“We’ve Had A Hell Of A Run”: Stanley Druckenmiller Sells 441,000 Shares Of Nvidia

Billionaire investor Stanley Druckenmiller, head of the Duquesne Family Office, sees the artificial intelligence bubble as overextended. He has slashed some of his holdings in “Magnificent Seven” technology stocks, including Nvidia. He’s not alone. Other notable fund managers and company insiders are jumping ship and unloading their shares.

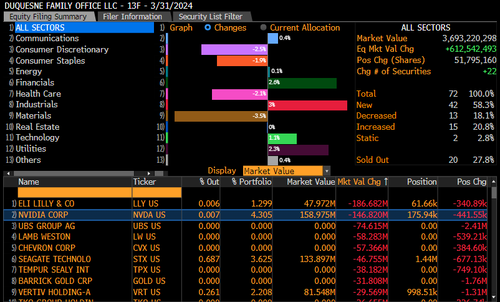

A recent 13F filing reveals that Druckenmiller’s family office sold over 441,000 shares of Nvidia Corp. in the first quarter, reducing its stake to only 176,000 shares, or worth just about $158 million. Since 13F filings are backward-looking, the firm may have further divested or adjusted those holdings since the first quarter.

We suspect Druckenmiller has not added to his Nvidia holdings.

Early last week, the billionaire investor appeared on CNBC’s “Squawk Box,” explaining that his exposure to Nvidia was reduced after it went from $150 per share to $900 in just over a year.

“I’m not Warren Buffett,” Druckenmiller emphasized, noting, “I don’t own things for 10 or 20 years. I wish I was Warren Buffett.”

Druckenmiller said that when Microsoft-backed ChatGPT soared in popularity, he doubled down on his Nvidia position because it was an obvious no-brainer.

“Even an old guy like me could figure out what that meant,” he said, adding the AI boom is likely a “mega-trend like we’ve never seen,” with the potential to be bigger than the internet.

Druckenmiller concluded: “I just need a break. We’ve had a hell of a run. A lot of what we recognized has become recognized by the marketplace now.”

Besides Druckenmiller, 13F filings showed David Tepper slashed his holdings in Amazon, Microsoft, and Meta Platforms. David Bonderman’s Wildcat Capital Management sold Meta stock, bringing his position to $23.7 million. Michael Platt’s BlueCrest Capital Management dumped Nvidia and Amazon.

It wasn’t just high-profile fund managers selling tech stocks. Insiders were, too…

Let’s also remind readers of Druckenmiller’s comments on CNBC last week, where he rated Bidenomics as an “F.” This is an ominous sign that his outlook on the US economy is far from optimistic.

Investor Stanley Druckenmiller on Bidenomics: “If I were a professor, I’d give them an ‘F’.” pic.twitter.com/WfsU4ecO6y

— Squawk Box (@SquawkCNBC) May 7, 2024

Smart money doesn’t want to be caught standing in the game of Fed chair Jerome Powell’s musical chairs when the music stops.

Tyler Durden

Thu, 05/16/2024 – 15:25

via ZeroHedge News https://ift.tt/tz16TEQ Tyler Durden