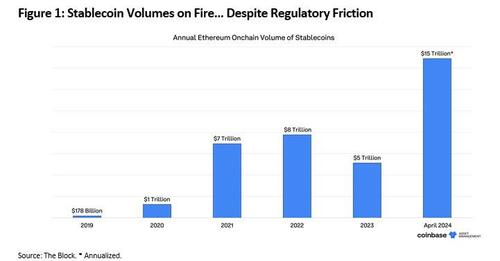

Stablecoin Volumes Are Tracking A Record $15 Trillion On Ethereum Alone

By Marcel Kasumovich, Deputy CIO of Coinbase Asset Management

Crypto sparked a renaissance in real-time payments. Sleepy you say? Time for a wake-up call – payment solutions are at the cutting edge of crypto’s integration into the mainstream, and it has plenty of competition.

“You’re probably used to crypto transactions, expecting me to bring out another guest for an eight-minute commentary while we wait for confirmation. But that’s old crypto. Are you ready for the new crypto world? Watch very closely…don’t blink…and that’s it,” John Collison exclaimed while illustrating a transaction on crypto rails with Stripe, a leading payment network that he co-founded. It was a seamless user experience, unlike the company’s initial foray into bitcoin in 2014.

Both PayPal and Stripe are now harnessing the power of stablecoins into their familiar user interfaces. This strategic move effortlessly brings users onto the blockchain – point, click, and it’s done. It’s the new trend, too. Traditional companies are bringing users onchain. There’s the crypto we see in noisy headlines and those working quietly to monetize the technology, like PayPal and Stripe. And they combine for a staggering 62% share of online payment software processing.

Digital payments may not seem like the exciting promise of the future. Yet, they are at the cutting edge. Digital payments are taking a rising share of a rapidly growing market as the world moves away from cash. Global payments are measured in the hundreds of trillions, and the digital payment market has risen from a modest $10 billion in 2017 to a projected $200 billion in 2030. We all live it, and the bulk of the transactions are small value, a coffee here, a donut there.

The process is so seamless that we seldom pause to consider how it actually works. Poorly, as it happens. Users expect to be able to pay whenever it’s convenient. Settling your restaurant bill, you don’t care that it’s outside of banking hours. You just want a simple form of payment – and that’s not cash. During the time between you tapping your card and accounts being settled, a middleman provides credit to make sure it all clears. And it’s expensive at 2.3% of transaction value.

One man’s profit margin is another’s invitation to disrupt. The typical narrative of disruption involves a wildly successful company losing its innovation edge, and missing market inflection points. Polaroid made the first instant camera in 1948 and dominated markets from floppy disks to film. Revenue peaked in 1991 and the company was unable to pivot to the new digital era, declaring bankruptcy ten years later. Learning from such histories, companies are now more adaptive.

We see this clearly in payments. Efficiency is precisely what brought PayPal and Stripe back to crypto. Transaction speeds have improved exponentially, now clocking at milliseconds, and costs have plunged to fractions of a cent. It helps that crypto tech fails fast – revealing resilience and weakness quickly. For instance, the resilience of USDC is now supporting its entry into the mainstream while Bored Apes Yacht Club weakness persists, down 90% off previous cycle highs.

Why now? Why not! Stablecoins are demonstrating their prowess as payment tools. Transaction volumes are tracking new highs this month, running at ~$15 trillion annualized on Ethereum alone (Figure 1). The efficiency gain is clear – instant and final settlements mean that your late-night coffee and donut purchases bypass the need for credit intermediaries. The middleman is dead, although living vibrantly through tools like Stripe that deliver users a familiar experience.

Users don’t care that it’s crypto. They want a great experience. Businesses don’t care, either. They are optimizing operating efficiency for profit. As crypto matures, so too does its value proposition. Crypto is the protagonist of real time payments and like any great innovation, it fosters competition. What’s unique with payments is that the competition comes from both private and government organizations, with regulatory stagnation working in favor of both.

Look beyond regions traditionally seen as leaders in innovation. The United States remains a beacon of creative talent behind innovation. But users are moving slowly, lagging in fintech adoption. After all, US users are accustomed to fees, don’t mind the service, and paying for points on expensive intermediation is a pastime. Real-time settlement systems adopted, like FedNow, are for business applications, not for consumers. It’s new players like India at the cutting edge.

The Unified Payment Interface (UPI), India’s real-time payment solution, was developed by the central bank in 2016. It integrates peer-to-peer real-time payments, directly competing with crypto technologies. Last year, UPI integrated 522 commercial banks covering 300 million active users and 117 billion transactions. Different from developed regions, intermediaries were not disrupted as these are largely new users. Cash was disrupted at the expense of the central bank.

Payments stand at the cutting edge of crypto’s future. User experience is paramount. Integrating into the regulatory mainstream will accelerate users onchain, just as service providers did for the internet. Crypto unlocked the real-time settlement innovation, but will face competition. It is a world that argues for being chain-agnostic. The data between Ethereum, Bitcoin and UPI will integrate to the highest of standards and security. That’s the road to making onchain the new online.

Tyler Durden

Sun, 04/28/2024 – 22:40

via ZeroHedge News https://ift.tt/lIEDyNA Tyler Durden