. There is a strong correlation between productivity, hours worked, and labor participation rates. However, the causal relationship is not entirely clear. Improved productivity could translate to fewer hours worked as the necessity for longer workweeks to sustain a certain lifestyle diminishes, for example. On the other hand, working less hours could also lead to higher productivity because of diminishing returns. Similarly, a reciprocal relationship exists between participation rates and hours worked. Individuals entering the labor force when participation rates are already high tend to work fewer hours. This likely results from maintaining an adequate worklife balance at the household level, especially when children are involved.

This sobering reality suggests that there is no silver bullet for these challenges, unless workers can be persuaded to make changes independently. Whether it’s working more hours, extending their careers, or maintaining full-time contracts even as productivity and participation rates improve, each scenario requires serious effort to convince workers. The Italians have recently demonstrated that such a thing is indeed possible. Average hours worked have risen compared to pre-pandemic years, despite the fact that the participation rate has continued to increase. Going against the usual current will require some extra commitment though.

Productivity growth remains an open question

In addition to addressing the demographic decline by encouraging increased workforce participation, another crucial factor to consider is enhancing productivity levels. Higher productivity growth could mitigate the negative impact of declining labor supply on the economy. However, achieving this goal is far from straightforward. Despite numerous attempts to revive it, productivity growth in the Eurozone has essentially halved since the Global Financial Crisis (GFC). While there are high expectations for technological advancements in AI to turn the tide, the current level of uncertainty makes it too challenging to make any definitive conjectures about the potential breadth and significance of such a productivity boost. The same holds for the impact of reforms and investments spurred with the EU’s Recovery and Resilience Facility, especially in Southern Eurozone member states. This is also true initiatives to strengthen Europe’s strategic autonomy by focusing more investment in sustainable energy, the semi-conductor sector, etc. These questions, however, are beyond the scope of this research note.

Conclusion

Decades ago, it was already clear that Europe would have to face the problems of its aging population at some point. Although governments have prepared themselves to some extent, it is unlikely to be enough to turn the tide. A shrinking (working) population will put a dent in Europe’s economic outlook, even if the potential of the working-age population is stretched to its limits. Lower economic growth does not automatically imply lower welfare to the same extent, given that you have to share the pie with fewer people. That said, it will have a profound impact on factors such as the affordability of public services and social benefits, debt sustainability, and on the Europe’s relative power compared to both its allies and rivals. In order to maintain the welfare state and prevent a negative spiral of austerity and economic growth, governments will likely have to both incentivize labor supply and find ways to improve the productivity of its workforce. This is easier said than done.

Full pdf available here.

Tyler Durden

Sat, 04/27/2024 – 08:10

via ZeroHedge News https://ift.tt/gf9ENcS Tyler Durden